Regulation serves as a fundamental feature underpinning the success of the financial services sector, guaranteeing the safeguarding of investors and the integrity of markets. Over the course of the last century, regulatory demands have continuously evolved, and they have been adapted by market participants and broker-dealer firms in an effective manner. This change matches the increasing intricacies, speed, and sophistication of financial markets. The adoption is not possible without technology interference.

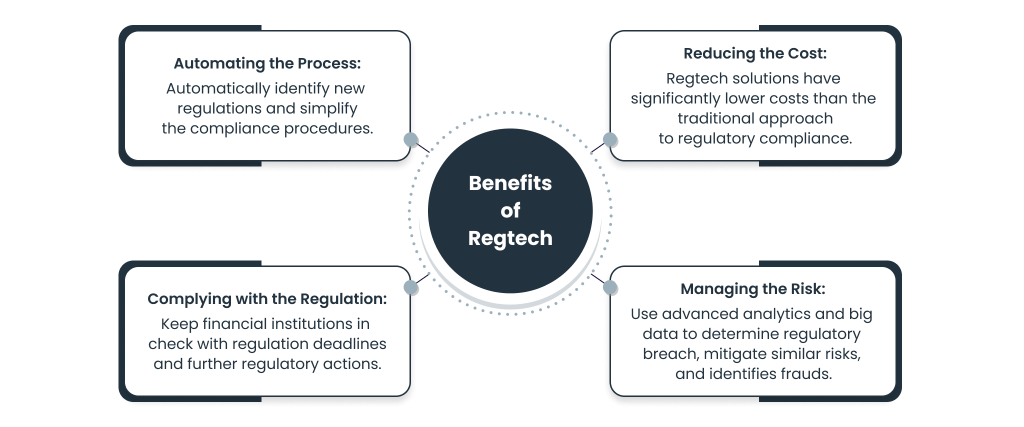

To stay well informed of regulatory obligations, financial services companies are now turning to novel and progressive Regulatory Technology (RegTech) solutions. These RegTech tools are invaluable in aiding broker-dealer firms in fulfilling their responsibilities effectively and efficiently.

Such RegTech tools have the potential to strengthen firms’ compliance programs, thereby fostering safer markets and ultimately benefiting investors.

What Is RegTech?

RegTech, short for Regulatory Technology, leverages innovative tech to simplify and improve how market participants handle regulatory compliance. This approach, defined by the Institute of International Finance, involves using new technologies to address regulatory challenges more efficiently.

Market participants increasingly adopt RegTech tools to create streamlined, risk-focused compliance programs. These tools can potentially transform how the securities industry manages its compliance duties, though they also bring new challenges, including supervision, vendor management, and data security.

For instance, FINRA uses these technologies to enhance market surveillance and regulatory functions, reflecting the broader trend of regulatory bodies harnessing technology for more effective oversight.

RegTech Application In The Security Industry

Surveillance and Monitoring

Market players are committing substantial resources to this realm, with a primary focus on RegTech tools harnessing cloud computing, big data analytics, and AI/machine learning. These tools aim to deliver more accurate alerts and boost the efficiency of compliance and supervisory teams.

The use of RegTech in the firm also reduces the false alerts generated by surveillance systems. This tool aims to move beyond traditional rule-based systems to a predictive risk-based surveillance model that identifies and exploits patterns in data to inform decision-making.

Certain RegTech tools also potentially allow a greater volume and variety of information to be readily reviewed and thereby may help to enhance the operation of a firm’s regulatory compliance program.

Customer Identification And AML Compliance

Another compliance area seeing increased interest in RegTech adoption is customer identification, commonly known as “know-your-customer” or KYC, along with anti-money laundering (AML) programs.

KYC and AML rules and regulations play a crucial role in maintaining the integrity of financial markets. They enable market participants and regulators to identify and prevent potential money laundering, terrorist financing, securities fraud, and market manipulation. However, complying with KYC and AML requirements also involves associated costs.

Reporting And Risk Management

Firms are increasingly turning to RegTech tools for their reporting and risk management programs. These tools employ technology to streamline or automate various processes, including risk data aggregation, risk metrics generation, and monitoring (for both enterprise and operational risk management), as well as regulatory reporting.

For example, when it comes to risk-data aggregation or regulatory reporting, firms can deploy RegTech solutions to collect and analyze data concerning capital and liquidity. They can then utilize this information in internal models or report it to regulators, thereby enhancing efficiency and accuracy.

Compliance Reporting

This is a critical function for every Broker-Dealer, as they are constantly required by regulation bodies such as SEC and FINRA to provide trade reporting to their TRACE (Trade Reporting and Compliance Engine), Blue sheets, and CAT(Consolidated Audit Trail) needs. For example, CAT reporting is a tedious process for BDs to report in a very specific manner and format that is required by FINRA. So, if firms do not have the right technology and capabilities to provide the right kind of reporting, they can outsource such regulatory reporting to companies like Ntiefs and Oyster Consulting for their CAT reporting obligations.

Conclusion

The outburst of technological innovation in regulation, often referred to as Regulatory Technology or RegTech, is reshaping the landscape of the financial services industry.

RegTech solutions are not only simplifying compliance processes but also enhancing their efficiency and effectiveness. They are invaluable tools that empower financial institutions, broker-dealer firms, and market participants to navigate regulatory obligations with ease. At Ionixx, we help broker-dealers stay on top of pre-trade regulatory requirements with dynamic order management systems. Get in touch with us.