DeFi is making waves by revolutionizing the financial landscape by replacing the traditional centralized financial system with a decentralized system. Powered with an open-source, immutable, and distributed framework, DeFi has unlocked a new possibility of lending, borrowing, trading, and investing and facilitates many financial activities without involving a third-party intermediary like a bank.

Decentralized finances picked up momentum since 2020 despite the collapse of FTX and many other token trading platforms. According to the DeFi Lama market report, currently, $51 billion value is locked in various DeFi platforms.

In this post, we’ll present a brief guide to building a DeFi app successfully.

Unlocking DeFi Fundamentals

DeFi, also known as Decentralized Finance, is based on the core principles that separate it from traditional centralized financial systems.

- Built on the decentralized architecture and open-source framework, DeFi has a distributed decision-making system that happens via nodes.

- Since it is interoperable, DeFi integrates with other protocols, empowering users to transact and swap various assets.

- DeFi’s smart contract should be self-executing.

- Decentralized financial apps allow users to participate in transactions without seeking permission.

- DeFi uses security and auditing through cryptography, consensus mechanisms, and peer reviews to address potential security vulnerabilities.

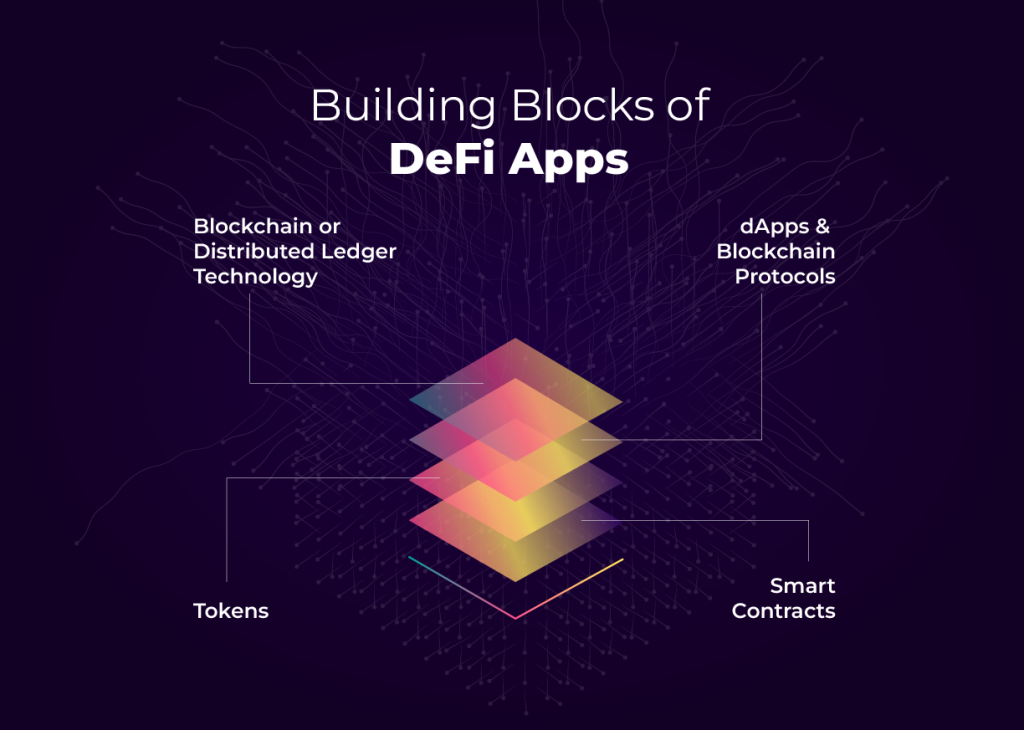

Building Blocks of DeFi: Vital Components for Next-Generation Applications

Before building a DeFi application, let’s understand its key components.

Creating a DeFi App from Scratch: A Comprehensive Step-by-Step Guide

Since you have understood the basic principles and components governing DeFi, we’ll learn how to create a DeFi application.

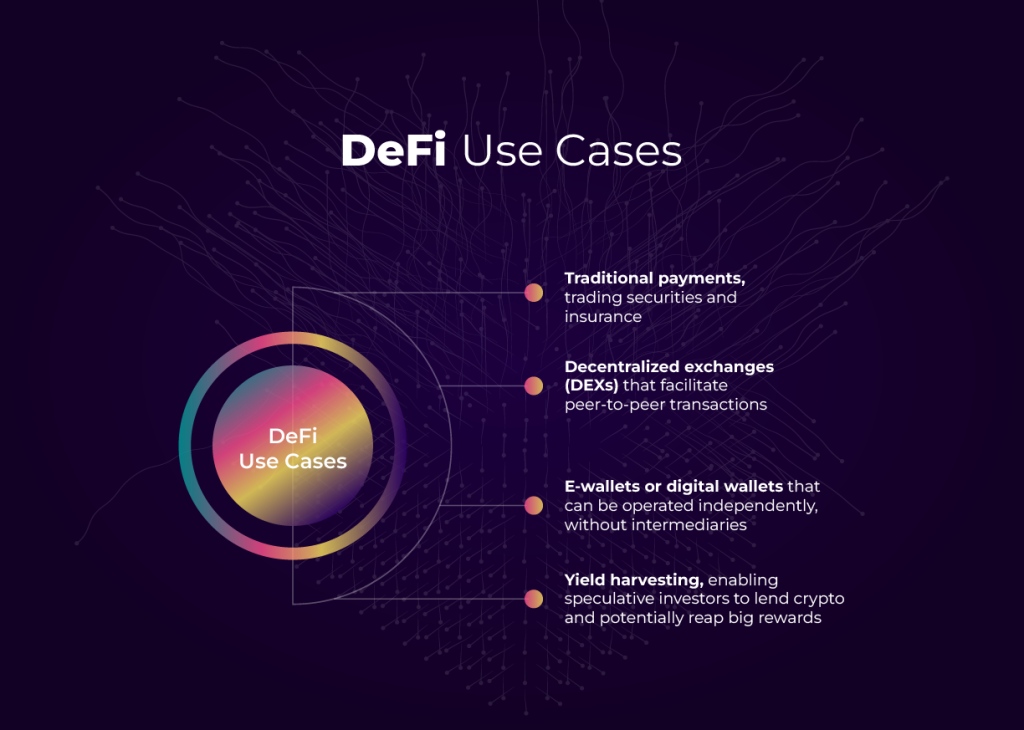

1. Define the Use Case

As DeFi offers broad use cases, such as lending & borrowing, decentralized autonomous organizations, DEXs, Nexus Mutual ( Insurance), stablecoins, yield farming, or decentralized identity and reputation, it helps you define your niche depending on your users’ needs.

2. Select Right Tech Stack

Developing a robust DeFi application depends on multiple aspects, and choosing the right tech stack is among the most crucial tasks. Here is a tabular representation of DeFi’s tech stack.

| Aspects | Tech Stack |

| Blockchain | Though Ethereum is the most popular blockchain protocol, Polygon, Flow, and Tezos are a few other protocols gaining momentum. |

| Smart Contract | Ethereum uses the Solidity platform to create smart contracts. However, other smart contract platforms like Truffle, Embark, and OpenZeppelin are also popular. |

| Decentralize Storage | IPFS: Hypermedia protocol system is a popular digital storage system. Filecoin: This is a cloud-based solution that offers all necessary digital storage features. Pinata: Helps in uploading and managing files on IPFS. |

| Development Tools | web3.js, web3.py |

| Front End Framework | React, Vue.JS, Angular, Bootstrap |

| Backend | NodeJS, ExpressJS ,Java , GO |

| Database | PostgreSQL, MySQL, NoSQL, MongoDB |

| UI Development | Web3.js or Ethers.js |

3. Define Architecture

Once the tech stack is sorted, the next stage is to decide the high-level and low-level architectures for your DeFi app. Along with the user interface and backend architecture, it clarifies how smart contracts will govern financial transactions.

Furthermore, list features and functionalities you seek in the DeFi application to support the use case.

4. Create and Test UI/UX

UX is not just about aesthetics; it’s about mapping users’ journeys to facilitate engagement. While designing UI, one must consider how users will access these different features and functionalities.

Sketch out the user flows to understand and design the optimal user interface of the DeFi app to perform the main task efficiently. When designing the DeFi app, it is most important to keep it simple and intuitive.

Lastly, it is necessary to carry out functional usability testing to ensure it provides an inclusive experience to beginners and pro users.

5. Plan Your Tokenomics Strategically

A good token omics incentivizes users to participate and contribute to the growth of the DeFi ecosystem, such as staking, liquidity pool, or governance. For instance, if a token is accepted as collateral across a wide range of DeFi protocols and its supply is limited, its utility and demand increase.

- Employing strategies like token burns, buybacks, partnerships, and integration with other projects, incentivizing token holders to keep and use tokens helps sustain and stabilize the token’s value.

- Transparency is an important aspect of DeFi. Therefore, participants should be clear about token supply, distribution, security, and governance.

- Take care of adaptability, as this space is consistently and quickly evolving. Therefore, the token model should make upgrading and adding new features easy. For example, Uniswap has enhanced its stakeholder and governance functionalities.

- A DeFi token empowers users to capture value through transaction fees, governance rewards, or collateralization. For example, Aave’s Lend token allows users to participate in governance.

6. Focus on Crypto-Wallet Integration

Token security is vital to any token to build trust among users and facilitate secure and seamless financial transactions. Make sure that crypto-wallet integration follows the best practices, including appropriate key management and encryption.

- Choose the right wallet, as each offers a different level of security, convenience, and functionality.

- Carefully select the integration methods, like API, SDK, or plugin integration.

- Ensure that the integration process employs robust security measures such as 2-factor authentication.

7. Choose Oracle Provider

Since DeFi brings external data into the blockchain, here are a few critical things to consider:

- Know what data your DeFi application needs, such as exchange rate, market price, or interest rates;

- Now, select the provider that offers these data reliably and securely;

- Take care of the security aspects of the Oracle provider and test it thoroughly with smart contract post-integration.

8. Strengthen Token Security

Developers should carefully write code for smart contracts, as there will be no way to release patches for poorly written intelligent contract programs. Conduct vulnerability assessment properly before releasing the app to the users and get it tested through external developers for a reward.

9. Maintain, Upgrade And Iterate

It’s essential to maintain and enhance the app after its launch. Therefore, gather users’ feedback and survey to remove friction for a better user experience by optimizing your decentralized finance app’s functionality, performance, and scalability.

DeFi App Development: Closing Thoughts

Unlike a regular fintech app, building a successful DeFi application requires thoughtful consideration of additional aspects, like blockchain protocol, use cases, architecture, governance, and token omics.

The process may not be as simple as you may think it to be. It requires the right software development team with a deep understanding of developing DeFi products.

If you are looking for an expert DeFi application development partner, Ionixx can help you launch the DeFi app within your budget and timeline.

For a free consultation, get in touch with us to develop your next decentralized financial application.