In financial markets, where millions of transactions occur daily, the seamless execution of trade orders is crucial. This is where Order Management Systems (OMS) step in, serving as the backbone of efficient and effective securities trading. In this blog, we will delve into the workings of OMS trading software and how it plays a pivotal role in buying and selling securities.

The Components of A Trade Order

Before we learn about the intricacies of OMS trading software, let’s break down what constitutes a trade order. When a dealer wishes to buy or sell a security, they must provide specific details within the trade order:

Security Identifier (Ticker Symbol): The first information in a trade order is the unique identifier of the security being traded. This is typically represented by its ticker symbol, which helps in precisely identifying the asset.

Order Type: Dealers specify the type of order they are placing, whether it’s a buy order, sell order, or a variation of these, such as limit orders or stop orders. Each type of order has distinct characteristics and objectives.

Order Size: The size of the order refers to the quantity of the security being traded. It can range from a single share to thousands or more, depending on the investor’s strategy and objectives.

Additional Order Instructions: In some cases, dealers may include specific instructions related to the order, such as price limits or timing constraints. These instructions help tailor the trade to the dealer’s unique requirements.

The Role of An OMS Trading Software

Order Management Systems are sophisticated software platforms that facilitate the execution of trade orders. They streamline the entire process, ensuring that each order is handled efficiently and accurately. Here’s how they work:

Order Entry: The process begins when a dealer enters a trade order into the trading software. The order includes all the details mentioned earlier, such as the security symbol, order type, size, and any additional instructions.

FIX Protocol: Most Order Management system transactions rely on the Financial Information eXchange (FIX) protocol, which is the industry-standard messaging system for securities trading. FIX enables seamless communication between different entities involved in the trade.

Order Routing: After receiving the trade order, the OMS trading software determines the best course of action based on market conditions and the dealer’s instructions. It may route the order to various exchanges, brokers, or market makers to find the best execution price.

Order Execution: Once routed, the trade order is executed on the chosen platform. The OMS trading software closely monitors the execution process to ensure it adheres to the specified parameters.

Order Tracking and Management: Throughout the lifecycle of the order, the trade order management system maintains a comprehensive record. This includes tracking open orders, monitoring their progress, and recording completed transactions. This transparency benefits both dealers and regulators.

Transparency And Record-Keeping

One of the crucial functions of trading software is its role in maintaining a transparent record of all securities transactions. This record-keeping is vital for several reasons:

Compliance: Regulators require financial institutions to maintain accurate records of their trading activities. Order Management System ensures that dealers comply with these regulations by recording every order and trade.

Audit Trail: In case of disputes or investigations, the trading software serves as an invaluable audit trail. It can trace the entire history of a trade order, from its entry to execution, providing a clear and verifiable account.

Analytics: The historical data captured by an OMS trading software can be used for analysis and decision-making. It helps dealers assess their trading strategies, evaluate performance, and make informed decisions for future trades.

Wrapping Up

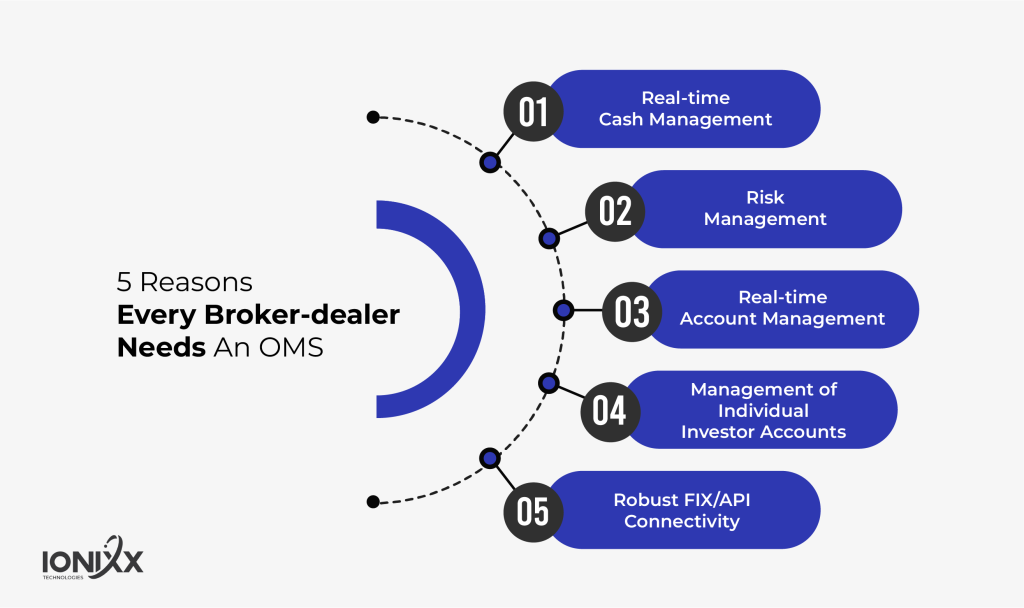

Order Management Systems are an effective tool in the securities trading world. They efficiently handle trade orders, adhere to industry standards like FIX, and maintain a transparent record of all transactions. In an environment where precision and compliance are paramount, OMS trading software plays a pivotal role in ensuring the smooth operation of financial markets.

Selecting the right OMS technology provider is crucial, with reliable service and support being the primary factors in the decision. At Ionixx, our dedicated team is equipped with the necessary expertise and experience to skillfully handle any challenges that arise. Our OMS solutions are tailored to effectively tackle the intricacies of pre-trade & core trade operations. Reach out to us for a streamlined and efficient OMS experience that meets your specific needs.