Investment Management has rapidly evolved to meet changing market demands. From AI-powered robo-advisors to comprehensive portfolio analytics, today’s platforms offer more than just stock-picking tools. They’re designed to help you diversify assets, manage risk, and confidently work toward long-term financial goals.

At Ionixx we specialize in implementing and customizing these solutions for businesses and individuals. Our focus is on aligning the right technology with your unique investment objectives. Below, we’ve highlighted the top five investment management solutions of 2025 – each with its own strengths, features, and ideal user profiles.

1. BlackRock Aladdin

Blackrock Aladdin’s visual identity and screenshots of the interface

Aladdin by BlackRock is a leading investment management platform utilized by asset managers, pension funds, and insurance companies globally. Renowned for its risk analytics, portfolio construction, and operational efficiency tools, it empowers users to manage investment portfolios effectively while minimizing risks.

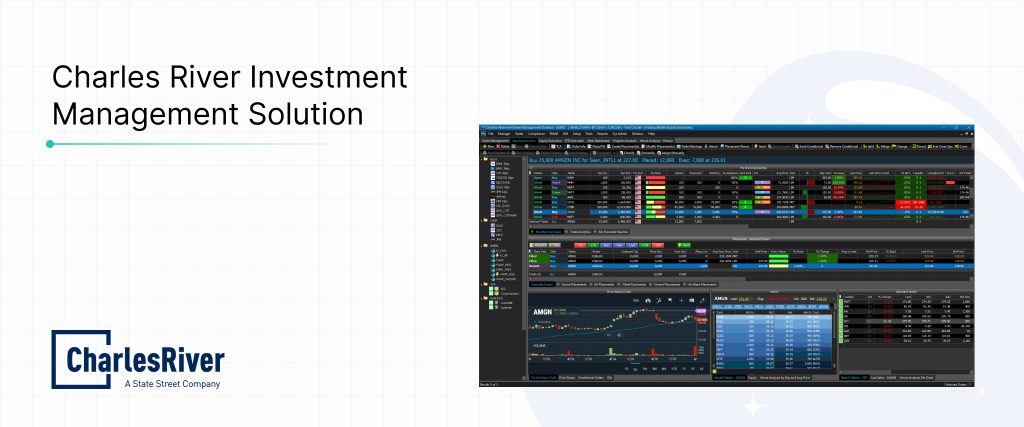

2. Charles River Investment Management Solution

Charles River’s visual identity and screenshots of the interface

Charles River Investment Management Solution (CRIMS) is an institutional investment management platform developed by Charles River Development, a subsidiary of State Street Corporation, providing end-to-end front and middle office solutions for asset managers, hedge funds, wealth managers, insurers, banks, and pension funds. Their comprehensive suite of tools includes Order & Execution Management System (OEMS), ensuring efficient trade execution and pre-trade compliance. Its Portfolio Management tools enable firms to model portfolios, assess risks, and run scenario analyses. Compliance & Risk Management ensures real-time monitoring and automated regulatory reporting. With advanced Data & Analytics, users gain insights through benchmarks and reporting tools. Performance Measurement & Attribution tracks portfolio performance for strategic refinement. The platform’s Connectivity & Integration links brokers, liquidity providers, and post-trade services for seamless operations. Additionally, its Wealth Management Capabilities support advisory, discretionary, and hybrid investment models.

3. Betterment

Betterment’s visual identity and screenshots of the interface

Betterment has solidified its position as a premier digital investment advisor, managing over $55 billion in assets and serving more than 900,000 customers. The platform offers automated investing strategies, personalized financial planning, and recently introduced solo 401(k) plans for independent advisors and their clients. Features include paperless account setup, digital contributions, and options for both Roth (retirement accounts) and traditional tax strategies.

They act as fiduciaries to manage the money through cash management, guided investing, and retirement planning. Their premium plan offers on-demand 1:1 access to advisors addressed as CERTIFIED FINANCIAL PLANNER® or CFP®, with exclusive content, and easy transitions.

4. Merrill Edge

Merril Edge’s visual identity and screenshots of the interface

Integrated with Bank of America, Merrill Edge provides a comprehensive suite of investment services, managing over $496 billion across 3.9 million accounts. The platform offers robust investment research, trade ideas, and tools like the Idea Builder and MarketPro. Its Life Plan program assists clients in financial planning from early stages through retirement.

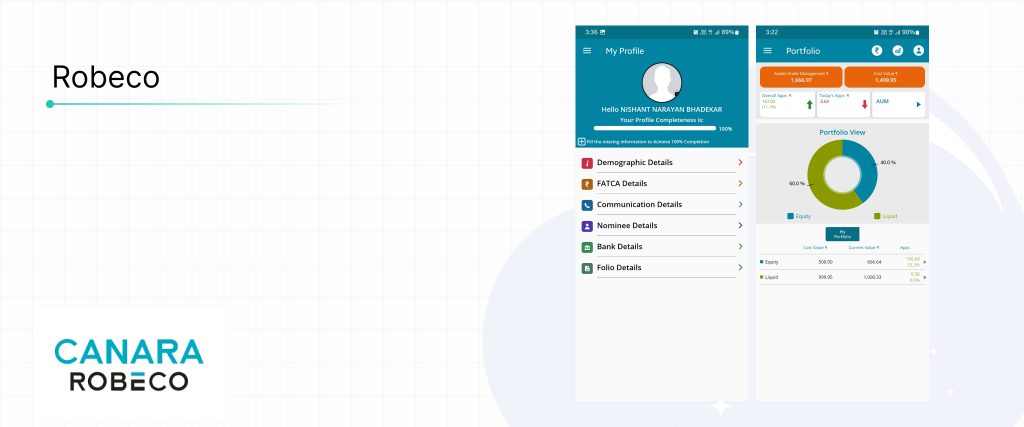

5. Robeco

Robeco’s visual identity and screenshots of the interface

Renowned for its commitment to sustainable investing, Robeco has launched its first actively managed ETFs focusing on sustainable investment strategies. These include global, US, and European equity ETFs, as well as a Dynamic Theme Machine ETF. With €196 billion in assets under management, Robeco leverages its expertise in sustainable and quantitative investing to offer innovative investment solutions.

Summary:

Final Thoughts: The Future of Investment Management in 2025

As financial markets continue to evolve, so do the platforms designed to help investors thrive. The top five investment management solutions of 2025 aren’t just tools; they’re holistic ecosystems combining technology, personalized strategies, and sustainability. Whether you’re looking for AI-driven insights, tax-efficient strategies, or diversified ETF options, these platforms empower you to navigate modern markets with confidence.

Looking ahead, technology will play an even bigger role in investment management. From automated trades to advanced analytics, choosing a solution that evolves with the times is crucial for lasting success. Ready to explore your options or need a tailored system to meet your exact needs?

Get in touch with us today, and let’s find or customize the perfect investment management solution for your financial goals.