Thanks to modern brokerage technology, this technological revolution is not just altering how trades are executed; it’s reshaping the very fabric of the trading world. In this blog, we’ll explore three significant ways in which modern brokerage technology is disrupting the traditional trading paradigm.

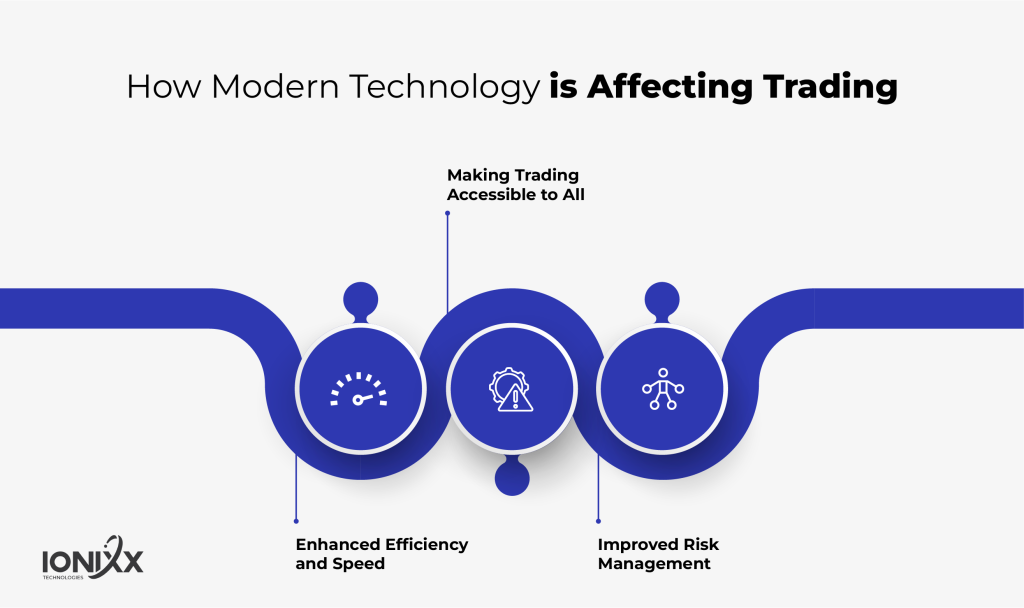

Making Trading Accessible to All

Accessibility for All: In the past, trading was perceived to be reserved for the elite or those with extensive financial knowledge. Modern brokerage technologies have democratized access to trading platforms. Today, anyone with a smartphone and an internet connection can engage in trading activities. This accessibility has opened up the markets to a whole new demographic, fostering a more inclusive trading environment.

User-Friendly Platforms: Contemporary trading platforms are designed with the user experience in mind. They offer intuitive interfaces, making it easier for novice traders to navigate the complexities of trading. This shift has lowered the barriers to entry, encouraging more people to participate in financial markets.

Enhanced Efficiency And Speed

Real-Time Data Analysis: Modern brokerage platforms leverage advanced algorithms and artificial intelligence to analyze market data in real time. This capability allows traders to make more informed decisions quickly, a crucial factor in markets where seconds can mean the difference between profit and loss.

Automated Trading Systems: Automation in trading enables trades to be executed at a speed and precision that is humanly impossible. These systems can monitor market conditions across various assets and execute trades based on predefined criteria, enhancing the efficiency and effectiveness of trading strategies.

Improved Risk Management

Sophisticated Analytical Tools: Today’s brokerage technologies provide traders with sophisticated tools for risk analysis and management. Traders can simulate different trading scenarios, assess potential risks, and make adjustments to their strategies accordingly. This level of analysis was previously available only to institutional traders but is now accessible to retail traders.

Enhanced Security Measures: As trading platforms become more technologically advanced, the emphasis on security has also increased. Modern brokerage platforms employ robust security measures like two-factor authentication, encryption, and continuous monitoring to protect traders’ data and funds. This focus on security helps build trust among users, encouraging more participation in trading activities.

Conclusion

The disruption caused by modern brokerage technology is far-reaching. It has not only made trading more accessible and efficient but has also enhanced the risk management capabilities of traders. As technology continues to evolve, we can expect further innovations that will continue to transform the trading landscape.

[sticky_tab url=”https://www.ionixxtech.com/solution/fintech/brokerage” text=”Explore Our Digital Brokerage Solutions”]