In the past decade, the digital lending scenario has changed dramatically with several new lending models such as Buy Now Pay Later (BNPL) emerging. Thanks to wider smartphone adoption, easy access to credit scores, and a positively increasing number of savings bank accounts, we are witnessing quite a boom within the digital lending landscape.

Nevertheless, loan recovery has been a critical process, and the inefficiencies surrounding manual collections and debt recovery systems have called for more robust processes that cut down errors. The need for proficient communication tools to improve loan recovery, comply with regulatory guidelines, and provide a consistent customer experience has been top of the mind goals for several fintechs.

Design challenges in this space include creating systems that are easily navigable, simplifying complex financial information, and ensuring a secure yet user-friendly platform. This requires specific design expertise for developing systems that not only meet the technical requirements but also cater to the nuanced needs of diverse users.

In this blog, we delve into how Ionixx’s design studio helped a microfinance company design a seamless platform to tackle late payments. The mission was straightforward: change the way microfinance companies deal with late payments.

Setting The Priorities Upfront

The primary objective was to revolutionize the way microfinance companies dealt with late payments. The overarching goals included:

Enhanced Debt Collection: We wanted to build a platform that would significantly improve the ratio of money collected from late-paying customers. This involved implementing strategies and features that collectively aimed to make the repayment process more efficient, engaging, and rewarding for borrowers.

Operational Efficiency: We aimed to design in a way that would enhance overall efficiency in handling overdue loans. This meant creating a system that streamlined the entire loan collection process, reducing the administrative burden and minimizing the time and resources required for recovery.

2 Key Challenges That We Had to Overcome

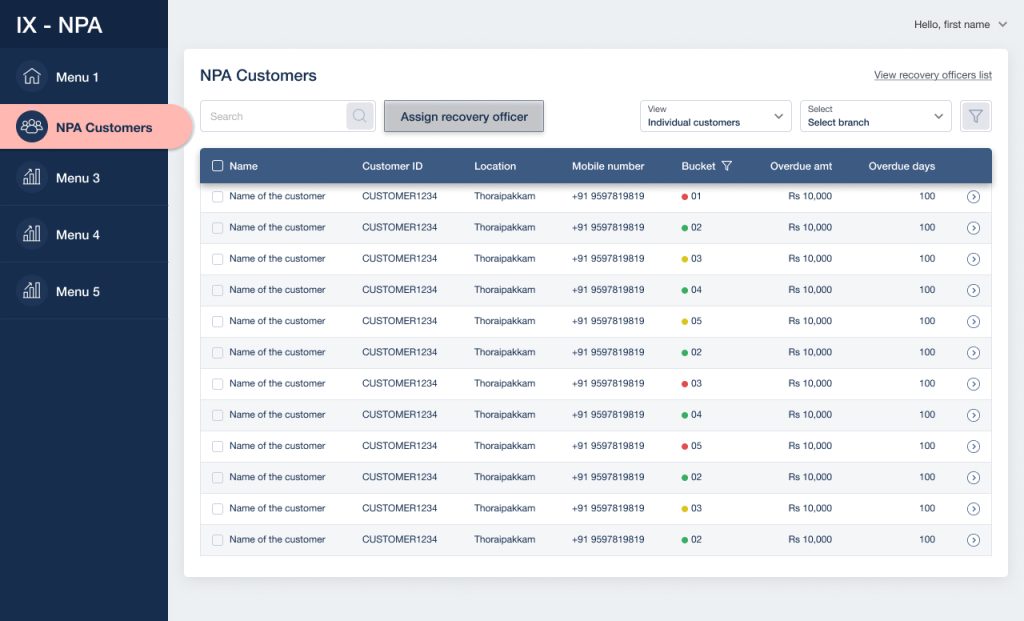

Tackle Non-Performing Assets (NPAs): The presence of Non-Performing Assets added another layer of complexity. Without effective strategies to address NPAs, microfinance companies struggled to manage their portfolios and ensure sustainable operations.

Build Cost-Effective Solutions: We had to find ways to recover overdue loans without incurring substantial costs. Traditional methods often involved significant expenses such as:

- Manual Debt Recovery:

- Physical notices, reminders, and follow-ups through calls or visits.

- Legal Proceedings:

- Filing lawsuits or court orders with associated legal fees.

- Collateral Liquidation:

- Seizing and selling collateral, incurring administrative and legal costs.

- Loan Restructuring:

- Modifying loan terms to accommodate borrower financial challenges.

- Third-Party Collection Agencies:

- Engaging agencies with associated service fees.

So the goal was to design a system that would be both effective and economically viable.

To get through this, we needed new ideas and practical solutions. Some ways in which we solved them are:

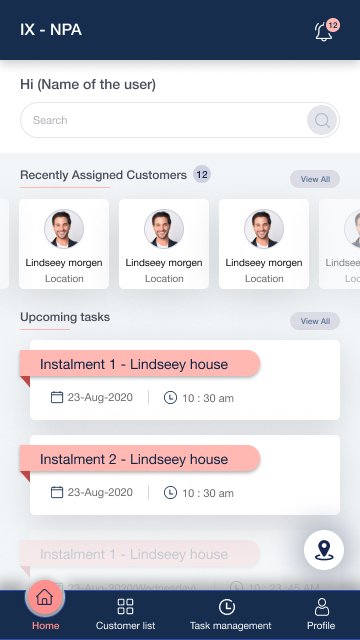

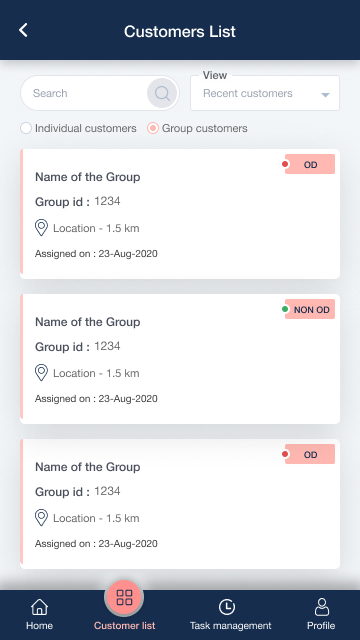

Building A Universal Dashboard: In a micro finance company, users of the dashboard would include a diverse range of roles such as loan officers, branch managers, credit analysts, accountants, and possibly even executives. Each role has distinct needs – loan officers may focus on pending tasks and client interactions, branch managers might prioritize branch performance metrics, credit analysts may require data on loan portfolio quality, and executives might seek overall company performance metrics. Crafting a versatile dashboard that caters to these varied user needs ensures effective decision-making and workflow efficiency across the organization. We made many dashboards, tested them with users, talked with the client, and finally, we got a dashboard that worked for everyone.

Designing Maps for Each User Group

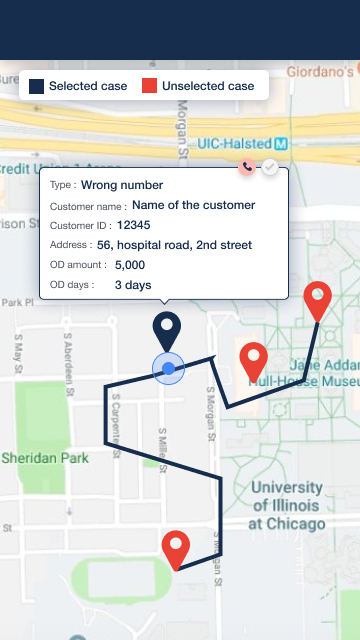

Each person in charge of collecting money had specific customers. We made a map which included features like:

1. Customer Locations:

Displaying the geographical locations of each customer assigned to the individual.Icons or markers indicating the type of customer (e.g., regular, overdue, high-risk).

2. Route Optimization:

Providing an optimized route for the user to visit multiple customers efficiently, reducing travel time and costs.

3. Customer Information: Access to key customer details, such as outstanding amounts, payment history, and any relevant notes or comments.

4. Real-time Updates:

Integration with real-time data to reflect the current status of customers (e.g., recent payments, overdue amounts) for informed decision-making during visits.

5. Navigation Tools:

Integration with navigation tools for turn-by-turn directions, ensuring the user can easily navigate to each customer’s location.

By incorporating these features, the map within the NPA application becomes a powerful tool for individuals responsible for debt collection, enhancing their ability to plan, navigate, and interact with customers efficiently for each person so they could see who the customers were nearby. This helped them plan their visits better.

Capturing Information: Sometimes, the person collecting money had to write down info when the customer wasn’t there. This was tough, but after trying a few times and understanding their work better, we made it work.

Devising A Telecalling System: We made a system for calling customers to remind them about late payments. It was tricky because sometimes customers weren’t available or their phones were off. We thought about all the things that could happen and made it work.

How Did We Start -By Creating Simple Wireframes

To deal with these problems, we started with simple wireframes. These helped us decide how things should work. Using black-and-white screens kept users focused on the main things without distractions.

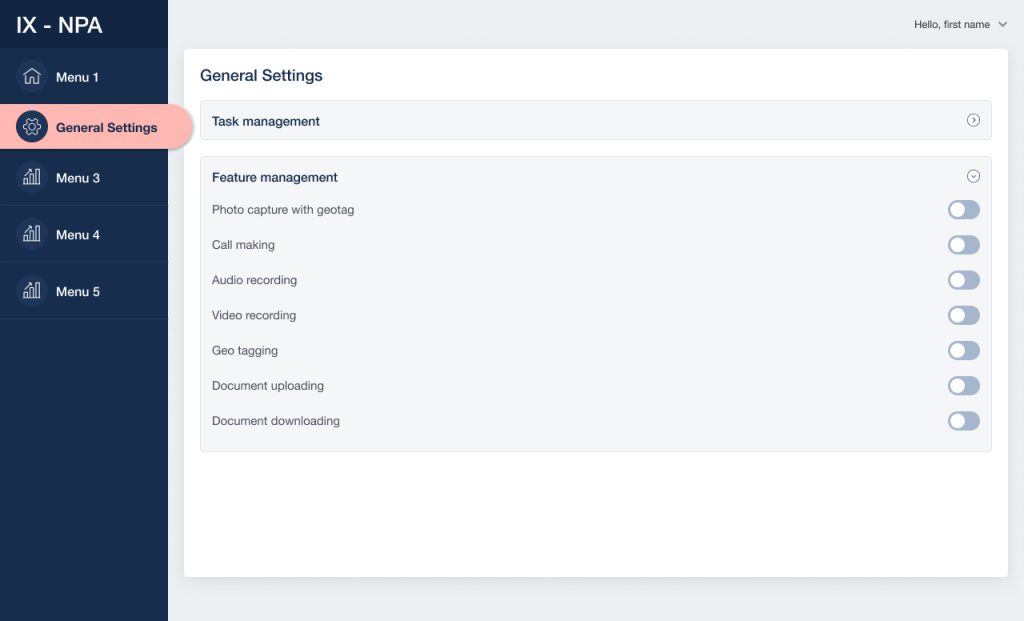

We had to handle tasks, rules, and the special needs of the microfinance company such as:

- Automated Payment Reminders:

- Implement automated reminders to notify loan recovery officers about upcoming payment due dates.

- Enable customizable reminders based on the borrower’s preferred communication channels.

- Task Management System:

- Include a task management module to assign and track specific loan recovery tasks.

- Prioritize tasks based on urgency and escalate as necessary.

- Customer Interaction History:

- Maintain a log of all interactions with borrowers, including calls, emails, and visits.

- Ensure that loan recovery officers have access to a complete history for informed decision-making.

- Mobile GPS Integration:

- Integrate GPS features to help loan recovery officers plan efficient routes for field visits.

- Provide real-time location tracking for better coordination and monitoring.

- Document Capture and Storage:

- Enable loan recovery officers to capture and upload relevant documents directly through the app.

- Streamline document management for a more organized and efficient workflow.

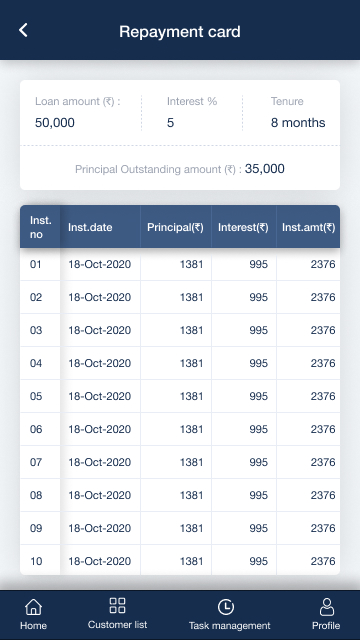

- Negotiation and Settlement Tools:

- Include features that facilitate negotiation and settlement discussions with borrowers.

- Provide guidelines and support tools for officers to structure viable repayment plans.

- Payment Processing Integration:

- Integrate the app with payment processing systems to facilitate on-the-spot payments during field visits.

- Ensure secure and convenient payment options for borrowers.

- Performance Analytics Dashboard:

- Create a performance analytics dashboard to track the loan recovery officer’s efficiency.

- Provide insights into successful recoveries, challenges faced, and areas for improvement.

4 Best Practices We Adhered to

User-Centric Design: The platform was designed with a user-centric approach, ensuring that the end-users, including loan officers and administrators, could easily navigate and utilize its features. Intuitive interfaces and clear workflows were prioritized to facilitate efficient usage.

Data-Driven Decision-Making: Leveraging data analytics, the platform incorporated tools to assess borrower behavior, identify patterns leading to late payments, and make informed decisions. This data-driven approach helped in creating personalized strategies for debt recovery.

Automation and Integration: To enhance operational efficiency, the platform integrated automation wherever possible. Automated reminders, communication tools, and integrated payment gateways were implemented to streamline the entire loan collection process.

Continuous Improvement: Post-implementation, a system of continuous improvement was established. Regular feedback loops and data analysis were employed to identify areas for enhancement and ensure the platform’s adaptability to evolving needs and challenges.

Key Takeaway

In the end, the platform we made shows how design can solve problems. By understanding the situation, setting clear goals, and solving problems with plans and design, we made a tool that helps companies handle late payments better. The journey had tough parts, but every problem helped us make a solution that changed things.

To know more on how we design for Fintech, and to understand how we can help you tackle your fintech application challenges through design, get in touch.