In light of the increased automation and algorithmic trading on securities exchanges and the rise of alternative trading systems (ATS), the need for effective risk management has become paramount. To address these concerns and enhance market integrity and investor protection, the Securities and Exchange Commission (SEC) implemented Rule 15c3-5 in 2010.

In recent times, owing to several instances of penalties by prominent broking houses, regulators have intensified their focus on enforcing this rule. The rule necessitates meticulous documentation to showcase risk management and supervisory procedures.

Previously, complying with the financial reporting and compliance requirements of Rule 15c3-5 was a laborious task involving manual data entry into spreadsheets and presentations. However, leveraging the right technology can significantly enhance firms’ efficiency in compiling the requisite documents.

This article discusses the essentials of Rule 15c3-5 compliance. It explores how advanced technology can play a pivotal role in assisting firms in meeting their regulatory obligations with greater ease and accuracy.

What Is the Market Access Rule?

According to Exchange Act Rule 15c3-5, also known as the Market Access Rule, firms offering market access to customers or having market access themselves must exercise appropriate control over the associated risks.

The primary aim is to safeguard their financial stability and that of other market participants while upholding the integrity of trading on securities markets and ensuring the overall stability of the financial system.

The regulatory obligation of the market access rule is for the firms with market access to “appropriately control the risks associated with market access so as not to jeopardize their own finance condition, that of other market participants, the integrity of trading on the securities markets and the stability of the financial system.”

This comprehensive rule applies broadly to various securities traded on exchanges or alternative trading systems, encompassing equities, equity options, exchange-traded funds (ETFs), debt securities, security-based swaps, security futures products, and even digital assets satisfying the SEC’s definition of a security. The rule’s scope extends to regulate the trading activities related to this diverse array of financial instruments to promote responsibly and secure market access for all stakeholders.

Why Rule 15c3-5?

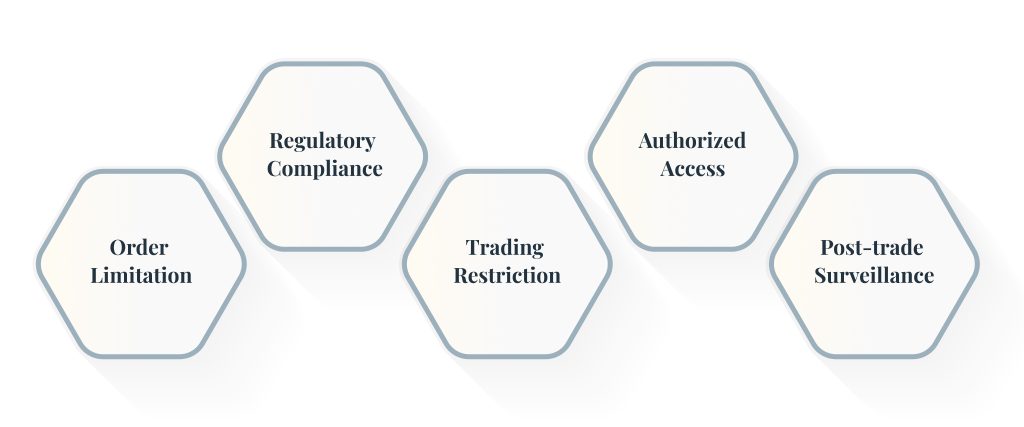

The market access rule or risk management controls and supervisory procedures must be designed to achieve the following:

- Prevent the entry of orders that exceed appropriate pre-set credit or capital thresholds or appear to be erroneous.

- Before entering any orders, broker-dealers need to ensure that all regulatory requirements are met for pre-order entry.

- Prevent the entry of orders for securities that the broker-dealer or customer is restricted from trading.

- Restrict market access technology and systems to authorized personnel.

- Ensure appropriate surveillance personnel receive immediate post-trade execution reports.

Importance of Compliance with Rule 15c3-5

The Market Access Rule is of importance for broker-dealers operating in the capital markets and exchange-traded derivatives (ETD) markets. Compliance with this rule ensures that broker-dealers establish appropriate credit and capital thresholds and prevent erroneous and duplicative orders.

How Does the Rule Impact Broker-Dealers and Brokerage Firms?

Firms are required to maintain comprehensive compliance documentation to ensure the validity and accuracy of risk management controls and supervisory procedure documents for each trading system. The scrutiny of compliance documentation and the need for signed-off company policies and procedures emphasizes the importance of full adherence to the standards.

Overcoming Compliance Challenges – Streamlining Rule 15c3-5 with Modern Technology

However, the process of Rule 15c3-5 compliance can encounter challenges, especially during the multiple levels of review across the organization. Legacy systems and tools often employed for financial reporting and compliance lack the efficiency required for creating these reports.

As a result, the manual nature of the compliance process using such tools can lead to inaccuracies, exposing various areas within the organization to heightened risk and severe penalties.

SEC has imposed charges against 15 broker-dealers and one affiliated investment advisor for widespread and long-standing failures by the firms and their employees.

Thankfully, modern technology offers a solution to this problem by introducing automation and streamlining the report creation process. Ionixx can empower firms to navigate the complexities of Rule 15c3-5 compliance with greater ease and precision.

Closing Thoughts

At Ionixx, we understand the significance of compliance with Rule 15c3-5 and the challenges faced by broker-dealers in the rapidly evolving securities market. Our cutting-edge technology frameworks and tools can help you enhance your risk mitigation systems and ensure seamless compliance. For a more detailed read on how staying compliant with Rule 15c3-5 lands you a competitive edge, read our blog.