Why Is The Capital Markets Moving To T+1?

The Securities and Exchange Commission (SEC) has enacted new rules aimed at reducing the standard settlement cycle for most broker-dealer securities transactions. This transition shortens the cycle from two business days after the trade date (T+2 settlement) to just one business day (T+1). The primary objective of this rule change is to enhance investor benefits while achieving reduced counterparty risk, lower market risk, faster access to funds, operational efficiency, cost reduction, enhanced transparency, regulatory compliance, market resilience, and liquidity management.

SEC Chair Gary Gensler expressed support for this rule change, emphasizing its potential to reduce latency, lower risk, and foster greater market efficiency and liquidity.

In this blog, we will discuss the risk associated with T+2 settlement, why the time of settlement matters, and the essential recommendations in shifting the settlement cycle?

Risks Associated With T+2 Settlement

In a T+2 settlement cycle, there is a two-day gap between trade execution and the actual settlement date. During this period, investors and broker-dealers have time to fulfil their respective obligations. But it also means that the risk of default or failure to settle exists during this timeframe.

Broker-dealers are required to set aside their capital to cover customers’ trades not just for the current trading day but for the subsequent two days, aligning with risk stipulations established by the National Securities Clearing Corporation (NSCC) to ensure successful trade settlement. According to a recent white paper from the Depository Trust & Clearing Corporation, the parent organization of NSCC, this capital allocation amounts to over $13 billion on a daily basis. The precise capital levels fluctuate in response to NSCC’s risk and margin calculations, which can be somewhat intricate.

In the below table, we discuss the profound risk of T+2 settlement

| S.No | Types of Risk | |

| 1 | Credit Risk | Credit risk in T+2 settlement poses a significant concern for broker-dealers. It stems from the potential default of buyers in fulfilling their trade obligations within the two-day period. This risk escalates during market volatility, impacting cash flows and financial stability. |

| 2 | Settlement Risk | Liquidity risks are more prevalent in the T+2 settlement cycle because there would be no readily available funds or assets. In the current settlement cycle, the market participants need to have sufficient liquidity to fulfill their contractual commitments. |

| 3 | Market Risk | As the T+2 settlement prolongs the settling time, there are huge risks associated with regulatory bodies introducing new rules, mandates, or compliance measures. |

| 4 | Liquidity Risk | As the T+2 settlement prolongs the settling time, there are huge risks associated with regulatory bodies introducing new rules, mandates, or compliance measures. |

| 5 | Operational Risk | Operational risk in T+2 settlement refers to the potential disruptions, errors, or failures in the operational processes and systems involved in settling trades within the standard two-day timeframe. This risk encompasses a wide range of issues, including technical glitches, communication breakdowns, data inaccuracies, and other operational challenges that can impede the smooth settlement of transactions. |

| 6 | Regulatory Risk | As the T+2 settlement prolongs the settling time, there are huge risks associated with regulatory bodies introducing new rules, mandates, or compliance measures. |

| 7 | Counterparty Risk | Counterparty risk arises from the possibility that the other party in a trade may default on their obligations. In a T+2 settlement, if the counterparty fails to deliver securities or make the required payment, it can lead to financial losses |

Why Are We Moving From T+2 To T+1 Settlement?

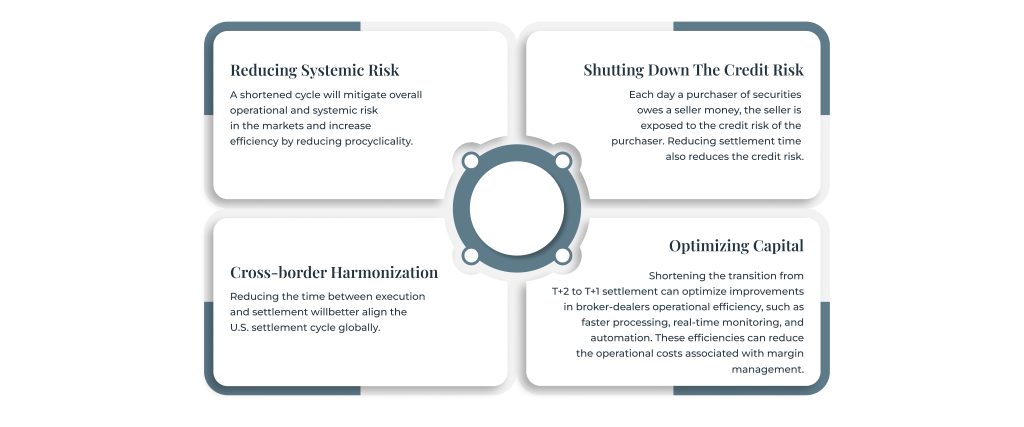

- The move to a shortened settlement cycle, from T+2 to T+1, offers several compelling benefits, like reduced risk, cost saving, and faster access to funds.

- Also, the pandemic year, with increasing market volatility and trading volumes, led to higher margin requirements. This limits the investor’s ability to trade during critical moments.

- The settlement cycle’s duration holds significant importance. It is due to the inherent risk of trade counterparties not fulfilling their obligations between trade execution and securities settling in a client’s account.

- A more extended settlement period amplifies the risk. It occurs particularly during high volatility and stressed market conditions. It is when unpredictable events, like firm defaults, can disrupt cash transfers or ownership of securities.

Conclusion

In conclusion, the move from a T+2 to a T+1 settlement cycle in the securities industry represents a significant step forward in reducing credit, market, and liquidity risks for market participants.

The need to minimize the time gap between trade execution and settlement, especially during periods of market volatility and stress, drives this transition. The potential benefits of this change include improved investor protection, enhanced market efficiency, and greater liquidity. To learn more about the T+1 settlement and to stay ahead in the financial market, keep in touch with us.