The shift to T+1 settlement gains momentum globally, with the U.S. and Canada implementing it by mid-2024 and discussions underway in Europe and the U.K.

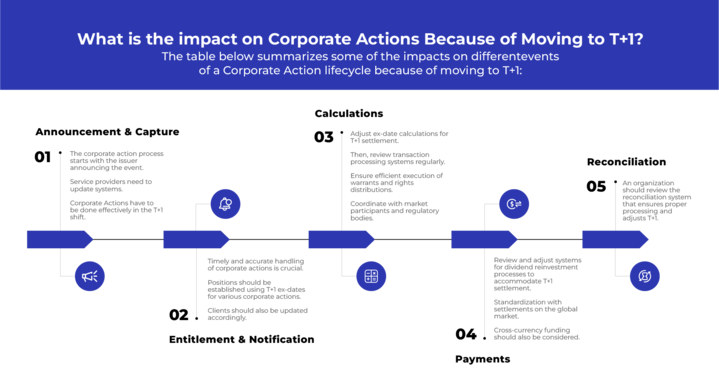

The move to a T+1 settlement cycle will have a significant impact on how corporate actions, such as Name or Trading Symbol Changes, Stock Splits, Reverse Splits, Dividends, Mergers and Acquisitions, Liquidation and Dissolution, are handled in the settlement process.

The shorter settlement will shorten corporate action event dates, which in turn will impact securities pricing in the event of a corporate action adjacent to a trade. It will also cause increased risk and impact of managing fails, liabilities, and claims in a shortened window. To overcome these challenges, the Securities and Exchange Commission will reform new rules and adopt the latest technology to align corporate actions with the new T+1 cycle and eventually with same-day settlement.

While this transition strains broker dealers’ operations initially, the long-term benefits include reduced risks, increased liquidity, and quicker access to trade proceeds for investors. This article provides insights into how T+1 settlement impacts the handling of corporate actions in the post-trade process.

What Are Corporate Actions?

A corporate action is any action that changes a company in a big way and has an effect on the people who have a stake in it. Corporate actions encompass a range of activities such as stock splits, dividends, mergers and acquisitions, rights issues, and spinoffs that impact shareholders in terms of ownership percentage, voting rights, or the cash or stock they receive. These decisions, subject to regulatory approval and often pre-communicated, refer to any action undertaken by a corporation affecting its shareholders and financial standing.

Six Common Types of Corporate Actions

| Corporate Actions Types | Description |

| Name or Trading Symbol Changes | If the company changes its symbol, it will reflect on the customer accounts statements and position holding. Because of these changes, the business might need to get a new CUSIP, which is a nine-symbol identifier that is given to each financial product. |

| Stock Splits | A stock split divides a company’s outstanding shares, typically in a two-for-one split, doubling the number of shares held by investors while halving the value of each share. |

| Dividends | A dividend is what a corporation pays to its shareholders when it distributes a portion of its earnings in the form of cash or stock. |

| Mergers and Acquisitions | A merger takes place when two businesses decide to unite into one. On the other hand, an acquisition—which can be either a friendly or hostile move—occurs when one firm buys the majority of the stock of another company. |

| Rights Offering | The rights offering is when a company offers existing shareholders the right to purchase additional shares in proportion to their current holdings within a specified period. Shareholders have a set window, typically one to three months, to participate before the offering expires. |

| Liquidation and Dissolution | A company goes through liquidation when it sells all of its assets and shuts down for good. During this step, the company’s assets are sold, and the money from the sales is used to pay off as many creditors as possible. |

What Kind of Challenges Will A T+1 Settlement Cycle Bring to Corporate Actions?

Moving to a T+1 settlement cycle for corporate actions presents numerous challenges for market participants, such as issuers, intermediaries, and investors. These challenges primarily stem from the accelerated pace and immediate processing requirements associated with corporate actions within the shortened settlement timeframe.

Timely and Accurate Information Dissemination

The rapid T+1 settlement cycle requires corporate action information to be disseminated quickly and accurately to all relevant parties. Any delays or inaccuracies in announcements can lead to discrepancies in processing.

Operational Efficiency

In a T+1 settlement cycle, market participants, including transfer agents, custodians, and depositories, must enhance their operational efficiency to ensure prompt processing of corporate actions, thereby heightening the risk of errors and operational delays.

Risk Management

Market participants must enhance their risk management practices to manage the risks associated with corporate actions within the shorter settlement period. This includes identifying and mitigating risks more effectively.

System Upgrades and Automation

Financial institutions and service providers may need to invest in upgrading their systems and technology infrastructure to support real-time processing of corporate actions in line with the T+1 timeline.

Processing corporate activities through manual processes is no longer possible in a T+1 environment. Many brokerage firms face a slowdown in the path to automation due to legacy systems that will not be updated or replaced for years or even decades.

Regulatory Adaptation

Regulatory bodies and market authorities may need to adopt regulations to accommodate T+1 settlement for corporate actions. Compliance with these regulations is vital.

Intermediary Coordination

Various intermediaries, including custodians, transfer agents, and depositories, need to coordinate efficiently to process corporate actions within the T+1 cycle. Delays or miscommunication among these entities can disrupt the process.

Cross-Border Challenges

In global markets, cross-border corporate actions can be particularly complex due to varying regulations and market practices. Achieving T+1 settlement for such events may require international coordination.

Compressed Timeframes

To get to T+1, broker-dealers need to manage expectations and make changes to both operations and technology. For voluntary corporate action events, both reconciliation and timely settlement of trades on securities undergoing corporate action is critical. The key to lowering risk is to take a comprehensive approach that lets each firm’s system take in the corporate action event announcement, create client entitlements, do trade reconciliation to find out the liabilities, and then finally connect the client instructions to DTCC in a timely manner.

Transitioning to a T+1 settlement cycle for corporate actions is a significant change that necessitates close coordination, robust systems, and a high level of accuracy and efficiency in processing corporate action events to prevent errors and minimize operational and settlement risk. It is a challenge that requires careful planning and investment from all participants in the financial ecosystem.

Conclusion

In conclusion, the shift towards a T+1 settlement cycle for corporate actions signifies a transformative phase in the global financial landscape, demanding robust adaptations across various market participants. This transition, while posing significant challenges in terms of timely information dissemination, operational efficiency, risk management, system upgrades, regulatory compliance, intermediary coordination, and cross-border complexities, also presents a unique opportunity for the industry to enhance its overall infrastructure and technology.

To have effective corporate action automation in the wake of t+1, it is crucial to have a robust post-trade settlement infrastructure. Our post-trade processing settlement systems equip broker-dealers with a fully automated post-trade clearing and custody services in a single digital brokerage system. Speak to our team now.