Over the last few decades, Corporate Actions have been crucial in reshaping the global financial industry. They have served as a mechanism for companies to grow, restructure resources, and distribute profits to investors directly. Traditionally, a company’s board of directors signs off on the corporate event, which directly affects the securities issued by that company. However, when a publicly traded company announces a corporate event, it’ll also end up affecting the trading lifecycle and the involved market participants.

How Corporate Actions Affect Securities and Trading Lifecycle

While some corporate actions are quite simple, others can lead to more substantive modifications, like in the event of a merger, acquisition, or symbol change. For example, if there’s a change in the ticker symbol, it has to be updated in the trading lifecycle to ensure there’s no impact on the orders. Or, one company could get acquired by another, changing existing shareholders’ stocks into the acquirer’s stock across trading systems.

Situations like these occur frequently in the market, and brokerage firms have to display these changes appropriately for customers to understand what’s happening to their stock accounts. That’s why these events require the attention of the investor, investment management, and counterparties involved in the trading lifecycle. By disseminating announcements to the market in an accurate, timely, and trustworthy manner, firms can provide investors and involved parties with real-time access to information affecting their securities.

Impact on Order Routing and Execution

When a company announces a corporate action, it often utilizes press releases, regulatory filings, or public websites to communicate events to investors and market participants. It involves a corporate action timeline that is crucial for investors, brokers, and other market participants to navigate the upcoming events and make informed decisions. The event date is when a company announces an upcoming action, the record date is when the ledgers will get updated, and the ex-date is the first day the security will be adjusted by the corporate action.

Post-trade firms and broker-dealers may obtain corporate event dates directly from an issuer or a third party. They’ll manually process the essential details and share with front and middle-office operations running preliminary checks on orders. After verification, they’ll route it to the executing broker, who’ll validate the order and send it to the exchange for execution. After execution, the order gets routed to the clearing house for trade matching and settlement. However, in case of an ongoing corporate action, this whole process can be hindered, leading to unnecessary delays and trade failures.

For a seamless order routing process, market participants must ensure timely system adjustments to implement changes in ticker symbols or stock quantities resulting from corporate events as per the record and ex-date. For example, a company announces a symbol change from AAPL to AAPE with record and ex-date. If the brokerage firm is unable to implement these changes in their systems before the announced dates, the impending orders routed to the exchange will get rejected and not be settled. So, brokerage firms should receive and respond to corporate action events in real-time to ensure smooth operations and minimal disruption for investors.

Risk Mitigation in Corporate Actions with Trading Automation

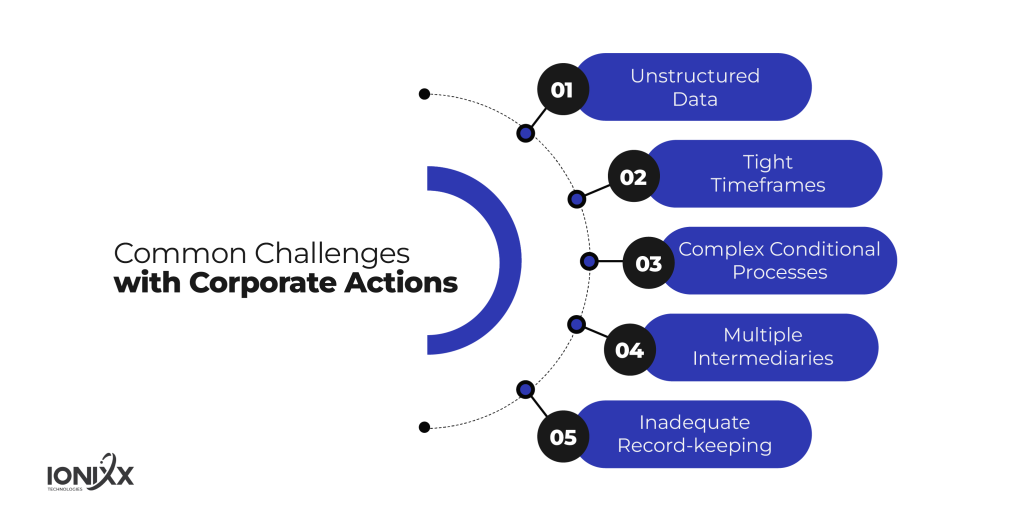

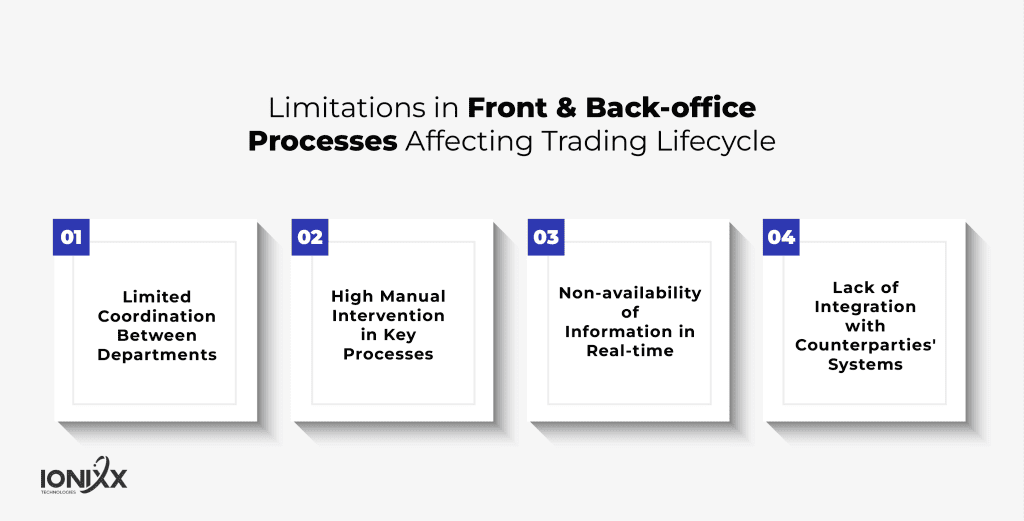

Brokerage firms must carefully validate the positions, update records, and adhere to restrictions to ensure their trading activities align with the ongoing corporate events and regulatory requirements. However, they’re held back by fragmented and complex processing of corporate action information in post and core trade systems. For now, they receive and process this information in the back-office or post-trade systems that are outdated and manually-intensive. So, they need to manually transfer all data from the back office into the middle office to ensure these changes are reflected in the order management systems as well.

While most firms have automated their front and middle-office operations for seamless order management and trade monitoring systems, digital evolution in the back office has been slow. It has led to a lack of standardization across the trading lifecycle, leading to more interoperability challenges among processes seen as too complex, risky, and non-differentiating. With end-to-end automation of the trade lifecycle, firms can reduce the effects of corporate action fragmentation with standardization, especially with real-time synchronization between both ends of this lifecycle.

Since the impact of corporate actions runs from order routing to matching and settlement, firms should start upgrading their systems to reduce manual processes and associated operational costs. By implementing a digitized, structured, and automated approach to core and post-trade operations, firms can keep investors well-informed and empower intermediaries to act promptly on timely information. It’ll also reduce the risks associated with manually interpreting non-standardized corporate action information by processing and communicating corporate events centrally to market participants in real-time.

Conclusion: The Road Ahead

Technology is crucial in allowing a brokerage firm or broker-dealer to meet client demands and differentiate themselves in the capital market. With tight margins and pressure to meet compressed timelines, they must continuously monitor and process corporate actions in real time for a competitive edge.

By leveraging our expertise in core and post-trade automation, Firms can ensure enhanced connectivity between their front and back offices to process corporate events and generate worksheets. It’ll also ensure effective record-keeping of corporate action processing based on end-of-day verification to ensure precise cost-basis calculations without manual intervention.

Connect now to capitalize on the latest trading technologies for order management, trade monitoring, and settlements to mitigate risk, improve client service quality, and enhance operational efficiency and scalability.

[sticky_tab url=”https://bit.ly/428QhMA” text=”Explore Our Digital Brokerage Solutions”]