In the current digital landscape, the rise of FinTech apps is reshaping how we handle our finances. The importance of seamless onboarding is becoming a critical factor for the triumph of FinTech apps. Whether it’s a mobile banking platform, an investment app, or a payment solution, the ability to effortlessly guide users through an intuitive onboarding process holds the key to capturing user attention and retaining customers. In this extensive guide, we’ll delve into the fundamental principles and effective strategies for achieving flawless onboarding in FinTech applications.

Adopting a User-Centric Approach

Before diving into the onboarding process, it’s crucial to grasp the requirements and expectations of your target audience. Conducting comprehensive user research is essential to identify pain points, preferences, and behavioral patterns. This customization ensures that the onboarding experience meets the unique requirements of your audience, thereby boosting user satisfaction and engagement right from the get-go.

Simplifying Registration

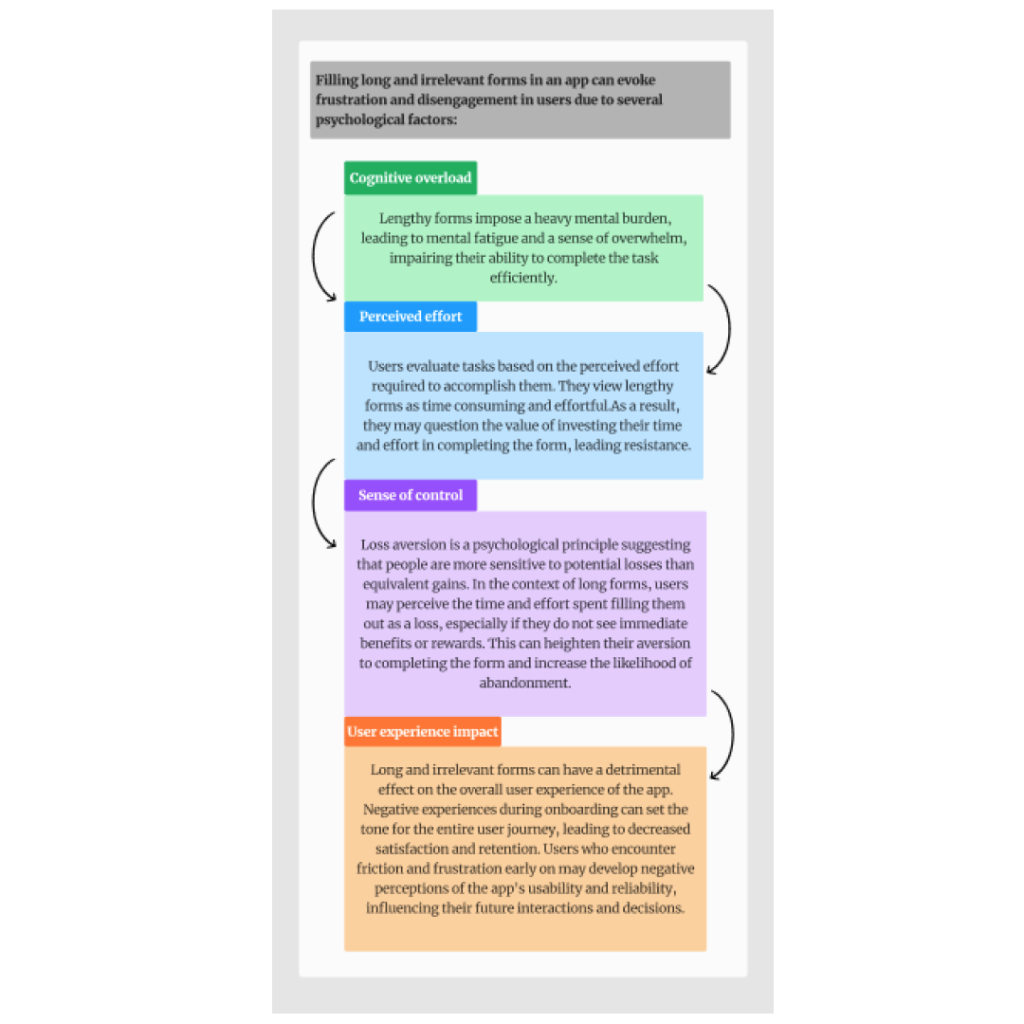

The first step in onboarding is often the registration process, which involves Know Your Customer (KYC), where users create an account or profile. This is a critical touchpoint where the user’s experience should be prioritized. To streamline this step, a good practice is to minimize the number of mandatory fields to lessen cognitive load and frustration. Additionally, clear instructions and guidance throughout the process should be provided to ensure users feel supported and empowered.

Furthermore, leveraging technology to automate and expedite KYC verification can significantly reduce waiting times, enhancing the overall user experience. By incorporating features like real-time document verification, users can complete the KYC process swiftly and with minimal effort.

Incorporating Guided Tours and Tutorials

Implementing interactive guided tours and tutorials throughout the onboarding journey to familiarize users with key features and functionalities. Use tooltips, walkthroughs, and interactive demos to explain complex concepts or processes in a user-friendly manner. By providing hands-on guidance, you empower users to navigate the app with confidence, reducing frustration and dropout rates.

Practicing Progressive Profiling

Instead of bothering users with a lengthy onboarding process upfront, embrace a progressive profiling approach. Collect essential information gradually over time as users engage with the app, prompting them to fill in additional profile details or preferences at strategic touchpoints. This minimizes cognitive overload, enabling users to focus on immediate tasks without feeling overwhelmed.

For example, instead of requesting beneficiary details from investors during the initial onboarding process, designers may choose to collect this information after users have completed the sign-up phase. This approach is based on the understanding that requesting beneficiary details as part of KYC for investors may not be necessary, as it adds unnecessary complexity to the onboarding process, potentially resembling a lengthy form. Additionally, beneficiary details may not be a critical piece of information required for creating an investor account. Instead, employing a progressive profiling strategy allows users to fill in such details at their convenience, typically within their profile section after signing up. This ensures a smoother onboarding experience for investors, minimizing friction and optimizing the user journey, especially for the High Net Worth Customers (HNC) target group. An incomplete indicator next to the profile will capture the user’s attention, prompting them to provide the necessary details when they are ready.

Now that we’ve covered the four fundamental principles and effective strategies for achieving seamless onboarding in FinTech applications, let’s quickly address a common oversight: the uniformity of the onboarding process for different sets of target audiences in FinTech applications.

For instance, let’s focus on two such sets: borrowers and lenders.

Although this approach may appear efficient initially, it overlooks the distinct needs and expectations of both lenders and borrowers, thereby impeding their onboarding experience.

Let’s explore why this one-size-fits-all approach is inadequate and why a tailored onboarding process for lenders and borrowers is crucial.

1. Divergent User Needs

Borrowers and lenders inherently have divergent needs and motivations when using a financial platform. Borrowers seek access to funds to fulfill their financial goals, while lenders aim to invest their capital for potential returns. Consequently, their onboarding requirements and preferences differ significantly. By applying the same screens and user flows for both borrower and lender onboarding, the application overlooks these nuanced differences, resulting in a suboptimal user experience for lenders.

2. Complexity and Cognitive Load

Lenders, unlike borrowers, are primarily concerned with financial transactions and investment-related activities. Presenting them with a comprehensive onboarding process that mirrors the borrower application introduces unnecessary complexity and cognitive load. Lenders may feel overwhelmed by irrelevant information or steps, leading to frustration and disengagement. Simplifying the onboarding journey for lenders is essential to mitigate these challenges and enhance user satisfaction.

Conclusion

Mastering the art of seamless onboarding is paramount for the success of FinTech applications in today’s digital age. By adopting a user-centric approach, simplifying registration processes, providing guided tours and tutorials, and implementing progressive profiling techniques, FinTech apps can create a frictionless onboarding experience that delights users and fosters long-term engagement.

However, it’s crucial to recognize the diverse needs and expectations of different user segments and tailor the onboarding process accordingly. By acknowledging these differences and designing personalized onboarding experiences, FinTech apps can effectively address the unique requirements of each user group, ultimately driving user satisfaction and retention.

In essence, seamless onboarding is not just about facilitating user interactions – it’s about building trust, delivering value, and establishing a strong foundation for ongoing user relationships. By prioritizing user experience at every step of the onboarding journey, FinTech apps can differentiate themselves in a competitive market landscape and position themselves for sustainable growth and success.