A 2023 press release from the SEC suggests that the shift to the T+1 settlement cycle for the US securities trading market will require a collective investment of $3.5 billion to $4.95 billion on the part of buy and sell-side firms.

Barely scratching the surface, these cover only implementation costs.

Add to the mix a cycle of new and evolving regulations that place substantial data processing burdens on market participants, amounting to compliance costs of approximately $5.5 million per institution.

Despite these significant costs, T+1 settlement promises substantial benefits in the future.

A T+1 settlement cycle typically reduces bottlenecks in the existing securities trading ecosystem, allowing assets to move more quickly through the economy. This translates to offering greater liquidity to market participants besides strengthening economic stability. An accelerated cycle offers the incentive of a lower cost of capital, given how longer settlement cycles lead to higher costs for holding trades, and as interest rates rise, these costs increase.

T+1 Settlement : Promise and Potential

Offering a glimpse into the transformative potential of the T+1 settlement mandate, a 2021 report from DTCC estimates that moving from the current T+2 to T+1 settlement could potentially mean a 41% reduction in the volatility aspect of central counterparties (CCPs) margin requirements.

With the deadline (May 28, 2024) for the industry-wide T+1 transition drawing closer, market participants are racing against time to make substantial investments in technology upgrades, personnel training, and process enhancements in order to remain relevant and competitive.

An Accelerated T+1 Settlement Cycle: Current Challenges

As a 2022 report by the Association for Financial Markets in Europe (AFME) observed, moving from two days to one is not a halving of the available post-trade processing time. The transition demands a radical overhaul of existing operational frameworks.

In this blog, we dig into a few pressing questions to gain insight into key aspects of the transition:

- What are the current challenges financial market institutions (FMIs) face in their preparation for T+1 settlement?

- How can they address the challenges; what kind of practical solutions are available for consideration?

- How are they prioritizing their technology investments in 2024, and where do Artificial Intelligence (AI) and Distributed Ledger Technology (DLT) fit into their strategic roadmap?

- How can Ionixx help capital market firms with T+1 settlement readiness?

Preparation for the T+1 Settlement Cycle amidst Existing Complexities

The extent of changes needed for T+1 settlement has a higher degree of complexity in comparison to what was done to get to T+2. Why? Simply because the challenges cannot be addressed with a sweep of a one-time effort or by following an industry playbook.

Let’s take a look at the range of challenges that exist.

Over-Reliance on Manual Processing

With the need to transition to a T+1 settlement cycle fast approaching and the mounting pressure to settle trades faster, trading systems that use manual systems will struggle with processing and integration complexities.

As transactions move into the post-trade phase (comprising trade confirmation, reconciliation, and settlement), the reliance on manual interventions is pretty high in the current T+2 cycle. This is particularly true for functions such as securities lending, collateral management, Corporate Actions, and other ancillary processes.

To streamline and automate post-trade processes, and to proactively take stock of errors and trade fails, and mitigate risks, firms need to be equipped with automated systems that can enable data and trade processing continuously, in as close to real-time.

Process Inefficiencies and Increased Risk Exposure – Legacy Systems

Extending into the challenge of manual processing is how existing legacy systems built on monolithic architectures such as Cobol and .NET are vulnerable to greater risk exposure in the current T+2 landscape, leaving ample room for market fluctuations and uncertainties.

This leads to operational complexities in managing and mitigating risks effectively. For instance, delayed confirmations, discrepancies in trade details, and manual interventions contribute to a higher likelihood of settlement failures.

Disparate Data Processing Systems and Multiple Data Formats

Again running into the previous two challenges, existing legacy systems have disparate data systems across front, middle, and back-office operations, causing a significant amount of technology and personnel cost, besides being a prime source of operational risk.

The current method of managing data exceptions by archaic technology systems is bound to fall through the cracks in a T+1 settlement environment because the data flow is fragmented into siloes.

As a first step to remedying this, firms need to look at integrating and normalizing data across the entire trade lifecycle. This will, in fact, be the foundation of future innovation and help ease their way to an eventual T+0 settlement cycle.

Beyond Table Stakes : Practical Solutions

Drive Automation and Enhanced Straight-through Processing (STP) at Scale

STP should be top of mind for FMIs if they have to adapt quickly to shorter trading day settlement issues. To achieve T+1 settlement, they should consider building real-time trade matching (RTTM) systems. An RTTM system serves as a unified technology platform that automatically collects and matches trade data sans manual interventions. RTTMs help achieve improved STP rates, thus enabling market participants to monitor and manage the status of trade activity in real-time. These real-time automated systems also offer visibility into a transaction from trade entry up to regulatory reporting. Understanding such instances in real time helps flag potential discrepancies faster, leading to enhanced issue resolution, timely settlement, and fewer operational risks.

Invest in and Integrate Systems Across the Board

The call for transformation extends beyond mere adaptation—it requires a unified, organization-wide effort. Firms must stagger their reliance on manual processes and legacy systems, embracing technology that facilitates continuous processing. It should The focus should not be limited to a single asset class or a single function but should span across the entire spectrum of financial operations.

Enabling interoperability between multiple stakeholders of the trading ecosystem is yet another critical step. Interoperable systems built on microservices can drive seamless interactions between market participants besides offering a better experience for operation managers in the system. Having access to modular, extensible, or embeddable solutions enables powerful connectivity inter-firm and intra-firm.

From reference data to trade funding, a holistic approach is crucial to building an integrated, automation-centric processing ecosystem that aligns seamlessly with the demands of T+1 settlement.

Optimize Workflows and Data for Operational Efficiency

Focusing on workflow improvement and adopting a data-centric approach will be key to successfully transitioning to a T+1 settlement cycle. Firms that work to rectify existing processes to streamline, integrate, and normalize data will see improved operational efficiency.

To start with, adopting a data-centric approach will help reduce trade fails significantly and enhance the quality of handling exceptions. A robust data-driven system will help identify potential blockers proactively and likely offer steps to mitigate them before they happen. For instance, consider an instance where information such as allocation details, settlement instructions, settlement location, and reference data are needed to execute a trade. In this scenario, it helps to know the origin of the data, how reliable the data is, and what actions need to be taken on it (matching, interpreting, validating, reconciling)– and so on. This will offer better insight and guide market participants in decision-making.

Ensuring the integrity of static data is a no-brainer for any market participant impacted by T+1, given how it’s a prerequisite for achieving high STP levels and enabling continued automation.

Secondly, firms need to establish strong communication protocols to facilitate seamless collaboration between front and back-office systems. Normalizing data across the entire trade lifecycle ensures a holistic approach to operational efficiency.

Toward T+1 and T+0: What Do Technological Investment Priorities in 2024 Look Like?

In an insightful session uncovering the findings of a recent Nasdaq post-trade industry report (covering the whole gamut of post-trade challenges, opportunities, and legacy technology), Barnaby Nelson, CEO of the ValueExchange, and Roland Chai, EVP and Head of Marketplace Technology at Nasdaq, reiterate that FMIs are expected to manage major transitions, with a focus on technology considerations and softer factors of change to gain buy-in, communicate with stakeholders, and set a vision for the future.

Here are some interesting insights that offer a telling perspective on where capital market firms are placing their bets to stay competitive and relevant.

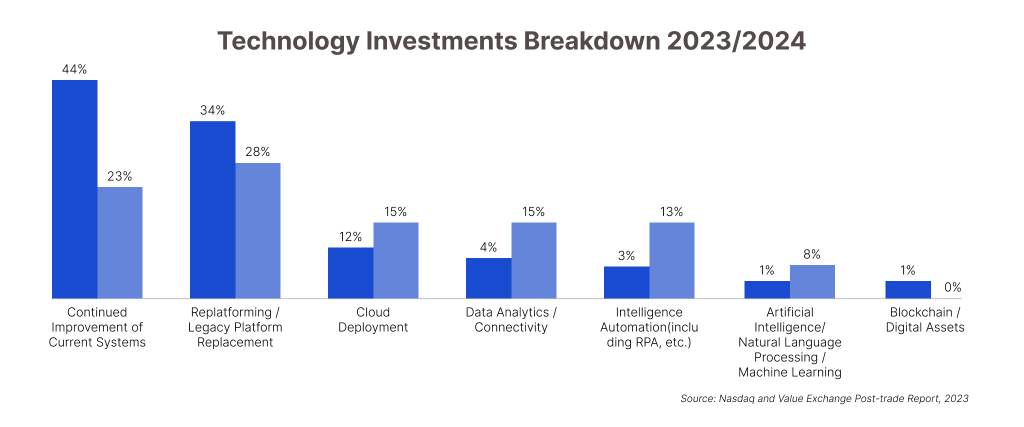

- There is a growing trend of FMI budgets (12%) toward cloud migration, making it the second-biggest trend behind legacy maintenance.

- Newer asset classes like carbon credits, crypto, and REITs are gaining interest, and 67% of firms surveyed expect to launch new data analytics and reporting capabilities within three years.

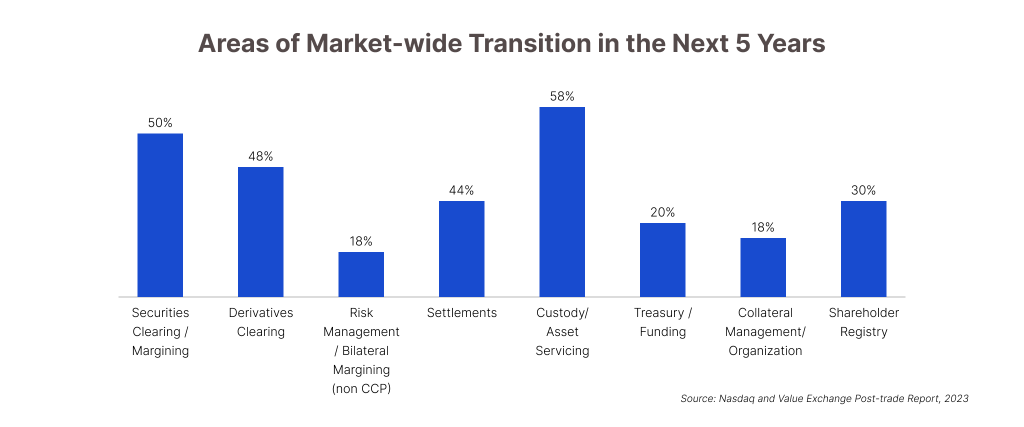

- Firms anticipate a major shift in Custody/Asset Servicing and Treasury/Funding, indicating that they are rethinking models, and leveraging new technologies to improve efficiency and service quality.

- Securities Clearing/Margining and Derivatives Clearing, with 50% and 45%, respectively, show that there is a clear intent to upgrade the systems responsible for the critical infrastructure of trading activities. This could be indicative of a push towards automating and streamlining clearing and settlement processes to reduce counterparty risk and operational costs.

- A staggering 44% of investment is earmarked for ‘Continued Improvement of Current Systems‘, signaling a trend towards enhancing the existing infrastructure to make it more robust and agile. This is a pragmatic approach that reflects a prioritization of immediate operational improvements over long-term speculative ventures.

- Replatforming/Legacy Platform Replacement and Cloud Deployment are significant focus areas, with 34% and 28% of total spending, respectively. The industry is evidently embracing cloud technology, which offers scalability, security, and cost-efficiency. This trend towards cloud deployment could be the key to unlocking new levels of operational efficiency and agility in services.

- However, it’s worth noting the relatively low investment in ‘Blockchain and Digital Assets‘, suggesting a cautious approach towards these technologies despite the buzz in the market. This could reflect a wait-and-see strategy, as firms observe the maturation of blockchain regulation and its practical applications in finance before fully committing.

In a nutshell, firms appear to be balancing the immediate need for improved operational efficiency by making incremental improvements and being fully cognizant of longer-term, transformative changes brought by emerging technologies.

How Can Ionixx Help Prepare for T+1 Settlement?

Regardless of your current stage in T+1 preparation, as your trusted technology partner, we offer an array of specialized T+1 services to facilitate your transition toward a streamlined, data-driven operating model.

Here are some ways in which we can support your seamless transition to T+1:

Architecture Assessment: Our experts will thoroughly analyze your existing architecture and controls to identify gaps and opportunities for enhancement in alignment with T+1 settlement requirements.

Agile Controls Implementation: Leveraging our agile methodologies, we’ll collaborate with your team to design and deploy robust controls that normalize and reconcile your data within the accelerated T+1 timeframes, ensuring accuracy and reliability.

Operational Model Development: We’ll work closely with you to develop a tailored operational model that ensures compliance and promotes efficiency, transparency, and auditability in your T+1 settlement processes.

With a strategic approach to technology infrastructure modernization toward meeting T+1 settlement requirements and beyond, you can confidently navigate technological and operational complexities, positioning your firm for success in this high-stakes transition.

Get in touch to speak to our post-trade settlement solutions team.

Additionally, to help you better prepare for the upcoming T+1 mandate, we are hosting a webinar on March 14, 2024 on the topic, ”Adapting to the Accelerated: Operational Risks in the T+1 Settlement Era.” Click here to register.

————————