What Is Pre-market Trading?

Pre-market trading refers to a session occurring before the official market hours, enabling investors to trade stocks and place orders before the regular market opens. This early session offers an avenue for investors to respond to recent news and events that may have transpired after the market’s closure the previous day.

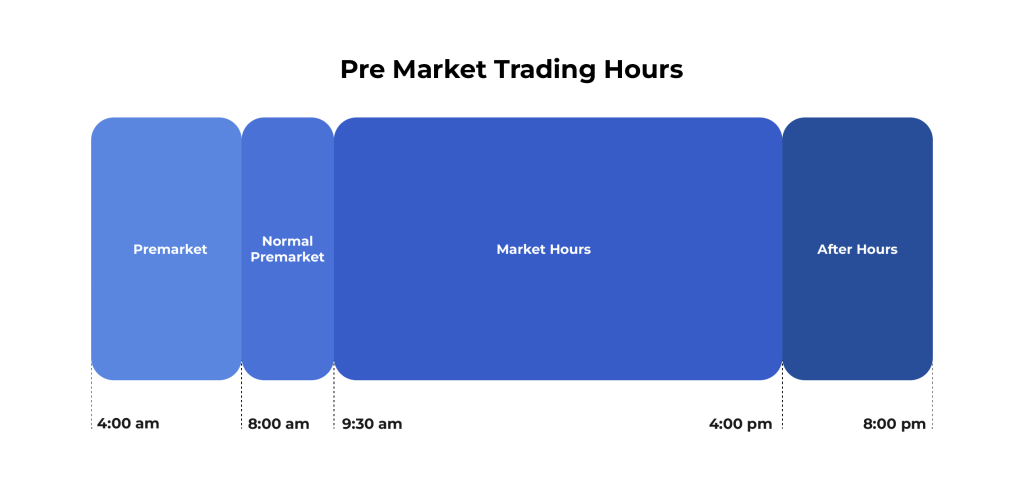

The pre-trading session falls between 8 AM and 9:30 AM. E.T. on weekdays. However, a number of brokers provided access to some exchanges, such as NYSE and NASDAQ, as early as 4 AM E.T.

In this article, we will explore the mechanics of pre-market trading, its advantages and disadvantages, as well as strategies to aid in making well-informed investment decisions.

What Are The Advantages of Pre-market Trading?

Early Investment Opportunities

Pre-market trading allows retail investors to respond promptly to overnight news before the commencement of regular trading sessions, whether related to corporate earnings, company announcements, geopolitical developments, or international market events.

Reversal Indicators

One important thing to keep in mind is that the way people reacted to the news in the pre-market could change during normal trade hours. The limited trading volume during pre-market hours may provide a signal of weakness or strength that may not be borne out when regular trading hours commence, and the usual trading volumes are reached. In this case, a stock that reports missing earnings might not see a lot of trading activity before the market opens, but it might turn around and end the regular session on a high note.

Flexibility for Individual Investors

Pre-market trading is especially beneficial for individuals with time constraints during regular trading hours, enabling them to participate early in the market and execute trades efficiently.

Advantageous Pricing

Pre-market hours are utilized by seasoned investors and traders who are acquainted with trading patterns and extended-hours trading to purchase or sell securities at more advantageous prices than those available to other traders during regular trading sessions. This phenomenon is contingent upon the accuracy of the reaction to news regarding a stock during pre-market hours and the stock failing to completely discount the news during that time period.

Enhanced Convenience

For investors seeking alternative trading periods, the pre-market session offers increased convenience, accommodating diverse trading preferences and schedules.

Immediate Response to Current Events

Timely access to vital updates and corporate announcements just before the pre-market session empowers investors to assess live trends swiftly, leveraging recent news for informed investment decisions.

Swift Establishment of Open-Price

Market participants, both institutional and individual, actively engage in pre-market trading, leveraging market updates to swiftly determine the opening price, providing an advantageous head start for the trading day.

Competitive Advantage

The relatively lower participation in this session presents a unique opportunity for seasoned investors to leverage their expertise and gain a competitive edge, allowing for strategic decision-making and potential success amidst reduced market competition.

The Risks Associated with Pre-market Trading

- Constrained Liquidity: This type of trading often sees reduced trading volumes, leading to restricted liquidity and broader bid-ask spreads. This is one of the Pre-market trading risks faced by the traders.

- Volatility in Prices: With liquidity limitations, stock prices might experience heightened fluctuations during the pre-market session, posing challenges for investors aiming to execute orders at their intended prices.

- Risk of Unfulfilled Orders: Orders submitted during the pre-open session may remain unexecuted without adequate liquidity or if the equilibrium price falls outside the designated price range.

Who Can Trade?

Initially, pre-market trading was primarily accessible to institutional investors, such as mutual funds and other professional traders, before gradually opening up to individual investors. The key participants in this early session include:

- Institutional investors: This category encompasses mutual funds, hedge funds, and prominent investment firms with direct market access and specialized arrangements with brokers or exchanges.

- Professional traders: These traders, either individuals or firms, leverage specialized trading software or platforms to engage in pre-market stock trading.

- Market makers: Playing a crucial role, they ensure market liquidity by actively participating in bid and ask prices, thereby contributing to market stability.

- Experienced investors: Certain qualified investors gain pre-market trading access through their brokerage firms, typically meeting specific criteria or maintaining substantial account balances.

Furthermore, major players like the U.S. exchanges NASDAQ and the New York Stock Exchange Euronext provide pre-market trading platforms catering to both individual and institutional investors keen on trading securities outside regular market hours.

How Does Pre-market Trading Works?

Pre-market stock trading is a dynamic space where various participants can benefit, ranging from institutional investors to individual traders. Observing pre-market activity allows investors to gauge market movements and anticipate potential trading patterns before the official trading hours commence.

Furthermore, pre-market trading serves as a strategic tool for traders aiming to capitalize on breaking news and global events that could influence market dynamics. By closely monitoring pre-market indicators, investors can proactively respond to corporate announcements, earnings reports, and other impactful developments, gaining a competitive advantage before the market reacts.

For instance, corporate earnings announcements made after regular trading hours can trigger significant market movements the following day. Traders actively engage in pre-market trading to position themselves favorably in response to such news, aiming to capitalize on price fluctuations before the broader market absorbs the information.

Pre-market activity can also be influenced by various external factors, including legal verdicts, regulatory changes, or shifts in analyst sentiment, contributing to the dynamic nature of early trading hours.

Conclusion

In conclusion, pre-market trading offers a valuable opportunity for both institutional and individual investors to react swiftly to overnight developments and news events. While it provides advantages such as early investment opportunities, advantageous pricing, and enhanced convenience, it also comes with inherent risks, including liquidity constraints and price volatility. Understanding the dynamics of pre-market trading, its advantages, and associated risks is crucial for making informed investment decisions. To Stay informed, stay vigilant, and leverage the potential benefits of pre-market trading, it is crucial to use robust managing software like OMS. You can plan, track, and trade easily and effectively using Ionixx’s trade order management system. To know more about it, contact us today.