The consensus is clear: Artifical Intelligence (AI)’s role in banking, spurred by ChatGPT’s success, promises transformative changes within the next five years. This isn’t just about filling gaps left by human limitations; it’s about a seismic shift that could redefine digital interactions and empower users in unprecedented ways. Therefore, the big question is not whether AI will reshape the fintech industry but how it will do so and how we can best prepare for its impact. AI is instrumental in shaping user experience for financial apps.

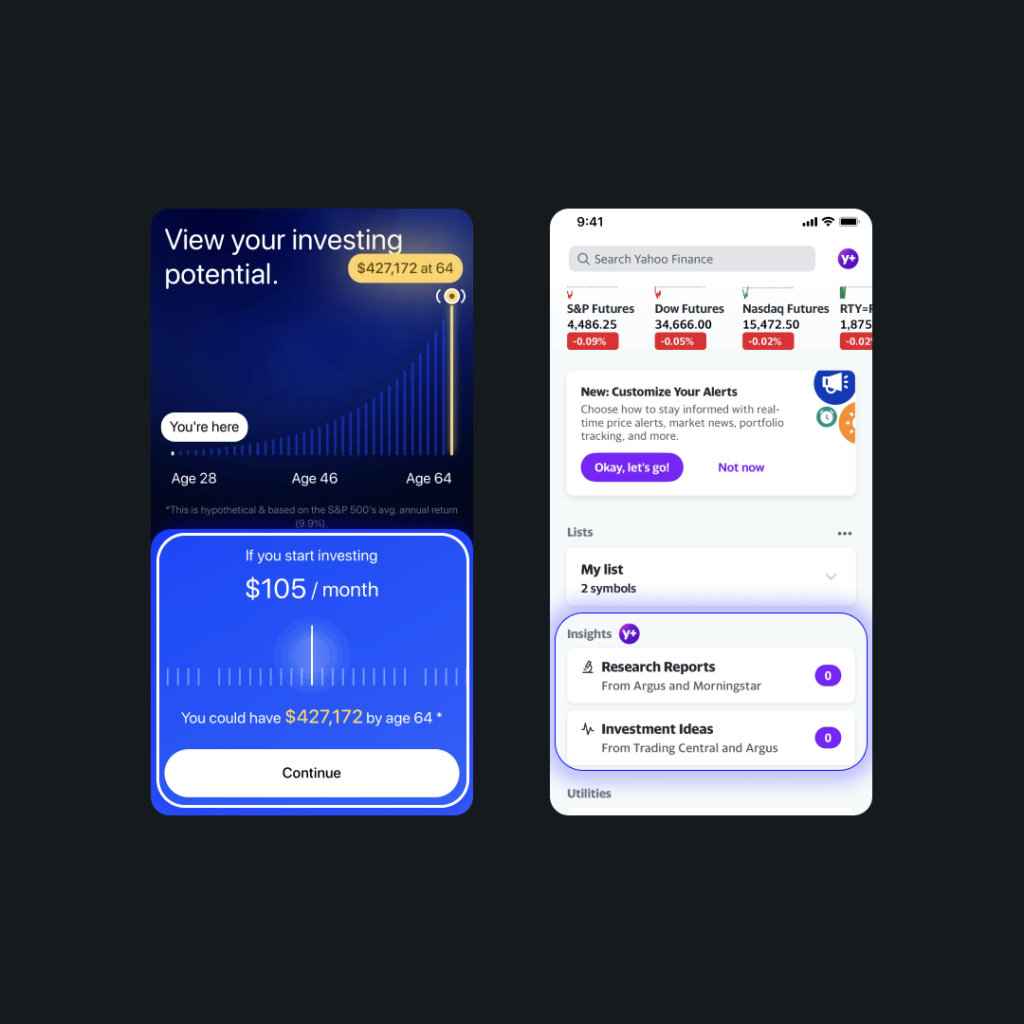

As technological advancements continue to change the dynamics of payments and transactions, the user experience (UX) of trading apps is poised to become a focal point in fintech innovation. AI is likely to drive transformative impact in shaping the next generation of trading app UX, focusing on personalization, efficiency, automation, and interactive elements.

What Does It Mean to Design An AI-Driven User Experience?

Designing for AI in trading apps involves creating interfaces and experiences that are not static but dynamic and responsive to the user’s behavior, preferences, and goals. It’s about moving from a one-size-fits-all approach to a tailored, intuitive experience that grows and evolves with the user.

For instance, consider a trading app that learns from your trading habits to suggest customized investment strategies, or one that anticipates market shifts based on your portfolio and alerts you proactively. For example, if a trader’s objective is to maximize dividends and the AI detects a shift in the market that could affect dividend yields, it might suggest alternative investments to keep the trader on track.

In part 1 of the 2-part series on AI for Designing Trading Apps, we explore 4 key aspects to factor in while designing an AI-led user experience.

- Personalization

2. Automated Trading Strategies

3. Risk Management

4. Data Visualization

Personalization for Every Trader

The days of one-size-fits-all trading seem to be over. User behavior, preferences, and historical data are fed into AI engines on the trading apps to provide individualized recommendations. Whether you are a ‘ Princess’ (meaning you want to be entertained and still need to be babied a bit) or you fall under the ‘Kid’ category (meaning you want a lot of interaction and maybe need a bit of hand-holding), the interface will be configured to suit your operating style and pop out opportunities and data that you need.

Personalization is crucial in trading applications as it allows users to tailor their experience to their specific needs, preferences, and trading strategies.

A UX designer can implement several features to enable personalization in a trading application:

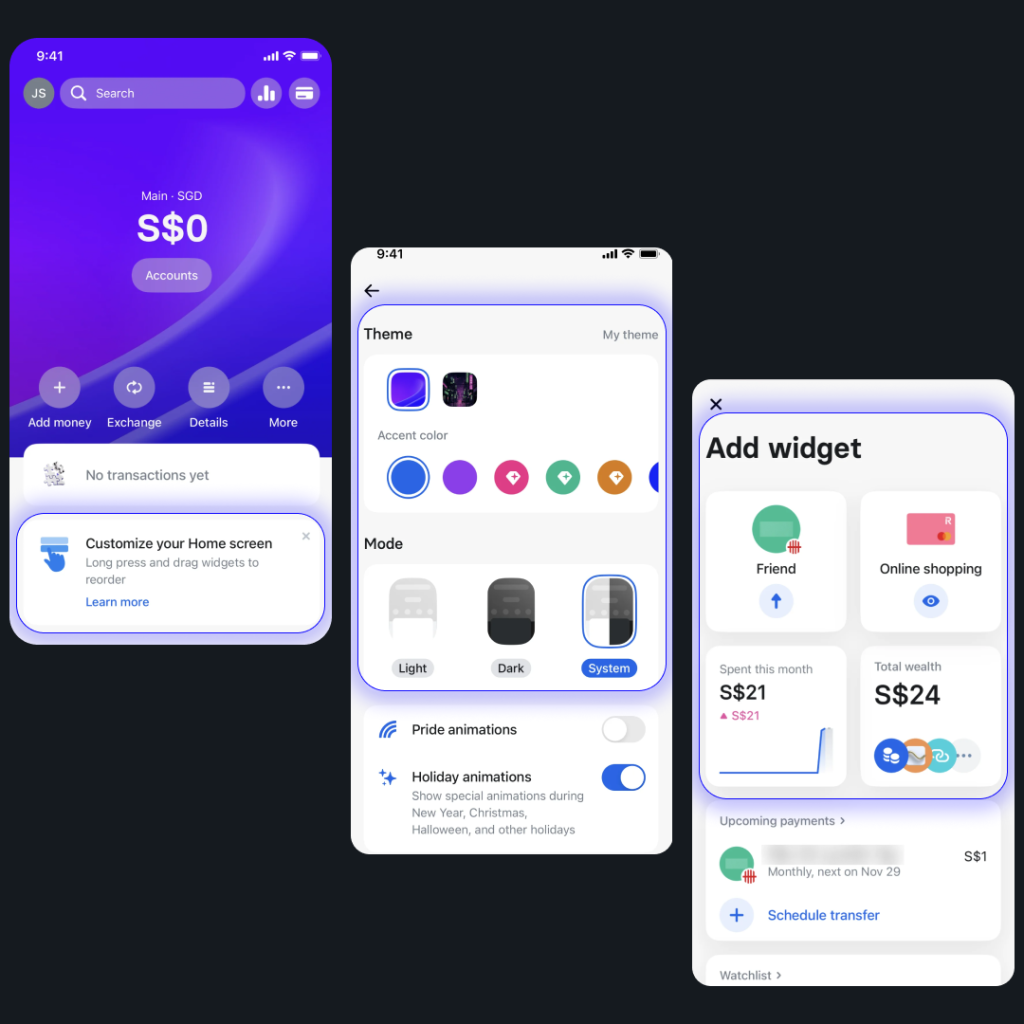

Customizable Dashboards

- Design dashboards that allow users to personalize their layout by adding, removing, and rearranging widgets such as price charts, watchlists, news feeds, and account summaries.

- Provide options to save multiple dashboard configurations for different trading strategies or market conditions.

Preference Settings

- Design a comprehensive settings menu where users can customize various aspects of the application, including theme colors, font sizes, language preferences, and notification preferences.

- Allow users to set default parameters for technical indicators, chart types, and order entry settings.

Saved Searches and Filters

- Implement features that allow users to save their favorite searches and apply custom filters to quickly find specific financial instruments based on criteria such as asset class, sector, market cap, or trading volume.

Automated Trading Strategies

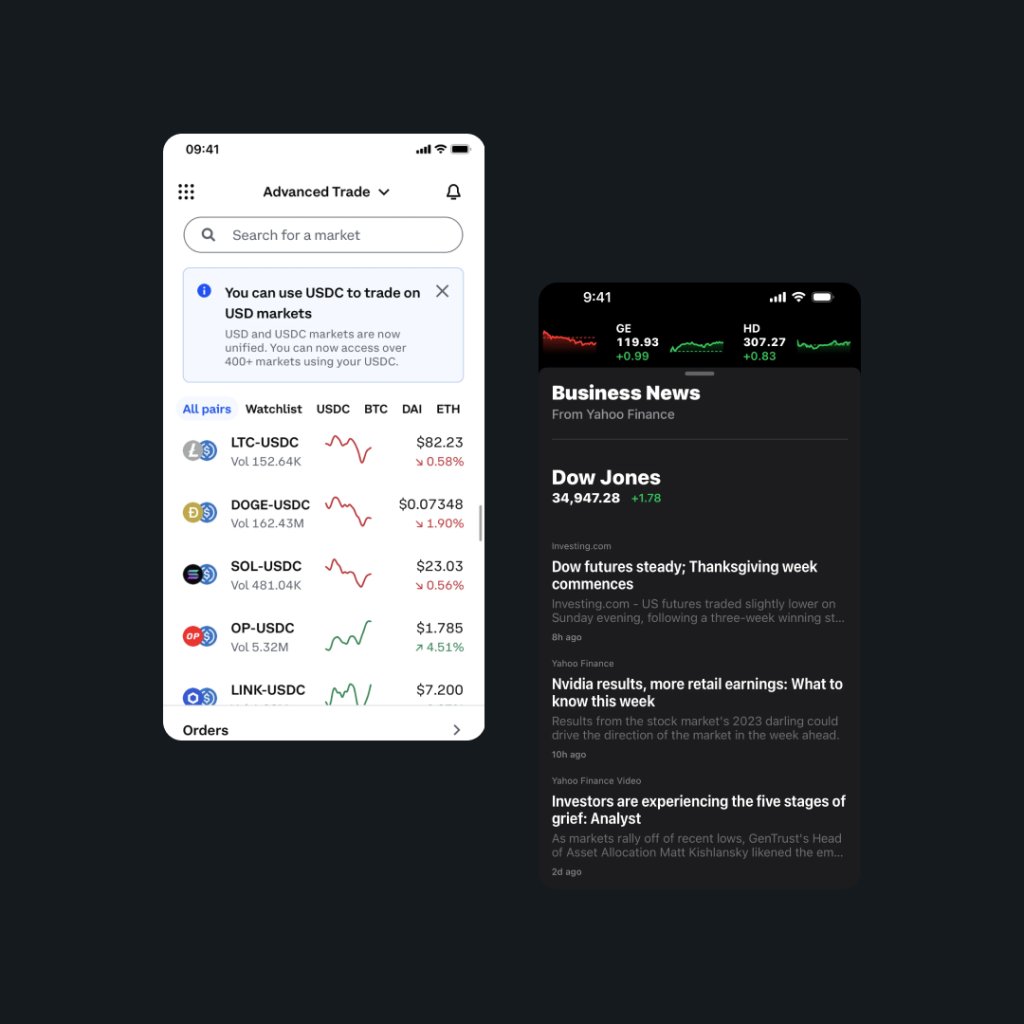

AI-powered algorithmic trading helps execute trades with a predefined set of rules that help to minimize or negate human errors. Not only does it speed up the trading process, but also makes sure that trades are executed accurately. Traders can predetermine the parameters, and AI takes care of the rest. The user can now focus on building the trading strategy and doing analysis.

AI-driven trading applications employ sophisticated algorithms to develop and execute automated trading strategies. These algorithms continuously analyze market conditions, identify lucrative opportunities, and execute trades at optimal times, minimizing human error and maximizing returns for users.

Trade Execution

This feature allows users to execute trades automatically based on predefined conditions set in their trading strategies. Users can specify parameters such as entry price, stop-loss, take-profit levels, and order size.

Backtesting Tools

Tools that allow traders to test their automated trading strategies using historical market data. Traders can evaluate the performance of their strategies and make adjustments before deploying them in live trading environments.

Real-time Data Feeds

Widgets that provide users with access to real-time market data, including price quotes, order book data, and market depth. This data is essential for monitoring market conditions and making informed trading decisions.

Risk Management Tools

Features that enable users to manage risk effectively when implementing automated trading strategies. This could include setting maximum position sizes, implementing trailing stops, or adjusting leverage levels.

Alerts and Notifications

Widgets that notify users of important events or conditions related to their automated trading strategies. This could include price alerts, trade execution notifications, or alerts triggered by specific market conditions.

Risk Management

Risk is calculated and adjusted in real-time as market conditions change and users’ portfolios fluctuate. AI-powered trading apps can send alerts and suggestions to reduce the risk of losing money, allowing users to monitor the market and trace their investments in real-time.

Managing risk effectively is crucial in trading applications to help users protect their capital and minimize potential losses. Here are some common features and widgets used for risk management in a trading application:

- Position Sizing Calculator:

- This widget helps users calculate the appropriate position size for their trades based on their risk tolerance, account size, and stop-loss level.

- Stop-Loss Orders:

- A feature that allows users to set predefined stop-loss levels for their trades. When the market reaches the specified stop-loss level, the trade is automatically closed to limit potential losses.

- Take-Profit Orders:

- Similar to stop-loss orders, this feature enables users to set predefined take-profit levels for their trades. When the market reaches the specified take-profit level, the trade is automatically closed to secure profits.

- Trailing Stops:

- This widget allows users to set dynamic stop-loss levels that adjust automatically as the market moves in their favor. Trailing stops help users lock in profits while allowing their trades to continue running as long as the market moves in the desired direction.

- Risk Management Settings:

- A feature that enables users to customize risk management parameters such as maximum position size, maximum loss per trade, and maximum drawdown limit. Users can adjust these settings to align with their risk tolerance and trading strategies.

- Margin Call Alerts:

- Widgets notify users when their account balance falls below a certain threshold, indicating that they may be at risk of a margin call. This helps users take proactive measures to manage their positions and avoid margin-related issues.

- Account Monitoring Dashboard:

- A customizable dashboard that provides users with an overview of their account balance, open positions, margin requirements, and risk exposure. Users can monitor their account metrics in real-time to assess their risk levels and make informed decisions.

- Risk Analytics and Reporting:

- Features that provide users with detailed analytics and reports related to their risk exposure, including metrics such as value at risk (VaR), volatility, and potential drawdown. Users can use these analytics to assess the effectiveness of their risk management strategies and adjust them as needed.

- Educational Resources:

- Features that provide users with access to educational resources, tutorials, and risk management guidelines within the trading application. These resources help users understand the importance of risk management and learn best practices for managing risk effectively.

- Simulated Trading Environment:

- A feature that allows users to practice risk management strategies in a simulated trading environment without risking real capital. Users can test different risk management techniques and refine their skills before applying them in live trading situations.

Behavior Analysis for Security

AI’s ability to analyze user behavior plays a crucial role in ensuring the security of trading platforms. By detecting anomalies and patterns indicative of fraudulent activities, AI helps protect user accounts and maintains the integrity of the trading ecosystem.

A UX designer focusing on behavior analysis for security in a trading application can design several features to enhance security and user experience. Here are some potential features and methods for implementing them:

Multi-factor Authentication (MFA)

Design a seamless MFA process that requires users to verify their identity using multiple factors such as passwords, biometrics (fingerprint, facial recognition), or one-time passcodes (OTP). Implement intuitive user interfaces for MFA methods, ensuring ease of use without sacrificing security.

Activity Monitoring

Design a dashboard or activity log that provides users with real-time insights into their account activity, including login attempts, trades executed, and changes to account settings. Utilize visualizations such as graphs and charts to highlight unusual or suspicious activities that may indicate unauthorized access.

Alerts and Notifications

Design customizable alert systems that notify users of important account activities or security events, such as failed login attempts, large transactions, or changes to account settings. Allow users to configure their preferred communication channels for receiving alerts, such as email, SMS, or push notifications within the trading application.

Behavioral Biometrics

Integrate behavioral biometrics technologies that analyze user behavior patterns, such as typing speed, mouse movements, and touchscreen gestures, to continuously authenticate users during their trading sessions. Design interfaces for collecting and analyzing behavioral biometric data in real-time, ensuring minimal disruption to the user’s trading experience while maintaining high levels of security.

Risk Assessment and Scoring

Design risk assessment tools that evaluate user behavior and assign risk scores based on factors such as transaction history, trading patterns, and device usage. Present risk scores to users in a clear and understandable format, along with recommendations for mitigating identified risks, such as changing passwords or enabling additional security measures.

Training and Education

Design interactive tutorials or guides within the application to educate users about common security threats, such as phishing attacks or malware, and provide tips for securely navigating the trading platform. Implement gamification elements to make security training engaging and encourage users to adopt secure behaviors while using the application.

User Feedback and Reporting

Design feedback mechanisms that allow users to report suspicious activities or security concerns directly within the application. Implement processes for analyzing and responding to user-reported issues promptly, demonstrating a commitment to addressing security threats and maintaining user trust.

Real-time Insights Through Data Visualization

The integration of AI allows for dynamic and interactive data visualizations. Real-time analytics and visual representations of market data empower users to grasp complex information quickly. These features enhance decision-making and contribute to a more visually engaging and user-friendly experience.

A UX designer can design various features for real-time data visualization in a trading application to provide users with insightful and actionable information. Here are some key features and methods for implementing them effectively:

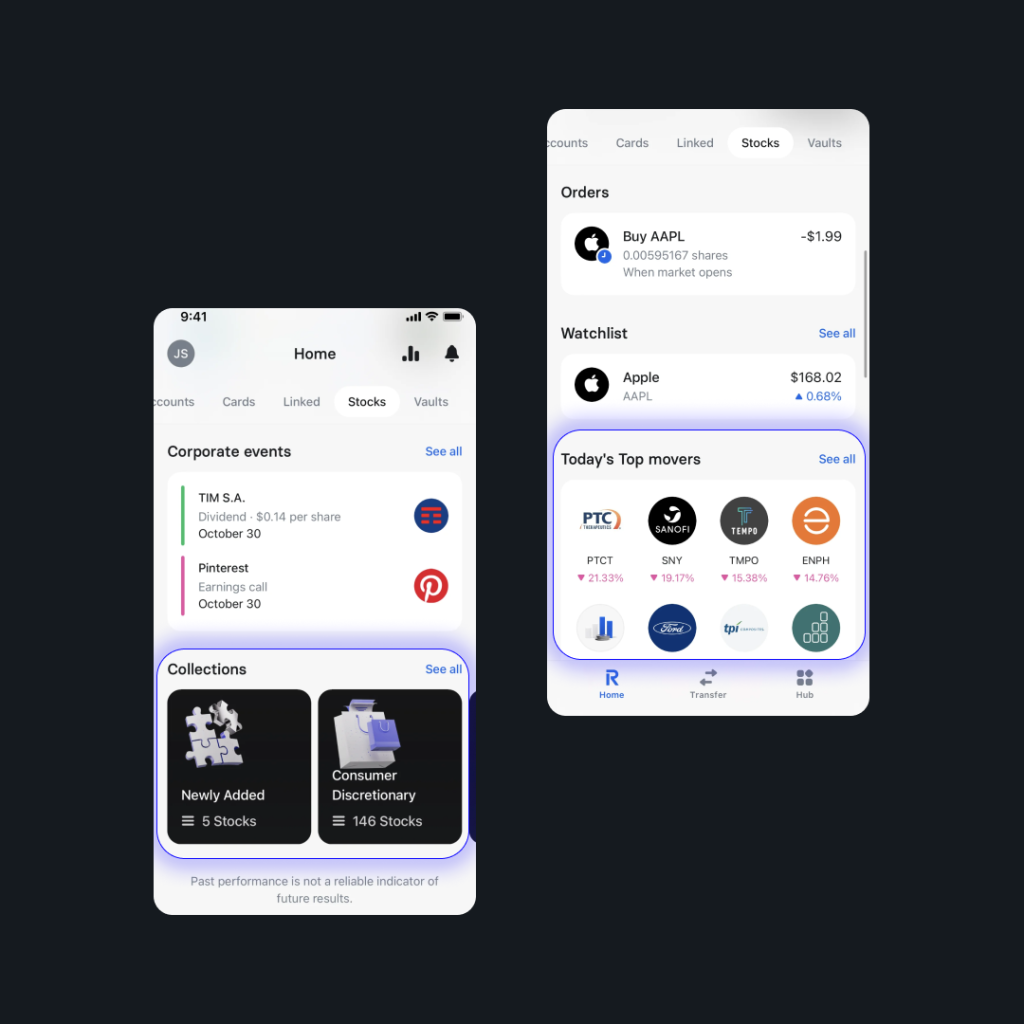

Live Price Updates

Design a visually appealing interface that displays real-time price updates for various financial instruments such as stocks, commodities, and currencies. Utilize color-coded indicators and animations to highlight price movements, trends, and significant changes in value.

Interactive Charts and Graphs

Design interactive charts and graphs that allow users to analyze historical and real-time market data, including line charts, candlestick charts, and bar charts. Implement features such as zooming, panning, and data filtering to enable users to focus on specific time periods or data points of interest.

Technical Indicators

Design a library of technical indicators (e.g., moving averages, RSI, MACD) that users can overlay on price charts to perform technical analysis and identify potential trading opportunities. Provide customization options for adjusting indicator parameters and settings based on user’s preferences and trading strategies.

Watchlists and Alerts

Design a watchlist feature that allows users to track their favorite financial instruments and receive real-time updates on price movements, volume changes, and other relevant metrics. Implement alert notifications that notify users when specific price thresholds or trading conditions are met, enabling them to take timely action.

Portfolio Dashboard

Design a portfolio dashboard that provides users with an overview of their investment portfolio, including current holdings, performance metrics, and allocation breakdowns. Visualize portfolio performance using interactive charts, graphs, and performance metrics such as ROI, P&L, and asset allocation.

Heatmaps and Sentiment Analysis

Design heatmaps that visualize market sentiment and volatility across different financial instruments, highlighting areas of strength or weakness. Integrate sentiment analysis tools that analyze news sentiment, social media trends, and other external factors to provide users with additional insights into market dynamics.

Customizable Layouts and Workspaces

Design a flexible layout system that allows users to customize their trading workspaces based on their preferences and workflow requirements. Provide drag-and-drop functionality for arranging and resizing components such as charts, watchlists, news feeds, and order entry forms within the application interface.

Responsive Design

Ensure the application’s data visualization features are responsive and optimized for various screen sizes and devices, including desktop computers, tablets, and mobile phones. Utilize responsive design techniques such as adaptive layouts, fluid grids, and media queries to deliver a consistent user experience across different devices.

In A Nutshell

As we stand on this brink, the call to action for businesses is clear: to harness AI’s full potential, humanizing technology to solve real-world problems will be the key to leading in a future where AI reshapes our world in ways we are only beginning to imagine.

Trading app developers should go all out to leverage the power of AI to redefine the user experience. From personalized recommendations to automated trading and real-time insights, AI is at the forefront of creating platforms that cater to the diverse needs of traders.

The future of trading is not just about making transactions; it’s about crafting an experience that is intelligent, efficient, and user-centric. With AI leading the way, the possibilities for the next generation of trading app UX are endless.

Explore the potential of integrating cutting-edge AI tools to craft user experiences that set new standards in trading apps. Talk to our designers at Studio Ix.