A New York broker-dealer paid a penalty of $35,000 late last year on charges of violating the Securities and Exchange Commission (SEC)’s Regulation Best Interest (Reg BI).

Expelling a broker-dealer from the system, FINRA penalized SW FInancial’s CEO over alleged churning of client accounts, alluding to violations of Regulation Best Interest.

In 2022, customers filed 216 arbitration actions alleging a violation of Reg BI.

These incidents bring to the fore how Reg BI has emerged as a crucial milestone in the context of safeguarding investors over time. It has been instrumental in instituting transparency and accountability for broker-dealers when making investment recommendations to retail clients.

In this article, we explore its significance, its role in ensuring a stable securities exchange market, the challenges that broker-dealers face in maintaining compliance, and what the future looks like in this space.

Regulation BI: What Triggered It?

The 2008 financial crisis was a pivotal point for regulators in the securities market. A slew of regulations were drawn up; one to clamp down on potential bad players with market access during the pre-trading process, and two, to impose higher standards of responsible conduct for broker-dealers, in their dealings with retail customers.

The underlying intention was driven by two prominent ideals:

- An active commitment to advocating for investor rights and

- The pressing call to shape a more trustworthy and responsible financial marketplace

Prompted by the urgency to address inconsistent standards and safeguard the interests of retail investors, the SEC introduced the Reg BI rule on June 5, 2019. However, it was only on June 30, 2020, that it came into effect. Reg BI effectively enhances the standard of conduct applicable to broker-dealers when making recommendations to retail customers regarding investment transactions, strategies, or accounts.

Fiduciary Duty for RIAs And Reg BI for Broker-dealers: Understanding The Difference

Despite substantial advancements in financial regulations over the years, the dichotomy between the fiduciary duty of registered investment advisors (RIAs) and the suitability standard upheld by broker-dealers remains muddled in confusion.

The decades-long debate over what the duties and obligations of broker-dealers and RIAs to their clients are and how they should be regulated rages on.

However, for RIAs; the Reg BI and its rules have little direct impact.

The table illustrates the distinction between the Reg BI and the Fiduciary duty rule.

| Regulation | SEC Regulation Reg BI | Fiduciary Duty for RIAs |

| Definition | A set of proposals issued by the SEC in early 2018, came into effect in June 2020, to raise the standard of conduct for broker-dealers. | A standard that encompasses both a duty of care and a duty of loyalty owed by investment advisors to their clients. |

| Obligation | Broker-dealers must act in the best interest of retail customers and avoid putting their financial interests ahead of clients’ interests when making recommendations. The 4 tenets that govern it: Duty of Care Duty of Compliance Duty of Conflict of Interest Mitigation Duty of Disclosure | Investment advisors must provide advice in the best interests of clients, seek the best execution of transactions, and offer advice and monitoring over the course of the relationship. The 5 tenets that govern it: Duty of Care Duty to Provide Advice that is in the Client’s Best Interest Duty to Seek Best Execution Duty to Act and to Provide Advice and Monitoring over the Course of the Relationship Duty of Loyalty |

| Duty of Care | Provide advice in the client’s best interests. Seek the best execution of transactions. Provide ongoing advice and monitoring. | Act with care, skill, prudence, and diligence considering the client’s goals and circumstances. |

| Duty of Loyalty | Broker-dealers must avoid conflicts of interest or disclose them and obtain client consent. Place clients’ interests above their own or their firms’. | Place clients’ interests above the advisor’s and the advisor’s firm. Avoid conflicts of interest and disclose any material conflicts. |

| Applicability | Limited to securities transactions and investment strategies. | Covers all financial assets, including non-securities such as tax strategies and insurance transactions. |

| Scope | Applies at the time of making recommendations. | Applies throughout the entire client relationship, not just during specific recommendations. |

| Implementation | Compliance took effect on June 30, 2020. | Applies at all times whenever a client engages an investment advisor for services. |

| Impact on Advisor’s Organization | Broker-dealers can still operate without becoming fiduciaries. | Investment advisors are bound to the fiduciary standard, acting in the client’s best interest at all times. |

In summary, Reg BI requires broker-dealers to act in the best interest of retail customers, with restrictions on putting their financial interests ahead of clients when making recommendations.

On the other hand, the fiduciary duty applicable to investment advisors, such as those regulated by the SEC and holding the CFP® certification, encompasses both a duty of care and a duty of loyalty. It obligates advisors to act in the best interests of clients, avoid conflicts of interest, and provide ongoing advice and monitoring.

Unlike Reg BI, the fiduciary duty applies at all times throughout the client relationship and extends to all financial assets, not just securities transactions and investment strategies.

Form CRS: A Springboard for Starting Conversations between Retail Investors And Broker-dealers

Within the context of Reg BI, the SEC created documentation for broker-dealers to provide to new and existing clients. One of these is Form CRS, which stands for Client Relationship Summary.

- Put together in easy-to-understand language, Form CRS helps retail investors evaluate the types of services they can expect from broker-dealers and investment advisors.

- It is designed to empower investors to make informed decisions when choosing a new broker or advisor (or continuing an existing relationship). Here are a few questions that the CRS seeks to answer:

- Does your firm’s policies, procedures, and controls continue to address compliance with FINRA Rule 2111 (Suitability), which still applies to recommendations made to non-retail investors?

- Does your firm have policies, procedures, and controls addressing Reg BI’s recordkeeping requirements?

- Has your firm provided adequate Reg BI training to its sales and supervisory staff?

- Does your firm and your associated persons consider the express new elements of care, skill, and costs when making recommendations to retail customers?

- Does your firm and your associated persons consider reasonably available alternatives to the recommendation?

- Does your firm and your registered representatives guard against excessive trading, irrespective of whether the broker-dealer or associated person “controls” the account?

- Does your firm have policies and procedures to provide the disclosures required by Reg BI?

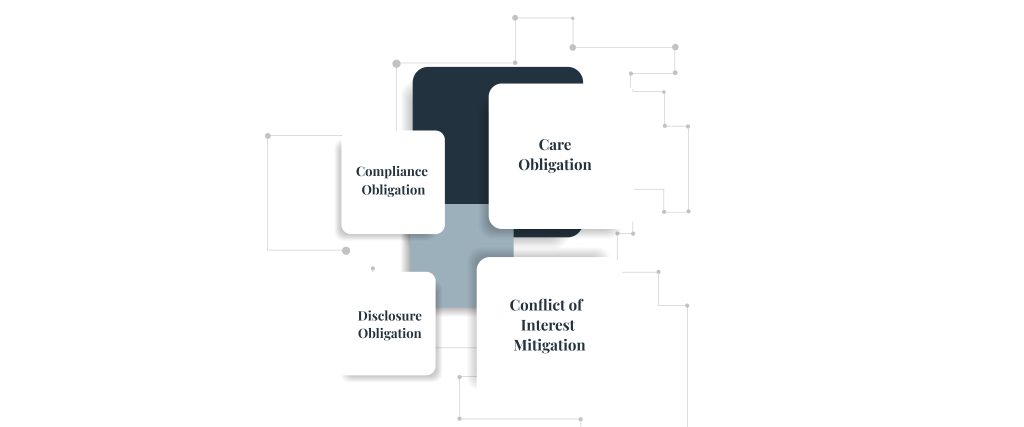

The Four Components of Reg BI: Understanding the Key Obligations

Reg BI rests on four essential obligations that broker-dealers must meet when dealing with retail customers. Let’s delve into each of these components and understand their implications.

- Compliance Obligation: The compliance obligation necessitates the establishment, maintenance, and enforcement of written policies and procedures reasonably designed to meet compliance with Reg BI, thus creating an affirmative obligation under the Exchange Act. Broker-dealers need to prioritize the overarching best interests of their retail customers, necessitating thorough analysis and consideration of various factors when making recommendations.

- Disclosure Obligation: This mandates broker-dealers to provide clear and concise disclosure documents to their clients, disclosing in writing all material facts regarding the scope of services, associated costs, and terms of the relationship with the client. This enhances transparency and allows clients to make informed choices. For example, a broker-dealer disclosing the compensation arrangement and the limited recommendations involved with reasonable fees, as compared to higher fees with in-depth recommendations around a product offering, so that an investor has a fair knowledge of it upfront, before making a financial decision, is in good compliance with the proposed obligation.

- Care Obligation: Broker-dealers are required to exercise reasonable care, skill, and diligence when selecting investment options for their clients. They are expected to analyze reasonably available investment options and consider costs, risks, and potential returns before making suitable recommendations. By treating the cost associated with a recommendation as an important factor, the Care Obligation would enhance the BD’s existing obligations under the new rule. For example, in the case of two separate portfolios that an investor is looking at, the rate of ROI between the two will distinguish and provide the best recommendation for reasonable investing.

- Conflict of Interest Mitigation: Reg BI emphasizes the importance of identifying, disclosing, and mitigating conflicts of interest to avoid compromising the client’s best interests. This includes adopting necessary policies and procedures that prioritize the interests of clients. A broker-dealer that is motivated during the recommendation process by their own self-interest such as for self-enrichment, self-dealing or self-promotion, is not acting in the best interest of the investor. For example, a broker-dealer making a recommendation to maximize the profit from commission and fees or expand the business relationships, or satisfy sales goals for the year, will be in conflict of interest with the financial interest of the investor.

Types of Conflicts

- Reg BI demands full disclosure and mitigation of conflicts of interest that might influence the broker-dealer’s recommendations. These conflicts may arise from financial incentives, proprietary products, or other relationships that could potentially compromise the objectivity of advice.

- The following conflicts of interest are not prohibited by the Reg BI, but can be considered as permissible as long as the broker-dealer has fulfilled all the requirements stated by the Reg BI.

- Receiving or providing differential compensation based on the product sold;

- Charging commissions or other transaction-based fees; Receiving third-party compensation;

- Recommending proprietary products, products of affiliates or a limited range of products;

- Recommending a security underwritten by the broker-dealer or a broker-dealer affiliate, including initial public offerings (“IPOs”);

- Recommending a transaction to be executed in a principal capacity;

- Recommending complex products;

- Allocating trades and research, including allocating investment opportunities (e.g., IPO allocations or proprietary research or advice) among different types of customers and between retail customers and the broker-dealer’s own account;

- Considering the cost to the broker-dealer of effecting the transaction or strategy on behalf of the customer (for example, the effort or cost of buying or selling an illiquid security); or

- Accepting a retail customer’s order that is contrary to the broker-dealer’s recommendations.

Navigating Reg BI Today: Challenges Faced by Broker-dealers

Implementing Risk Alerts in Surveillance Systems

In a risk alert on Reg BI compliance issued in January 2023, the SEC said it had found that some broker firms lacking adequate automated systems to monitor transactions. It observed that the existing compliance processes were not robust enough to skillfully provide brokers the tools needed to document and showcase that they were in fact acting in clients’ best interest.

Simply explained, the SEC risk alert seems rather too broad to give clients clear guidance to set up procedures on how systems should be managed.

“The SEC risk alert is vague about what firms should do, it could have used more detail on what they want. There could be unexpected challenges for firms setting this kind of system up. They could have done more to explain it.”

Lack of Specificity in the Reg BI

Reg BI does not define how deeply broker-dealers and their registered representatives, in the exercise of reasonable diligence, must delve into the issuer’s financial history, collateral, or business model (or changes to its business model) to sufficiently understand the risks, rewards, and costs associated with the recommendation.

This lack of specificity in Reg BI renders SEC enforcement actions susceptible to the affirmative defense of “void for vagueness,” as well as claims of regulation by enforcement.

Handling Hold Recommendations

Another challenge is the requirement by the SEC Reg BI to record and review all recommendations, which would include hold recommendations, which has been the toughest part of the compliance process that broker-dealers have had to grapple with. Multiple independent broker-dealers have created electronic trade tickets to record hold recommendations, but a whole lot of other broker-dealers have yet to create an adequate method.

Disclosing The New Policies & Procedures

Reg BI’s compliance obligation requires broker-dealers to establish written policies and procedures reasonably designed to achieve compliance with the rule, the SEC noted in the risk alert. However, SEC staff members have observed that some broker-dealers do not have such written policies and procedures while others did not identify the parties responsible for creating or updating disclosures, how to identify that material changes have occurred, or when material changes should result in new or updated disclosures.

Changes & Considerations for Broker-Dealers To Prepare For Reg BI Compliance

Reg BI requires broker-dealers to make several significant changes and considerations across their business operations and technological infrastructure.

Technological Infrastructure Changes

Account On-boarding

Streamlining the client onboarding process becomes crucial to ensure compliance with Reg BI. Broker-dealers may need to implement automated onboarding systems that gather comprehensive client information, assess risk tolerance, and determine suitable investment recommendations. By utilizing these systems, broker-dealers can ensure they have a robust understanding of their clients’ needs and tailor their recommendations accordingly.

Customer Relationship Management (CRM)

A robust CRM system is essential for maintaining accurate and up-to-date client information, including preferences, investment objectives, and past interactions. With Reg BI in place, broker-dealers must demonstrate that investment recommendations align with each client’s unique circumstances. Leveraging CRM technology, broker-dealers can access comprehensive client profiles and ensure that recommendations are suitable for their specific needs.

Trading

To comply with Reg BI’s best interest obligation, broker-dealers must execute trades in a manner that minimizes transaction costs and aligns with the client’s objectives. Advanced trading platforms can help analyze market trends, assess liquidity, and execute trades efficiently. By utilizing these tools, broker-dealers can provide clients with the best possible execution for their investment transactions. Care should be taken by the broker-dealer in determining whether a recommendation is in the best interest of the retail customer. A broker-dealer’s trading desk can certainly aid in determining these factors that include:

- Product or Strategy’s investment objectives

- Liquidity

- Risks and potential benefits

- Volatility and,

- Performance in a variety of market and economic conditions

Supervision and Compliance Surveillance

Broker dealers need to strengthen their supervision and compliance surveillance capabilities to detect and address potential conflicts of interest. Technology solutions that provide real-time monitoring of financial advisors’ activities can help identify any irregularities and ensure compliance with Reg BI. For example, automated compliance systems can flag any recommendations that may not align with the client’s best interest, prompting further review and corrective actions.

Business Structure Changes to Support Reg BI

Adding New Products or Removing Existing Product Types

To align with Reg BI’s best interest obligation, broker-dealers may need to reassess their product offerings. Certain investment products may carry higher costs or potential conflicts of interest, making them less suitable for retail clients. As a result, broker-dealers may decide to remove these products from their offerings.

On the other hand, broker-dealers might introduce new products that better align with the interests and risk tolerance of their clients. For instance, a broker-dealer could add low-cost, passively managed exchange-traded funds (ETFs) as an option for risk-averse clients seeking diversified investments.

Altering the Existing Commission and Fee Structure

Reg BI aims to reduce conflicts of interest related to commission-based compensation. Broker-dealers may need to review their commission structures and consider transitioning to fee-based compensation. Fee-based models eliminate the direct link between compensation and product sales, promoting unbiased advice and enhancing the client’s best interest.

For example, a broker-dealer could replace a commission structure based on the volume of trades with a flat fee charged to clients for advisory services. This change ensures that financial advisors’ compensation is not influenced by transaction volume but rather by the value of advice provided to clients.

Adjusting the Compensation and Incentive Structure of Financial Advisors

Incentive-based compensation can create potential conflicts of interest, influencing financial advisors to prioritize their financial gains over their clients’ best interests. To comply with Reg BI, broker-dealers may need to reevaluate how they incentivize their advisors.

One approach could be to establish a balanced compensation structure that rewards financial advisors for meeting clients’ long-term financial goals rather than short-term sales targets. For instance, incentivizing advisors based on client retention and satisfaction scores promotes a client-centric approach and encourages advisors to act in the client’s best interest.

Impact of Reg BI on The Investment Advisory Market

The Reg BI impact on broker-Dealers is a good chunk of the advisory market, and the effect of this compliance is certainly making a mark along the way. According to NASAA’s 2022 Investment Adviser Section Annual Report, in 2020, 97.0% of advisers offered portfolio management services to one or more groups of clients. The most common of these services is financial planning. In 2020, 42.3% of advisers provided financial planning services, serving approximately 4.6 million clients.

After financial planning, the most common additional services are providing advice on the selection of other advisers (perhaps as part of a sub-adviser relationship) and pension consulting services. This was offered by over 20% of advisers in 2020.

What’s In Store for Broker-dealers with Reg BI in The Future?

To tackle the ambiguity and subjective nature of Reg BI, the SEC has published three guidance notes since Reg BI came into effect – account type recommendations (March 2022), deficiencies and weaknesses observed during examinations (January 2023), and most recently in April 2023, Staff Bulletin: Standards of Conduct for Broker-Dealers and Investment Advisers.

This has been a welcome move as it acts as tangible and interpretative guidance for broker-dealers and investment advisers on steps to take to satisfy the SEC’s requirements. Particularly, the April guidance note provides answers to twenty major questions and is designed to assist firms and their financial professionals with meeting their care obligations such that they comply with their obligations to provide advice and recommendations in the best interest of retail investors.

The answers to these questions will be welcomed by everyone in the industry, as they have been on the minds of many since the inception of Reg BI.

Best Practices for Staying Compliant with Reg BI

While Reg BI primarily impacts broker-dealers, all providers of retail financial services can use these as best practices while defining their compliance mechanisms and documentation for Reg BI and associated frameworks.

- Compile Conflicts of Interest: Create a comprehensive list of all conflicts of interest present.

- Assess Conflict Management: Examine the current framework for identifying, minimizing, and disclosing conflicts, especially those linked to product sales and financial incentives.

- Revise Customer Disclosures: Review and, if necessary, revise all disclosures provided to retail customers.

- Implement Timely Disclosures: Develop procedures to ensure timely delivery of required disclosures to retail customers before making recommendations when prior delivery is not feasible.

- Evaluate Regulatory Alignment: Analyze how the regulation applies directly and consider its incorporation into improved operational practices.

- Update Policies and Procedures: Revise internal policies and procedures to align with the new regulatory requirements.

- Ensure Consistency: Guarantee that actions and operations conform through continuous assessments, trials, and audits.

- Prioritize Conduct and Culture: Maintain a focus on enhancing existing programs for compliance, culture, and ethical conduct.

As financial firms and broker-dealers deliver services to retail customers in observance of the new regulatory requirements, many are identifying ways the experience can be improved using technology. Ionixx Technologies helps your firm build dynamic technology systems to stay ahead of compliance. Get in touch.