Classic bank runs of enormous magnitude have dominated global headlines over the past fortnight, throwing players across the global banking system into an unnerving frenzy.

Three banks in the US have collapsed — a startup funding behemoth in the nation’s largest tech hub, and two prominent crypto-friendly lenders. The Silicon Valley Bank, Signature, and Silvergate banks have over $45 trillion in assets spread across the nation’s banking institutions. At the moment, industry experts are grappling to trace the root cause of the massive US banking fallout – in a bid to get perspective, ensure damage control, and draw up remedial measures into the future.

So where did it all begin?

Were the bank runs sparked by a series of reckless lending practices to borrowers who were ill-equipped to pay it back?

Was it a mounting surge of defaulters and foreclosures?

Or was it just poor PR on the part of the banks that sent a giant wave of panic and anxiety among investors?

Even as speculations are rife, a good section of the financial services industry attributes the entirety of the collapse, particularly Signature’s and Silvergate’s, to digital currencies, aka cryptocurrencies. Having put all its eggs into a single industry, Signature’s story got several industry experts sharing their two cents on how crypto’s volatility could be one of the significant reasons for the bank’s demise.

The Silver Lining: Bitcoin rally

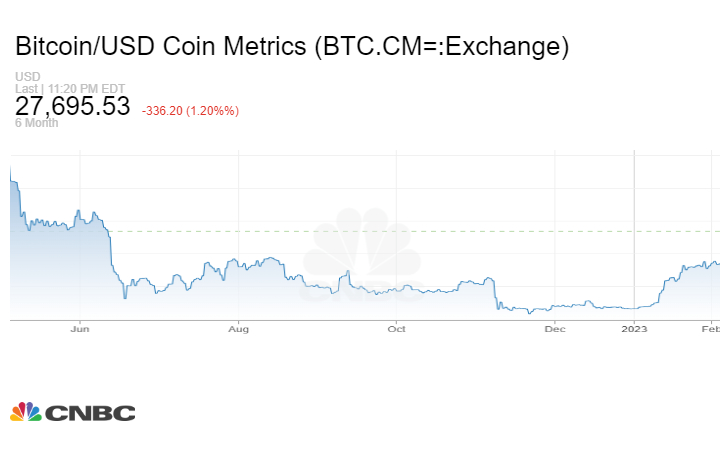

While a sentiment of doom and gloom from the failure of the top banking institutions took centerstage with subsequent risks of contagion into other banks and the global banking sector, there was one glowing moment offering a glimmer of hope. The price of Bitcoin rallied over 18% during the same time period. USDC, the second largest stablecoin, recovered about 4%, a day after the SVB crisis. Now, what do we make of this? Did the financial instability caused by the banking debacle prop up the crypto market and instill a sense of confidence among disarrayed investors? Maybe.

Making its most significant run ever, Bitcoin demonstrated the possibility of challenging traditional systems by exposing how they are fraught with risks and battered with the side effects of poor decisions.

Regulators clamping down with remedial and regulatory measures

The US federal government on its part, helped bail out SVB from a deeper financial turmoil, and restored a semblance of normalcy to the financial system. Here’s a quick snapshot of all the remedial measures taken by the US federal government.

Creating the expansive emergency lending program to recapitalize banks: Intended to prevent a wave of bank runs that would threaten the very existence of the banking system, the Fed enabled banks to raise cash to pay depositors, precluding the need to sell treasuries and other securities. Silicon Valley Bank had been forced to dump some of its Treasuries at a loss to fund its customers’ withdrawals. Under the Fed’s new program, banks can post those securities as collateral and borrow from the emergency facility. This helped stabilize the banks’ balance sheets and improve their ability to lend to customers.

Strengthening regulations: The Fed is currently reevaluating its stance on crypto by deliberating the introduction of stricter regulations to prevent future financial crises.

Providing guarantees for deposits: The government provided guarantees for deposits in banks and other financial institutions, reassuring customers that their money was safe.

Injecting liquidity into the system: The Federal Reserve injected liquidity into the financial system by opening its discount window to provide loans to SVB.

While the damage control exercise by the federal government proved to save the financial system from greater agony, there was a surging interest among crypto market enthusiasts and participants toward banking networks in Asia. And for good reason

It’s worth mentioning about Japan in this context. At the cusp of implementing cutting-edge regulatory measures that offer a practical and mature outlook, Japan seems well poised to make the most of crypto’s features, particularly decentralization and transparency.

The long and short of it — Is the stage set for a crypto disruption?

Decentralization as a solution to the US banking crisis

In a nutshell, the instability in the traditional financial system across the entire banking spectrum has led to a general loss of trust in conventional banks and fiat currencies. This loss of trust could well be the catalyst for people to explore and dabble with alternative forms of currency or unconventional models that leverage the premise of decentralization, precisely blockchain technology.

The role of government regulations in shaping the future of cryptocurrencies

In the same breath, as the Federal Reserve continues to print more money to support the struggling banks, inflation can become a serious concern. Cryptocurrencies are often seen as a hedge against inflation since they have a capped supply, which cannot be inflated or manipulated by central banks.

Considering the the long-term investment potential of cryptocurrencies coupled with the growing adoption of decentralized finance (DeFi) and blockchain technology, the crypto industry is becoming increasingly established and legitimized. This could potentially make it a more attractive option for people looking to protect their assets and invest in safe and stable financial systems.

We also exercise the need to tread with caution, given that crypto markets are still volatile and not entirely immune to economic downturns. We’d love to leave you with thoughts from some industry folks who may, in fact, have the last word—that crypto is here to stay, thrive, and possibly conquer.

“The bankruptcy of SVB, in the short term, can lead to a liquidity crisis for cryptocurrency companies, such as Circle, that have deposits in the bank. This could result in a temporary yet noticeable decline in the cryptocurrency market. However, the bank’s bankruptcy may prompt many people to embrace cryptocurrencies more actively in the long term. It has also fostered public distrust of centralized financial institutions like banks, ultimately benefiting decentralized cryptocurrencies. After all, cryptocurrencies offer the advantage of secure storage in personal digital wallets, which is the safest option.”

Owner of Canny Trading

Quantitative Researcher at GF Securities

“The collapse of SVB is yet another symptom of the volatility and risk that financial markets face. As we’ve already seen in the past, when the SPY sneezes, the cryptocurrency markets get pneumonia. However, this is unlikely to have a long-term impact on the overall growth and adoption of cryptocurrencies.”

Founder, CEO

Quantitative Modelling and Research LLC