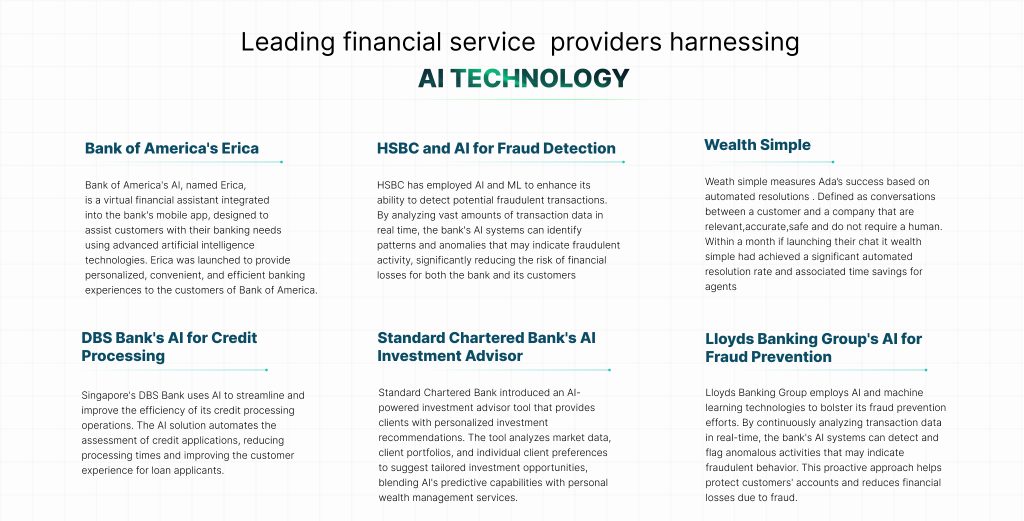

As more people rely on digital solutions for their banking needs, the impact of AI becomes increasingly relevant to our daily lives. AI’s market value is expected to reach $190 billion by 2025, and its integration into financial services can be a game-changer for consumers. FinTech firms are leveraging the capabilities of AI to deliver personalized, efficient, and secure services, enhancing user satisfaction and loyalty in a way that meets the sophisticated demands of today’s tech-savvy customers.

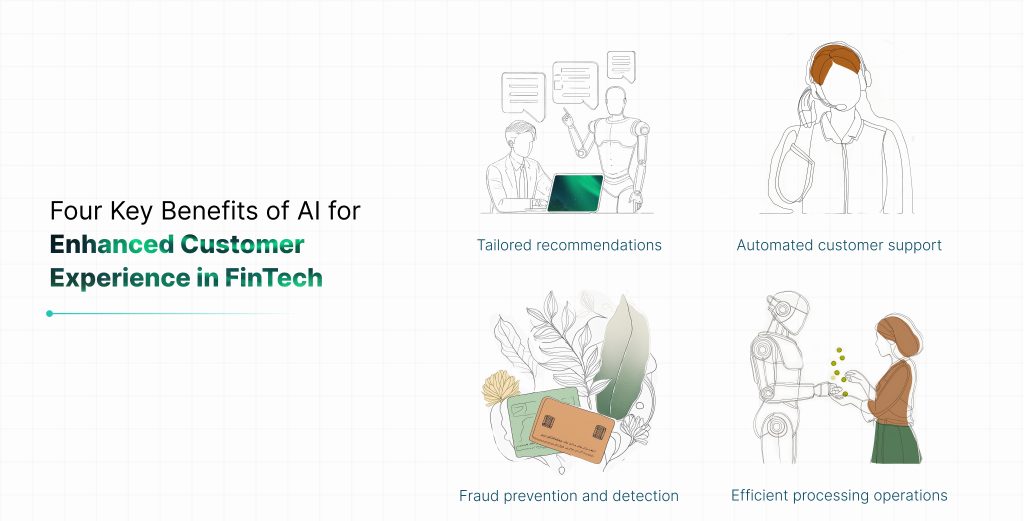

Tailored Financial Solutions

Imagine having a financial advisor who truly understands your spending habits, investment preferences, and financial goals. AI empowers FinTech companies to offer this level of personalized service by analyzing vast amounts of data to cater to each customer’s unique needs. As AI tailors services to meet these specific needs, it not only increases product adoption but also fosters greater loyalty among customers.

For example, consider a young professional passionate about sustainable investments and travel. Using a popular FinTech app powered by AI for personalized financial advice, she receives a notification suggesting a new sustainable mutual fund. This fund not only aligns perfectly with her values but also has a strong track record. This tailored recommendation not only meets her investment preferences but also resonates with her desire for eco-friendly financial decisions.

Feeling understood and valued by the app’s personalized approach, she becomes more engaged with its services, leading to higher satisfaction and stronger loyalty to the FinTech company behind the app.

Automated Customer Support

AI-powered chatbots are revolutionizing customer service in FinTech by swiftly and accurately addressing a wide array of customer queries. These chatbots offer instant responses, significantly enhancing customer satisfaction while relieving the burden on human agents.

For example, imagine a bustling call center during its busiest hours, where customers often face extended wait times, and banks struggle to cope by increasing staffing. AI transforms this situation by optimizing how calls are routed and managed, enhancing operational efficiency. Drawing insights from diverse data sources such as customer histories, past interactions, and call patterns, AI-driven chatbots handle high call volumes with personalized responses. This intelligent approach not only reduces wait times but also ensures each customer receives tailored and efficient support, leading to enhanced satisfaction and support effectiveness.

Fraud Prevention & Detection

Fraud remains a critical issue in financial transactions. Traditional methods of fraud detection, like manual review, can be slow and often have narrow capabilities. In contrast, AI excels in identifying and thwarting fraudulent activities by swiftly recognizing unusual patterns and behaviors in real-time.

For instance, consider a scenario where AI-powered algorithms monitor a bank’s transactions. They detect an abnormal pattern where a credit card is used for multiple continuous large purchases within a short timeframe. AI promptly flags this as suspicious activity, preventing potential fraud before significant losses occur.

Efficient Processing Operations

Implementing AI to streamline credit processing operations significantly enhances the efficiency and customer experience for loan applicants. This faster process not only improves customer satisfaction by respecting their time and urgency but also enhances accuracy and consistency in decision-making, minimizing errors and ensuring fair evaluations. By simplifying and speeding up the credit application process, AI helps reduce customer drop-off rates. Applicants are less likely to abandon their applications midway due to frustration or delays, which contributes to higher conversion rates for FinTech companies. The personalized service and reduced friction further contribute to a smoother experience, boosting conversion rates and strengthening the company’s relationship with its clients.

Closing Remarks

As FinTech continues to evolve with AI at its core, financial service providers are striving to become the world’s most humane companies by leveraging technology that enhances customer experiences while maintaining a human touch. AI-powered chatbots and robo-advisors have revolutionized the industry, offering personalized financial solutions and streamlined support that deflects query tickets effectively. Beyond customer interaction, AI strengthens security measures with robust fraud prevention capabilities, ensuring swift responses to potential risks. This transformative integration of AI not only meets but exceeds the expectations of tech-savvy consumers, delivering seamless, intuitive, and secure financial services that drive greater satisfaction and loyalty in an increasingly digital world.