Maintaining a robust pre-trade check system is imperative for investment firms to ensure compliance with the SEC and FINRA. This system acts as a preventive measure, safeguarding against erroneous trades and unauthorized use of inside information by employees and mitigating conflicts of interest that could arise within the organization or with clients.

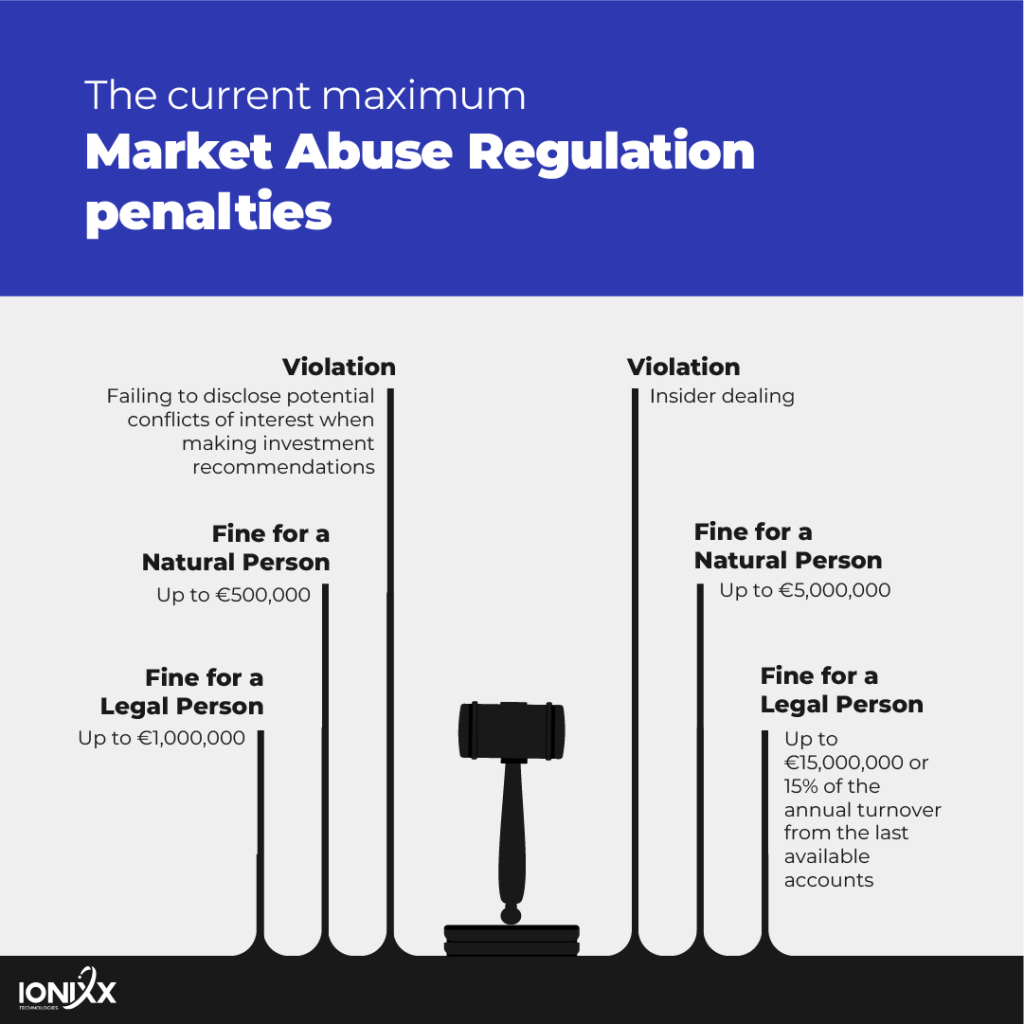

Permitting such activities within the organization carries the potential for significant reputational damage, erosion of trust, and the heightened risk of financial penalties. Therefore, implementing an effective pre-trade check system is not only a regulatory necessity but also a crucial component in safeguarding the integrity and reputation of your business.

Why Use A Pre-trade Check System?

The utilization of a pre-trade check system as part of an OMS is essential for several reasons. Running retail trades through such a system enables the identification of potential issues before any purchase or sale is executed. This proactive approach serves to prevent market abuse fines and other regulatory penalties.

It is crucial to strike a balance between effective compliance and operational efficiency. A well-designed pre-trade check system flags potential problems and streamlines the trading process.

This ensures that trades can occur in a timely manner without burdening the compliance function with extensive manual investigation work. Broker-dealers can reduce administrative overhead by adopting a pre-trade check system while ensuring adherence to all relevant legislation on financial crime. In this article, we will explore the key features that a comprehensive pre-trade check system should possess to facilitate seamless compliance.

Benefits of Pre-trade Check System

Time Efficiency

The utilization of an automated pre-trade check system brings about time savings for all involved parties in personal trading. The goal for institutions and broker-dealers is to advance into low-latency execution and extreme order vetting processes that can accommodate vast volumes of trades simultaneously. A good pre-trade check system will aim to ensure trades are sent for market access from secure brokerage accounts after being thoroughly validated and filtered, at the same time enabling the best price or liquidity and execution speed.

Streamlines Compliance

Automation serves as a streamlined solution for ensuring compliance within the organization, instilling confidence in adherence to established laws and regulations. The automated process significantly reduces the likelihood of manual errors that might otherwise result in financial penalties for the organization. By implementing electronic capture for monitoring purposes, the accuracy of the entire process is enhanced.

The 6 Essential Features of A Pre-Trade Check System

The pre-trade check system serves as a critical component in financial markets, ensuring compliance and risk management before the execution of trades. To optimize this process, a robust pre-trade check system is needed, and it should include the following features

Automation Rules

Configure your pre-trade check system with customizable rules and parameters that define the criteria for compliant trades. This enables the system to efficiently evaluate and approve or decline requests based on the specified rules. Furthermore, these rules facilitate continuous monitoring of trades, promptly notifying the compliance function in the event of a potential violation.

By implementing these parameters, the need for compliance team members to manually monitor each trade is eliminated whenever there are rule changes initiation of blackout periods.

Pre-check mechanisms serve to proactively prevent traders from engaging in non-compliant trades. Simultaneously, violation alerts are triggered when a trade falls outside the established parameters and rules in line with company policies, enabling swift identification and resolution of any contraventions.

Real-time Compliance Checks

Ensure the system conducts instantaneous compliance checks against regulatory requirements, internal policies, and risk parameters. Real-time monitoring prevents potential violations and ensures trades align with established guidelines.

Customizable Rule Engine

A flexible and customizable rule engine allows institutions or broker-dealers to tailor compliance rules according to their specific needs. This adaptability ensures the system can accommodate evolving regulatory landscapes and internal policies.

Automated Approval Workflows

Implement automated approval workflows to streamline the check process. This feature expedites decision-making by routing trade requests through predefined authorization hierarchies, reducing delays and enhancing efficiency.

Integration Capabilities

Seamless integration with existing trading systems, risk management tools, and market data sources is crucial. Compatibility with various platforms ensures a cohesive and interconnected financial ecosystem, facilitating accurate decision-making.

Audit Trail And Reporting

A comprehensive audit trail is essential for regulatory transparency and internal oversight. The system should maintain detailed records of all check activities, providing a transparent and traceable history. Additionally, robust reporting tools aid in performance analysis and compliance monitoring.

Incorporating these features into a pre-trade check system establishes a foundation for efficient, compliant, and risk-aware trading activities in the dynamic landscape of financial markets.

Conclusion

A robust pre-trade check system is essential for regulatory compliance and safeguarding the integrity of investment firms. With features like automation, analytics, and security, such systems ensure adherence to financial legislation and streamline operations, contributing to the overall success and trustworthiness of the organization. You are on the right track if you are looking for an automated pre-trade check system. Experience seamless trading with Ionixx’s cutting-edge order management system tool. From ensuring regulatory compliance to facilitating efficient trades, our platform is designed to meet all your pre-trade requirements. Connect with us today.

0 Comments