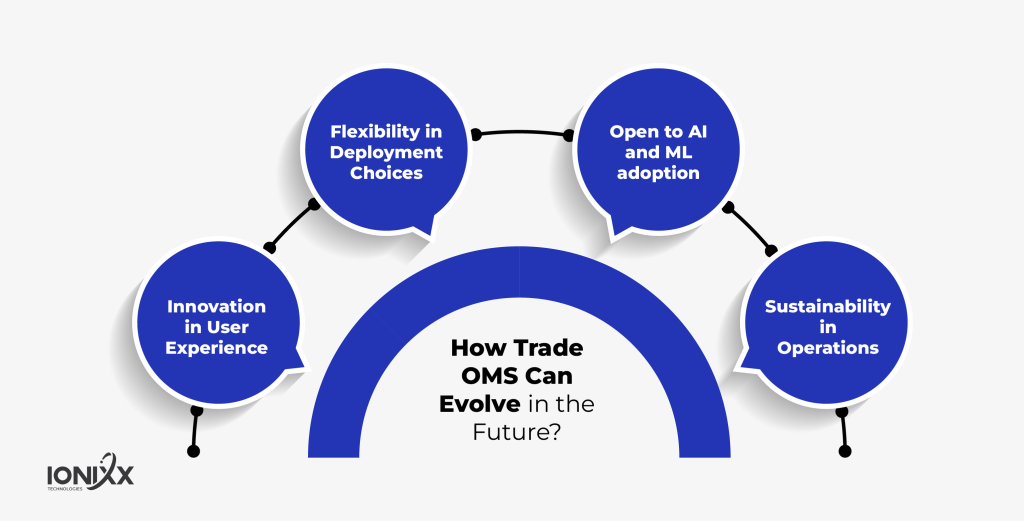

The future of order management systems in asset management will see exponential growth in automation and digital adoption/advancement. This trend involves leveraging the capabilities of artificial intelligence and machine learning, enhancing the accuracy and efficiency of trade executions. Additionally, the integration of blockchain technology is expected to significantly boost transparency and security within these systems.

There’s a growing demand for instantaneous data analysis to improve risk assessment and portfolio management. In the asset management sector, Order Management Systems (OMS) are embracing technology-driven solutions. It enhances operational efficiency and elevates overall performance.

How Artificial Intelligence And Machine Learning Can Transform Trade OMS?

Artificial Intelligence (AI) and Machine Learning (ML) offer significant enhancements in the realm of order management systems (OMS), particularly in the following areas:

- Automated Trading Strategies: Utilizing AI and ML, OMS can develop algorithmic trading strategies. These strategies enable rapid response to market dynamics and facilitate precise trade executions.

- Enhanced Portfolio Management: By analyzing extensive datasets, AI and ML can detect patterns that inform strategic decisions. This capability is key in optimizing portfolio performance and mitigating risks.

- Real-Time Risk Analysis: By continuously monitoring and analyzing real-time data, these technologies can pinpoint potential risks within a portfolio, allowing for timely adjustments to minimize those risks.

- Optimized Order Execution: AI and ML can evaluate current market conditions to determine the most efficient trading venues, ensuring optimal order execution.

- Enhanced Compliance Monitoring: These technologies can be employed to scrutinize trading activities, effectively detecting and addressing compliance issues, such as insider trading or market manipulation.

- Proactive System Maintenance: AI and ML are instrumental in predicting system maintenance needs. They analyze usage patterns to estimate potential system failures, enabling preemptive repairs or upgrades, thus minimizing downtime.

The Benefits of Integrating Blockchain Technology in Trade OMS

Blockchain technology offers several transformative benefits for integrating order management systems (OMS), including:

- Tamper-proof Records: It ensures a high degree of transparency and traceability for all trading activities and financial transactions, thanks to its immutable ledger.

- Automated Transactions via Smart Contracts: By using smart contracts, blockchain enables the automation of trade execution and processing of transactions, enhancing efficiency and minimizing the likelihood of errors.

- Enhanced Security through Decentralization: The decentralized nature of blockchain significantly bolsters security, offering robust protection against hacking and other cyber threats.

- System Integration and Interoperability: Blockchain facilitates the smooth integration and interoperability of various systems and platforms within the financial ecosystem, thereby enhancing the connectivity, transparency, and security of OMS.

Conclusion

The future of order management systems (OMS) is on the cusp of a technological revolution. The integration of Artificial Intelligence and Machine Learning is set to radically transform how trades are executed and managed, with automated strategies and real-time data analysis driving efficiency and accuracy. Blockchain technology further complements this shift, bringing unparalleled security, transparency, and interoperability to the table. As these technologies continue to evolve and intertwine, they promise to not only streamline existing processes but also open new avenues for innovation in trade order management.

Implementing an Order Management System is essential for traders to effectively handle the intricacies of today’s financial markets. A robust system is key in optimizing trades and meeting pre-trade compliance for broker-dealers. Ionixx’s solutions offer real-time updates on account balances and positions, along with comprehensive reporting, aiding broker-dealers in navigating the dynamic capital markets. Contact our OMS solutions team for more information.