Bitcoin halving events are a core part of its protocol, designed to control the supply of coins gradually approaching the total cap of 21 million. As we explore the significance of Bitcoin halvings, their mechanics, and the potential outcomes of the most recent one, it becomes clear that these events are pivotal moments that shape Bitcoin’s economic model, supply dynamics, and overall market sentiments. Let’s dive into how these halvings work and what the latest one means for Bitcoin’s future.

Exploring the Mechanics of Bitcoin Halving

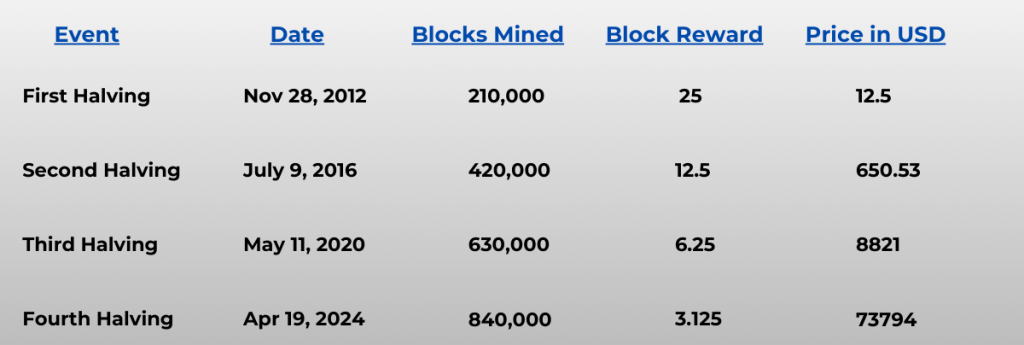

Bitcoin halving occurs roughly every four years or after every 210,000 blocks are mined. This event reduces the number of new BTC issued by half, in line with the cryptocurrency’s design to have a maximum of 21 million BTC. There will NEVER be more than 21 million BTC in the world. The US Treasury can mint infinite USD, but this hard cap means that no one can create more BTC once the 21 Million are in circulation.

So what is a block? A block in Bitcoin is just a list of Bitcoin transactions (simple example: 1 BTC was sent from A to B at 5:00pm today, 2 BTC was sent from C to D at 5:01pm.. and so on). Miners validate these transactions and group them into a block. Each block also includes a reference to the previous block, effectively linking the blocks together and creating a chain (get it, a chain of blocks – the BLOCKCHAIN) of past transactions. This creates a continuous and secure digital ledger of Bitcoin transactions.

The most recent halving event decreased the block rewards from 6.25 to 3.125 BTC per block, emphasizing Bitcoin’s supply limits. Consequently, the reward for miners has halved, impacting profitability and incentivizing the pursuit of more efficient mining practices.

Historical Impact of Bitcoin Halving

Bitcoin halving events are crucial milestones in Bitcoin’s history, drawing significant attention and speculation from the cryptocurrency community and beyond. Previous halvings in 2012, 2016, and 2020 have had a profound impact on Bitcoin’s price, market sentiment, and mining ecosystem. These events have reshaped Bitcoin’s price trajectory and contributed to the understanding of cryptocurrencies as a unique asset class.

Bitcoin halvings have often sparked price rallies before and after the event due to reduced supply issuance, increased scarcity perception, and heightened investor interest. However, it’s essential to remember that past performance doesn’t guarantee future outcomes, and market reactions can vary based on factors like macroeconomic conditions and regulatory changes.

Bitcoin’s Price Rollercoaster Near Halving

In the months preceding the halving event, Bitcoin experienced a notable surge in price. By March 2024, BTC had achieved a new all-time high, partly driven by the anticipation surrounding the halving and the introduction of various Bitcoin ETFs. Specifically, BTC price peaked at approximately $73,794 in March, a significant increase from its starting point of around $50,000 earlier in the year.

Following the halving, there was an initial price spike, but market movements subsequently stabilized to a certain extent. This trend suggests a maturing market that may exhibit reduced sensitivity to external shocks compared to previous market cycles.

Eric Demuth, CEO of Austrian cryptocurrency broker Bitpanda, said bitcoin was increasingly dependent on wider market sentiment and there was no clear pattern of retail trading activity around the halving. “Crypto is so similar to stocks already. The same people that are trading stocks and tech stocks are also into crypto,” he added.

Investor Sentiment and Market Analysis

“While bitcoin’s price remained relatively stable post-halving, transaction fees on the network surged, signaling increased activity,” noted Kok Kee Chong, CEO of AsiaNext, a Singapore-based digital-asset exchange.

The 2024 halving was met with mixed sentiments among investors, reflecting a blend of optimism and caution. Many investors were bullish, anticipating potential price increases as a result of reduced supply, a trend observed in previous halvings. This bullish sentiment was evident in the market’s pre-halving dynamics, where prices often surged in anticipation of the event, highlighting the significant impact halvings have had on market sentiments until 2020.

However, alongside this bullish wave, there were cautious voices in the market. Some investors pointed to the broader economic context and increased market maturity, suggesting that the explosive growth seen in earlier halving cycles might not be replicated. Despite differing opinions, market volatility during the 2024 halving remained high but less intense than in previous halvings, showing a calmer reaction.

Expert Take

First, Bitcoin Mining: Forget about the number of blocks – the real dynamics of Bitcoin mining are heavily influenced by the market price, which is THE FACTOR that drives miners to either enter or exit the market.

Running a mining operation is notably resource-intensive, especially in terms of electricity consumption. Back in 2017, small-scale miners could achieve substantial profits with setups involving just 15-20 GPUs. However, the landscape has evolved – today, the computational power required to remain competitive has surged, escalating not only the costs associated with assembling sophisticated mining rigs but also intensifying the competition among miners.

The fluctuations in BTC price play a crucial role in the decisions of miners to persist in or withdraw from the market. Currently, with the price of BTC being relatively high, it incentivizes larger mining enterprises to remain engaged. Despite the reward per block halved to 3.125 BTC from 6.25 BTC during the last halving event in May 2020, the financial translation of these rewards in USD terms is significantly higher now than it was then. At the time of the last halving, the 6.25 BTC reward was valued at approximately $53,000. Today, the 3.125 BTC reward can equate to nearly $200,000. So while the rhetoric is that you are getting 50% of what you used to get, but its actually 400% of what you would get at the last halving based on the USD value of mining a single block!

For Investors: Investing in Bitcoin has moved beyond niche enthusiasts to attract serious attention from large financial institutions and corporate investors. They see Bitcoin as ‘digital gold,’ an asset that not only diversifies a portfolio but also offers a hedge against inflation due to its fixed supply. This shift is raising Bitcoin’s profile and solidifying its place in the investment world.

Yet, the regulatory environment remains a wildcard. Positive regulations, like the approval of Bitcoin ETFs, have made the cryptocurrency more accessible and boosted its liquidity. However, it’s crucial to stay informed about changes in the regulatory landscape, as adverse decisions in key markets could increase volatility and affect investment strategies.

For those considering Bitcoin as a part of their investment portfolio, it’s not just about speculating on price increases. It’s about leveraging Bitcoin’s unique properties as a way to diversify and protect assets, especially in times of economic uncertainty. Keeping an eye on these factors will help investors navigate the complexities of the cryptocurrency market and make informed decisions.

In essence, as Bitcoin continues to evolve within the financial landscape, savvy investors will benefit from understanding its dual role as a speculative asset and a strategic hedge, keeping a keen eye on institutional behaviors and regulatory trends to effectively navigate its opportunities and risks.