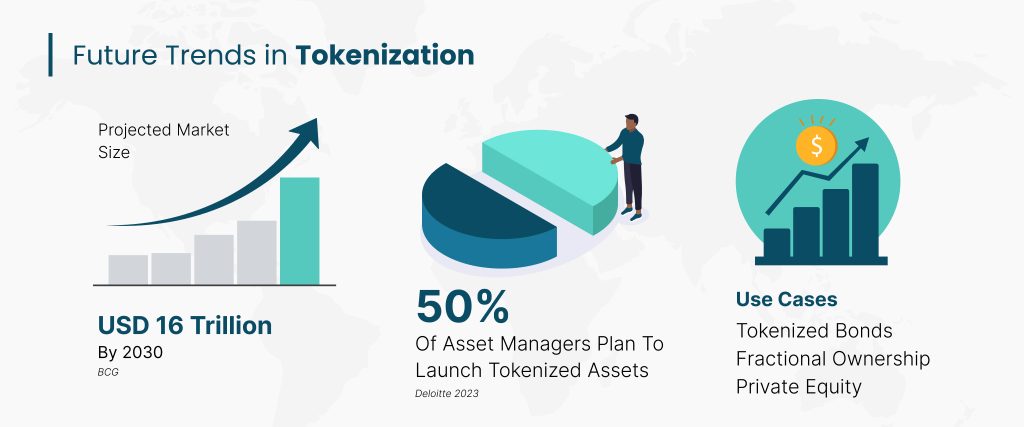

Roland Berger Consulting estimates that the total market value of asset tokenization will exceed USD 10 trillion by 2030, while BCG projects a USD 16 trillion.

Current on-chain analytics suggest that $3 billion in assets are already tokenized, with major firms like BNY Mellon and JP Morgan leading the pack.

By definition, asset tokenization involves the process of converting physical assets (real-estate, coveted pieces of art, etc) into digital tokens on the blockchain. These tokens represent ownership, allowing small shares of the asset to be easily bought, sold, or traded online.

Imagine a luxury apartment in the heart of Manhattan, valued at $10 million. Traditionally, purchasing this prime piece of real estate would demand substantial capital upfront and involve lengthy legal processes. Tokenizing this property (putting it on-chain and dividing it into 10,000 tokens, each representing a 0.01% ownership stake) allows an investor to own a fraction of the apartment (by buying one or more tokens). It also offers added benefits of portfolio diversification and enhanced liquidity for the investor, as the tokens can be traded on secondary markets.

Capital markets infrastructure players have been enthusiastic about embracing asset tokenization. A 2023 Deloitte survey reports that more than 50% of asset managers and 30% of asset servicers have well-defined plans to launch tokenized assets in the near future. Broadridge’s Distributed Ledger Repo (DLR) platform currently facilitates over $1 trillion worth of tokenized repurchase agreements monthly.

That said, the true potential of tokenized assets goes beyond operational efficiencies. In this blog, we discuss some of its use cases, which promise to shape a more inclusive and equitable trading landscape and provide value for early adopters.

Tokenized Bonds for Real-time Settlement

A critical component for the potentially widespread adoption of tokenized assets is its inherent ability to settle trades instantly. The European Investment Bank’s (EIB) venture into tokenized bonds (a €100 million digital bond issued in partnership with Goldman Sachs, Santander, and Société Générale settled using the Ethereum blockchain) is a prime example of providing real-time settlement and increased transparency. For brokers, tokenized bonds offer a new way to attract clients, especially institutional investors, as they can benefit from the increased liquidity and real-time settlement benefits of tokenized bonds.

For customers, trading bonds in real time on the blockchain reduces the risk and friction of traditional bond markets. This democratization of access means a wider range of investors, including smaller institutions and retail investors, can participate. The success of token-based systems will depend on how well they interact with traditional account-based systems.

Fractional Ownership

Tokenization allows mutual funds to be traded in smaller, more accessible units, opening up investment opportunities to a wider audience. Extending beyond merely enhancing asset liquidity, tokenized funds can also serve as collateral, provide fractional ownership, and facilitate seamless transactions. Franklin Templeton’s tokenized money market fund, launched in 2019 on the Stellar blockchain, is a prominent example. Tokenization enables fractionalization of real estate and real-world assets (RWAs), introducing new dynamics and efficient avenues for investing and profiting.

A Level-playing Private Equity Field

Typically, private equity investments are accessible only to high-net-worth individuals due to high minimum investment thresholds and long lock-up periods. Tokenization opens up private equity investments to a broader audience by lowering the barriers to entry. For brokers, tokenizing private equity assets empowers them to integrate fractional trading into their offerings while also broadening their client base.

Additionally, the transparency provided by blockchain can enhance investor confidence, as the performance and valuation of tokenized private equity assets can be tracked in real time. Smart contracts can automate the distribution of dividends and profits, ensuring timely and accurate payments to investors.

However, integrating tokenized ETFs within brokerage operations mandates a comprehensive approach that addresses several key areas around operational efficiency, security, and compliance. The first critical step for brokers is adapting to new custody solutions, often involving the use of hardware security modules (HSMs) and multi-signature wallets. Fidelity International’s recent move to tokenize its money market fund using JPMorgan’s Onyx Digital Assets blockchain reflects a broader trend of firms exploring blockchain for asset tokenization. JPMorgan plans to expand the scope of assets to include equities, fixed income, and other asset classes.

Expert Take

In his 2023 Forbes article, “Why Tokenization is Failing,” Steven Ehrlich, editor of Forbes CryptoAsset & Blockchain Advisor, asserts that trust, not technology, hinders the adoption of asset tokenization. That might sound a bit of a half-truth because it’s crucial to recognize that trust is built through successful implementations and proven utility.

Looking at real estate’s success with tokenization can be a good blueprint given how projects like Colarado’s Aspen Coin and Middle-East-focused Mantra have brought liquidity, fractional ownership, and near-instant settlement to traditionally slow real estate markets. JP Morgan’s sustained commitment to tokenizing traditional finance (ONYX Digital Assets that processes between $1bn and $2bn on a daily basis) and BlackRock’s BUIDL fund (topped $500M early this week) are signs that the tokenization initiatives are poised to be successful at scale for new instruments such as private credit and cross-border transactions, which are inherently digital and relatively easy to migrate to blockchain.

Trust is no longer the barrier it once was; the tech will catch up, and soon enough, we’ll see more use cases falling into place.