What is T+1 Settlement?

T+1 settlement refers to the process of settling securities transactions one business day after the trade is executed. This is a notable shift from the traditional T+2 or even T+3 settlement cycles, representing a substantial reduction in the time between a transaction and its settlement. This transition promises to reduce market risk and enhance the efficiency of capital allocation.

The significant upcoming deadline for transitioning systems to T+1 is slated for May 28, 2024. The industry will significantly shift with a redefinition of operations of financial transactions.

Challenges in Adopting T+1 for Legacy Systems

The systems of many financial institutions are often outdated and rigid, struggling to adapt to the faster pace and increased transaction volumes of T+1 settlement.

- Processing speed is another critical concern; the batch processing common in older systems falls short of the real-time requirements of T+1. In these systems, transactions are accumulated over time for bulk processing, usually at the end of the day. This process works today, but it would create a bottleneck for the continuous, real-time transaction flow required in the T+1 settlement cycle.

- It isn’t feasible to rip and replace existing systems, so to effectively address the batch processing limitations in legacy systems for T+1 settlement, a modern processing software that supports continuous, incremental transaction handling can work in tandem with existing systems, ensuring a timely and efficient settlement process.

Also, managing large and complex data sets under T+1 can be problematic, leading to potential errors and compliance risks. Upgrading these systems is an endeavor, requiring substantial investment in time, finances, and skilled professionals and should align with new regulatory requirements.

Interoperable Technology

Developing a compatible ecosystem of components to ensure communication between trading platforms and clearing systems requires not only the integration of these newer systems but also their compatibility with existing legacy systems.

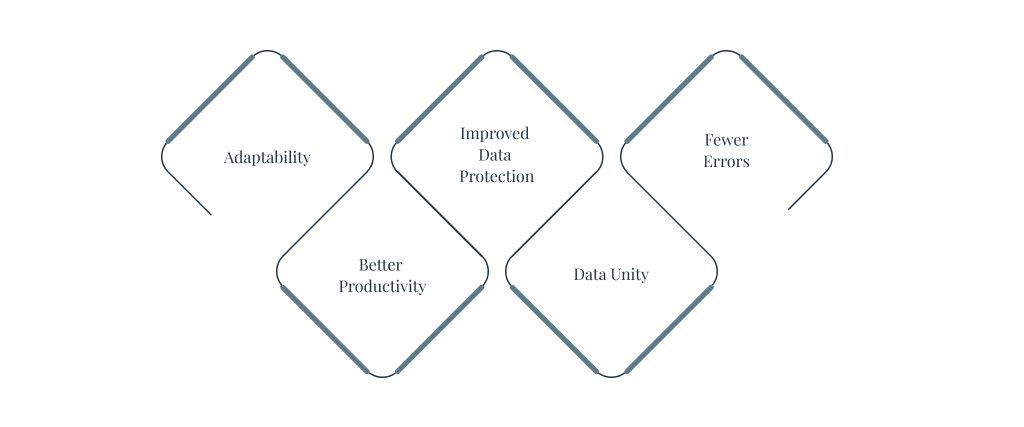

Top Benefits of Interoperability

One of the key challenges in achieving interoperability is the integration of newer technologies with older, established systems, many of which may be based on frameworks like .NET. Ensuring that new fintech solutions can interact with these .NET-based legacy systems is essential for a smooth transition to T+1. This requires a concerted effort in developing middleware, APIs, or adapters that can translate and relay information between old and new systems without disrupting the existing workflows.

Adopting standardized messaging protocols such as FIX (Financial Information eXchange) further aids in this interoperability. FIX protocol, being a well-established standard for the real-time electronic exchange of securities transactions, facilitates efficient communication across diverse systems, which is pivotal for T+1 settlements. This ensures that regardless of the underlying technology – be it a modern platform or a legacy system – the information exchange is standardized, reliable, and efficient.

In addition to enhancing communication, employing encryption protocols like TLS (Transport Layer Security) is critical for safeguarding data in transit. The core functionality of TLS lies in its ability to encrypt data before it is sent over a network, thus protecting it from eavesdropping, interception, and tampering. This is particularly crucial in the fast-paced environment of T+1 settlements, where large volumes of financial data are exchanged rapidly and continuously. TLS employs a combination of symmetric and asymmetric cryptography to secure these data transfers. Asymmetric cryptography is used for the secure exchange of keys, while symmetric cryptography encrypts the actual data being transmitted.

Automation and AI

For the shift towards T+1, the need for advanced analytical tools becomes increasingly evident. Predictive analytics stands out as a critical technology in this transition. It offers a powerful means to analyze vast amounts of transactional data, enabling financial institutions to anticipate and mitigate risks associated with the faster settlement process.

This specialized application of predictive analytics is distinctly different from the capabilities of advanced language models such as GPT. While GPT models are renowned for their ability to understand context, generate text, and interact in human-like ways, predictive analytics in is all about numerical and data-driven insights. Its primary goal is to identify patterns, predict outcomes, and optimize decision-making specific to financial transactions. This involves using sophisticated algorithms to forecast issues that might arise in the rapid T+1 settlement timeframe, a task that requires a deep understanding of financial data rather than language or text.

As predictive models identify potential risks or inefficiencies, automated systems can immediately respond, adjusting processes in real-time to mitigate risks. This seamless integration not only streamlines transaction processing but also significantly enhances the capacity to manage and process large volumes of transactions quickly and accurately. It represents a transformative approach in the financial sector, where efficiency, accuracy, and speed are paramount.

Conclusion: A Strategic Opportunity in T+1 Transition

The transition to T+1 isn’t just a regulatory requirement to check off; it can be a powerful new tool for your company to streamline operations, enhance efficiency, and harness the latest in financial technology. This shift offers an opportunity to not only comply with new standards but also to innovate and gain a competitive edge.

At Ionixx Technologies, we understand the intricacies of this transition. We provide consultancy and development services, helping you integrate legacy systems with interoperable technology and leverage automation and AI. Our team is more than just a service provider; we’re your strategic ally, experienced in successfully completing this transition.

To consult with our digital modernization expert and schedule your strategy session, contact us today.