The journey of technical evolution commenced with the implementation of the Order Management System (OMS). Initially designed to monitor trade orders, the OMS saw a significant transformation with the advancement of the Financial Information eXchange (FIX) protocol in the 1990s. This evolution led to the integration of electronic order routing features, effectively automating and simplifying the trade order routing process.

Subsequently, the development of the Execution Management System (EMS) empowered sell-side brokers and day traders to actively participate in the rapidly evolving electronic marketplace. The adoption of EMS tools expanded among the buy-side as vendors began offering comprehensive global, multi-asset class platforms.

In the contemporary landscape, these technologies have undergone substantial advancements while retaining their pivotal role in streamlining investment processes and enabling investment firms to maintain a competitive edge.

Drawing on this extensive expertise, I delve into the essential functionalities and crucial factors to consider when evaluating an OMS, EMS, and Order and Execution Management System (OEMS) by comprehending the unique positioning of each technology in addressing the complexities and possibilities within modern markets.

What Is OMS?

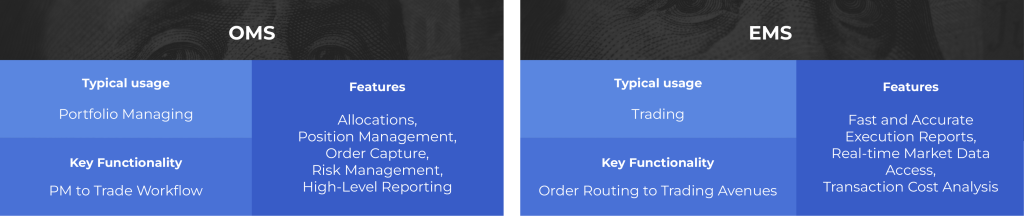

The OMS, widely employed by investment managers, primarily addresses front- and middle-office operations. Its key role involves optimizing daily investment activities through automated allocations, advanced compliance capabilities, and position monitoring.

In meeting the evolving needs of contemporary investment firms, a modern OMS encompasses a spectrum of functionalities, including portfolio modeling, P&L and exposure visualization, order routing, and decision support. Unlike its earlier versions, the contemporary OMS supports an extensive range of asset classes, adapting to the diverse portfolios of investment firms.

Flexibility and configurability are crucial aspects of an efficient OMS platform. A streamlined and agile trade generation process saves time and minimizes the risk of errors and missed opportunities. Moreover, scalability is imperative to accommodate evolving requirements. Without this scalability, the total cost of ownership can escalate rapidly, surpassing any initial cost-saving benefits associated with seemingly affordable options.

What Is EMS?

The EMS is primarily designed to facilitate rapid trade execution. Serving as a firm’s direct link to the market, it provides swift access to global liquidity, equipping traders with advanced execution options beyond the capabilities of the OMS. When selecting an EMS, prioritize systems that offer automated trading features, including rules-based order routing and sophisticated order types like conditional orders, list trading, and multi-leg orders.

Modern EMS platforms also deliver comprehensive, real-time market data and insights to traders. They enable the generation of quick, accurate execution reports and support Transactional Cost Analysis (TCA).

In high-volume, fast-paced markets, ensuring compliance can be particularly challenging. A robust EMS integrates compliance seamlessly into every stage of the workflow, ensuring uninterrupted trade flow while mitigating compliance risks.

The Power of OEMS

- The OMS and EMS technologies remain integral to the investment workflow, adapting to address the ever-evolving challenges encountered by firms, such as the growing adoption of global multi-asset strategies, shifting regulatory requirements, and heightened operational risks.

- To effectively tackle these challenges, many firms are opting to merge the OMS and EMS into a single OEMS, consolidating data into one centralized source of truth.

- An essential consideration when selecting an OMS provider is to ensure it offers the integrated, advanced EMS functionality needed to avoid the complexities and additional costs associated with third-party EMS integration.

- Seamless integration at the code level synchronizes data between the systems, allowing for a cohesive solution that combines the key features and functionalities of both the OMS and EMS.

- This integration eliminates the need for users to switch between multiple screens, resulting in more streamlined workflows and reduced costs and risks across trading, compliance, technology, and operations departments.

Conclusion

The evolution of OMS and EMS has significantly transformed the investment landscape, equipping firms with the tools needed to navigate the challenges of modern markets. As these technologies continue to advance, the integration of OMS and EMS into a single OEMS emerges as a powerful solution for investment firms, providing a centralized source of truth and streamlining workflows across various departments.

Irrespective of the chosen technology, whether OMS, EMS, or OEMS, it is crucial to ensure that the technology provider offers reliable and robust service and support. The technology team should possess the expertise, scale, and experience to effectively and efficiently address the broker-dealer requirements.

So, when choosing an OMS technology provider, the most important consideration is reliable service and support. At Ionixx, our dedicated team brings the essential expertise and experience needed to adeptly navigate challenges. We offer an OMS solution that specifically addresses the complexities in pre-trade operations. Connect with us today for a seamless and effective OMS experience.