Inefficient and outdated proprietary systems have long kept post-trade processes slow and less responsive to dynamic changes. Against a data-driven capital markets environment, t broker-dealers have been recognizing the value of breaking down technology barriers across front, middle, and back offices to boost efficiency and cut costs. Forward-thinking firms are consolidating the entire trade lifecycle through the use of advanced technology and optimizing complex trade workflows.

According to a 2020 survey by the Depository Trust & Clearing Corporation (DTCC), improving efficiency in post-trade processes can save up to 20-25% of costs across the post-trade lifecycle. Moving from being an operationally focused industry to a technology-oriented sector, brokerage firms see the merit of investing in back-office automation and integration. This move has, in part, been due to the mounting pressure on margins and fees, growing trade volumes, and of course, the challenges surrounding regulatory compliance.

Why Is It Crucial To Prioritize Middle and Back-Office Process Integration?

Most of the back office systems in brokerage firms have been built over many decades, with some still running on the Cobol programming language. They are rather dated, and they are not quickly migratable to automated systems. This emphasizes why middle and back office connectivity is crucial and how it can be facilitated through robust APIs.

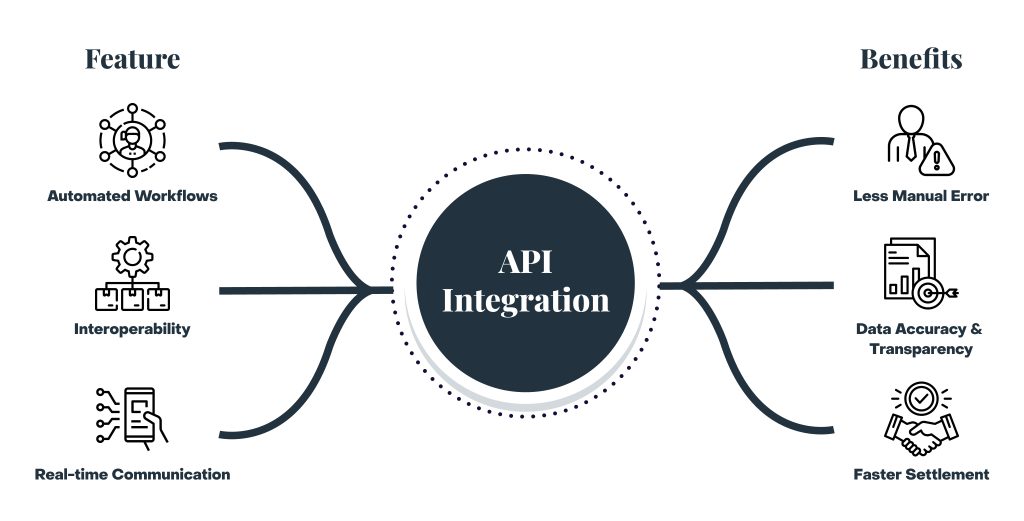

Here are a few possible reasons that justify how APIs can play a part in facilitating seamless communication and data sharing between front, middle, and back-office systems. In effect, they ramp up post-trade efficiency by streamlining operations and reducing manual interventions.

Growing Regulatory Change

On February 15, 2023, the Securities and Exchange Commission adopted rule amendments to shorten the standard settlement cycle for most broker-dealer transactions from T+2 to T+1.

In view of these regulations, firms have been actively seeking technology solutions that can help integrate their front, middle, and back office communication systems back-to-front flow of information helps achieve a near-real-time settlement or same-day affirmation while maintaining high levels of straight-through processing.

Newer Digital Asset Classes

With growing asset classes and instruments such as crypto and bonds in post-trade, there is an increasing need to devise newer methods of data processing systems that are not one-size fits.

The complexity of processing these asset classes demands a more flexible approach, and that’s where API integration holds promise.

Spike in Trading Volumes

A 2021 DTCC annual report mentions that DTCC set several new volume records in 2020. The company handled securities transactions worth $2.3 quadrillion, showing an increase of almost 8% compared to 2019. On March 12, it achieved a new single-day record of 363 million U.S. equity transactions, surpassing more than two-and-a-half times the average daily processing volume.

The frequency of data exchanges and interactions compels firms to identify novel methods to meet the complex data exchange requirements. A flexible API with strong integration capabilities can help to seamlessly relay data between middle and back office systems. This way, firms can also ensure regulatory compliance and minimize settlement failures.

Challenges In Integrating Middle and Back-office Functions

The integration of middle and back-office operations presents an opportunity to overcome long-standing operational inefficiencies. Here are some challenges that come in the way of the integration of middle and back office systems.

- Complex Technology Infrastructure As A Barrier To Innovation

The main challenge faced by investment banks is either a lack of the latest technologies or complex technology infrastructure. Over time, they have accumulated various technology systems from different vendors and developed their own in-house systems. This outdated or complex technology has led to a fragmented and siloed setup.

To overcome the inefficiencies with data operating in silos, it is essential to offer a unified view of data through integration. This can be achieved well with API architecture.

- Legacy Systems Could Potentially Lead to Fragmented Data

The standard post-trade process involves four stages: confirmation, netting, settlement, and reconciliation. Legacy systems face challenges at each stage, with issues in trade matching, manual netting, settlement risks, and post-trade reconciliation. This is because the fragments of data are unable to flow effectively to the front office. Enabling a modern approach to application connectivity using usable and accessible data with APIs can enable better integration across the middle, back, and front offices.

- Siloed Systems Cause High Regulatory Risks

Manual operations and data integrity issues in siloed systems result in incorrect payments and regulatory risks. Automated processes-enabled API integrations will lead to better post-trade reconciliation and thereby help avoid penalties and costs.

API Integration As A Technology Solution

Deploying successful APIs for post-trade systems can achieve streamline operations, optimize efficiency, and enhance the client experience. DTCC’s announcement on Feb 04, 2020, about launching its API Marketplace to streamline access to service and improve user experience is a case in point. s.

We list a few benefits of API integration in post-trade systems.

- Real-time Communication for Interoperability: APIs enable real-time communication and data exchange between various participants in the post-trade settlement process, such as trading platforms, clearinghouses, custodians, and regulators. By facilitating instantaneous settlement instructions and confirmations, API integration significantly reduces settlement timeframes. Real-time settlement minimizes counterparty risk, as trades are quickly and securely settled, reducing the window of exposure to potential market fluctuations or default events. This enhanced speed and risk reduction contribute to a more stable and resilient financial ecosystem. APIs help in better communication between two systems and provide better interoperability between the front office, middle office, and back office. APIs enable data integration and interchange, avoiding the need to build a whole modularity or system. It enables faster settlements, scalability, and flexibility.

- Automation of Manual Processes: APIs play a significant role in simplifying systems integration. The automated nature of APIs ensures faster processing and minimizes the likelihood of human errors, ultimately leading to cost savings and improved resource allocation. Moreover, the efficiency gains allow market participants to focus more on value-added activities and strategic decision-making.

- Increased Flexibility: Brokerage firms use API as a protective bubble or wrapper, ensuring a smooth transition to a more advanced system without disrupting the overall operations. Without major system overhauls, APIs allow trading settlement systems to handle major volumes of trade and market complexities efficiently. APIs are modular, designed for easy integration with existing infrastructure, and offer the flexibility to adapt to evolving market dynamics.

Conclusion

Broker-dealers are prioritizing back and front-office integration as it enables real-time views of positions and risks. Aside from enabling faster settlements, it also enables risk management. But on the other hand, firms need to manage their risk in real-time as things are happening so quickly. Moving from a legacy to more modern technology provides more flexibility and scalability to the systems. By adopting advanced technology like API integration, financial firms can optimize trade workflows, reduce costs, and enhance overall efficiency.

Through API integration, capital markets gain a strategic advantage, as real-time data flows effortlessly between trading venues, clearinghouses, and settlement platforms. As a Fintech technology solutions provider, Ionixx Technologies helps your firm build robust post-trade APIs that expedite settlement times, optimize trade reconciliations and help manage risks by reducing manual interventions. Get in touch with us.