Before leaping into T+1 impact, it is crucial to know about who is the prime broker and their role in digital brokerage along with the hedge funds and asset management.

Who Is a Prime Broker?

Prime brokerages, offered by major financial institutions like investment banks, provide services to hedge funds, asset managers, and institutional investors. These services help clients optimize investment strategies, including securities borrowing, cash lending, and netting.

Prime brokers offer a spectrum of trade-related services, including custody, settlement, facilitating securities location for potential short sales, margin financing, asset servicing, and provisioning of back-office technology. The confirmation and affirmation processes between executive brokers and prime brokers are integral to efficient trade processing within the prime brokerage framework.

A key function of prime brokerage is trade settlement, where Executing Brokers (EBs) settle trades on behalf of the prime broker. The prime broker may involve self-clearing and clearing firms for EBs in settling some or all of the client’s trades.

What Is Hedge Funds?

Hedge funds are investment pools that aggregate funds from accredited investors and institutional clients. They aim to generate positive returns by investing in various assets and strategies. Professional portfolio managers or investment teams typically oversee these funds.

What Is Asset Management?

Securities asset management, also known as investment management, is a specialized sector within the financial industry. It involves the professional management of securities portfolios, which encompass a diverse array of financial instruments such as stocks, bonds, derivatives, and various marketable financial assets. Professionals in this field are responsible for managing these assets effectively.

T+1 Impact on Prime Brokerage

On February 15, 2023, the Securities and Exchange Commission (SEC) implemented a rule amendment to reduce the standard settlement cycle for most regular securities transactions. This change shifts the settlement period from two business days after the trade date to just one business day after the trade date, commonly referred to as T+1. With the proposed deadline set for May 2024, market participants are now racing against time to prepare for this transformation.

Expediting the settlement cycle will definitely put pressure on the buy-side firms, sell-side firms, and prime brokerage. In this blog, we discuss the impacts caused by this shift in the prime brokerage sector and how they are thriving to iron out the technological and regulatory difficulties.

How It Impacts The Hedge Funds And Asset Managers?

- To prepare for the T+1 settlement, it is important to engage with sell-side counterparts, including prime brokers and executing brokers, as they will need to comply with the T+1 mandate and Same Day Affirmation (SDA) objectives. Expect adjustments to counterparty conduct and operational processes, which may lead to policy updates affecting hedge fund clients. Implement greater automation in the allocation and confirmation process to meet T+1 requirements.

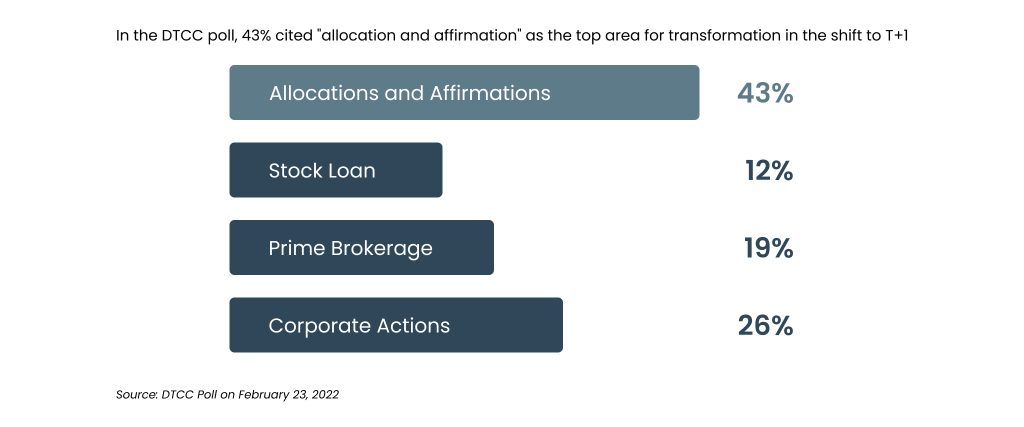

- Currently, buy-side participants allocate block trades to underlying accounts and share these details with executing and prime brokers. Upon completing the allocation process, the investment manager, designated custodian, or prime broker creates a detailed transaction record confirming each trade. It includes information about the trade, the trade date, the cost, and the net value. Subsequently, the investment manager, designated custodian, or prime broker affirms this confirmation. To prepare for T+1, sell-side firms must complete these activities on the trade date for matched and agreed transactions to meet accelerated settlement timeframes. Failure to automate this process may hinder T+1 achievement and increase trade failures.

- Hedge fund firms should focus on middle- and back-office processes supporting the post-trade lifecycle, especially allocations, confirmations, and affirmations. So, the automation for these areas of the post-trade lifecycle has traditionally had less technology investment compared to the front office. Because the processing speeds can be in milliseconds. Automation is crucial for executing and prime brokers to comply with T+1. Because the shift from manual to automated processes being the most effective approach. Consider leveraging automated central matching solutions for enriched trade details and same-day affirmation.

- SEC Registered Investment Advisers (RIA) among hedge funds have an additional record-keeping obligation under T+1, requiring time and date stamps for transactions and adherence to T+1 expectations. For RIAs, post-trade automation is essential to meet these new requirements as T+1 becomes a compliance issue.

Asset Manager:

Anticipating the accelerated settlement changes to T+1, asset managers are preparing for significant enterprise-wide transformations that will span from the front office to the back office. A comprehensive assessment reveals the specific areas that demand meticulous attention to ensure readiness for T+1.

| Key Areas | The Impact |

| Communication And Messaging Channels | Many investment firms currently rely on manual communication channels such as email, Bloomberg, and phone calls to interact with sell-side broker-dealers, which could be efficiently automated. These legacy communication methods frequently result in transmission delays and errors in crucial information exchange between counterparties, consequently impeding key settlement processes and elevating the number of trade breaks necessitating manual resolutions. |

| Allocations | The SIFMA implementation playbook underscores the importance of completing allocation instructions by 7pm EST on Trade Date. However, expedited allocation submission post-order execution is recommended to afford ample time for subsequent confirmation and affirmation processes. Some firms and counterparties may still adhere to manual allocation submission processes, potentially escalating errors and curtailing downstream teams’ ability to address discrepancies or failures. |

| Confirmations & Affirmations | The DTCC affirmation process mandates that confirmations and affirmations occur by 9pm EST on Trade Date, as outlined in the SIFMA implementation playbook. Broker-dealers can venture into the T+1 cycle by using automated affirmation tools like DTCC’s Central Trade Manager (CTM) and expedite this process by providing pre-matched information to custodians. |

| Securities Lending | Securities lending recall procedures frequently hinge on legacy batch processing among custodians, third-party lending agents, industry utilities, and borrowers. In a T+1 environment, the identification and initiation of loaned securities recalls must be expedited to prevent trade disruptions and failures. Thus, firms are advised to prepare for the new 9pm EST Trade Date cutoff for recalls, as recommended by SIFMA. |

| Collateral Management | In the context of T+1, the identification, substitution, and recall of securities posted as collateral necessitate earlier execution to avert delays or disruptions. Special attention should be given to the expedited recall process for rehypothecated collateral to minimize trade failures. |

| Leverage | Investment managers employing leverage must review their position management tools and assess the repurchase agreement process with various trading desks. Additionally, staffing levels on the desk and considerations regarding best execution pricing demand evaluation. |

| Timezone & FX | Asset managers located outside North America face challenges related to the reduced timeframe for resolving trade issues during the transition to T+1. This situation particularly affects broker-dealers and asset managers. As a result, managers may explore options such as overnight shifts, establishing new regional offices, or potential outsourcing to bridge this gap. Similar constraints apply to FX trading, necessitating a thorough analysis for managers unwilling to delegate FX trading to custodians. Furthermore, asset management firms should collaborate closely with their prime brokers and custodian banks to comprehend any timing modifications affecting reporting, file submissions, and security/cash/collateral deadlines. Legal and compliance teams should also be engaged to assess the readiness of existing legal agreements (e.g., ISDAs, MRAs) to forestall potential trading restrictions. |

| ETF Activity | Settling shares in exchange-traded Funds (ETFs) typically involves a longer process compared to most equities and other highly liquid securities. This is due to the need for transferring the actual underlying securities that compose the index tracked by the fund’s portfolio. In certain instances, these securities may be listed in various time zones and jurisdictions, introducing complexities similar to those encountered in the foreign exchange (FX) sector. Additionally, this process necessitates posting collateral a day in advance. To address these added complexities, DTCC is implementing changes to enhance support for ETF trades. These changes involve a shift from batch processing to real-time processing for their ETF application. Furthermore, DTCC is making functional adjustments to the Universal Trade Capture process and the primary and secondary ETF creation and redemption processes, as outlined in their comprehensive DTCC Functional Changes document. |

Conclusion:

The shift to T+1 settlement cycles is transforming the financial landscape, impacting prime brokers, asset managers, and hedge funds. As the industry adapts to this accelerated environment, meticulous preparations are vital. Broker-dealers should focus on automating communication, allocation, confirmation, and affirmation processes to meet T+1 requirements efficiently. To become a key player in the capital market and to navigate this t+1 shift, it is important to build efficiency into your post-trade systems. At Ionixx, we help you make the most of emerging, cutting-edge technology and combine it with our domain expertise to deliver practical solutions for the future. Contact us today.