Equity market volatilities in early 2021 have led the U.S. Securities and Exchange Commission (SEC) to consider the transition to a shorter trade settlement cycle. In an industry whitepaper, Advancing Together: Leading the Industry to Accelerated Settlement, the DTCC makes the case for T+1 settlement by showcasing how it has the potential to drive significant cost savings, reduce market risk, and lower margin requirements.

A comprehensive FAQ section from DTCC projects that volatility margin costs can be cut by 41%, as a consequence of transitioning to T+1.

Shortening the settlement window from the current two days (T+2) to one day (T+1) would have several benefits for market participants. That said, it will also require the investment of time and money to prepare and test systems before implementation.

A collaborative Press Release laid out by the Investment Company Institute (ICI), The Depository Trust & Clearing Corporation (DTCC), and the Securities Industry and Financial Markets Association (SIFMA) in 2021 draws a roadmap on what it takes for firms trading securities as they move toward accelerated settlement cycles.

In our blog, we interpret the roadmap and lay out the challenges and opportunities that buy-side and sell-side firms are presented with as they continue preparing for the May 2024 transition.

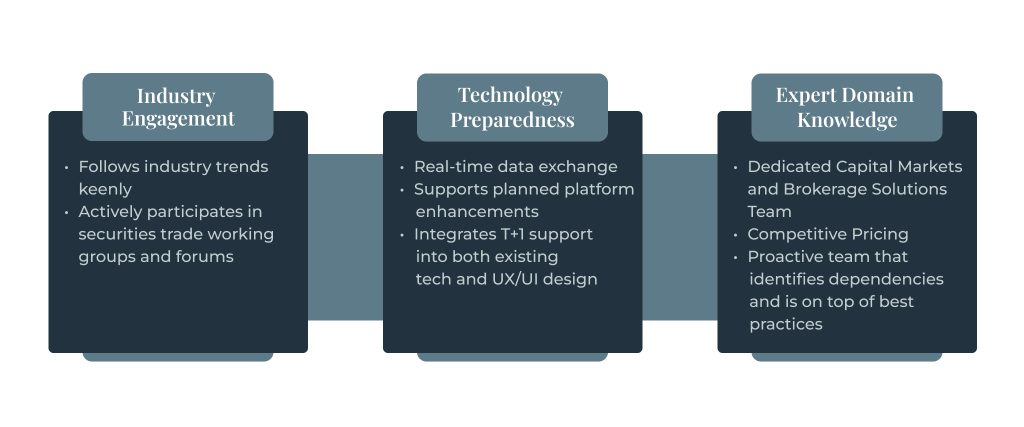

We also cover some ground on how we, as an emerging FinTech solutions provider, can help brokerage firms prepare for T+1.

Navigating the T+1 Transition

Buy-side firms, including asset managers, hedge funds, and institutional investors, play a crucial role in the financial ecosystem. Buy-side firms also help to diversify risk and improve market liquidity. Sell-side firms, including broker-dealers and market makers, are at the forefront of market activities. They facilitate trading, provide liquidity, and ensure the smooth functioning of financial markets.

However, the shift to a T+1 settlement cycle presents distinctive challenges and opportunities for them.

Preparing for the T+1 transition involves leveraging automation, modular architecture, real-time monitoring, and proactive client engagement.

Challenges Involved: The Underlying Need for Post-trade Settlement Efficiency

Transitioning to T+1 settlement requires addressing challenges through automation, API integration, and real-time data transmission solutions. With next-day settlement and a subsequent T+0, both buy-side and sell-side firms need to be equipped with appropriate data architectural frameworks and technology toolkits.

An incremental, modular technology infrastructure using cloud computing and APIs can enhance operational efficiency in a staggered manner for brokerages looking to make a successful T+1 shift.

Table 1 below highlights the key operational challenges and potential solutions

| Challenges | Technology Solutions | Benefits |

| Absence of Real-Time Data Transmission | Use APIs to automate the validation of standing settlement instructions (SSIs) provided by individual market participants. By integrating APIs that cross-verify SSIs against standard criteria and predefined rules, discrepancies or inconsistencies can be identified at the beginning of the trade process. | Integrate AI tools into your brokerage’s systems to trigger email alerts automatically when potential issues are identified. These email alerts, generated in real-time by AI tools, can be sent to relevant parties involved in the trade, including executing brokers and support desks. This helps notify the necessary stakeholders of the detected problem and the need for prompt resolution. |

| Lack of A Proactive Follow-Up Mechanism | Integrate AI tools into your brokerage’s systems to trigger email alerts automatically when potential issues are identified. These email alerts, generated in real-time by AI tools, can be sent to relevant parties involved in the trade, including executing brokers and support desks. This helps notify the necessary stakeholders of the detected problem and the need for prompt resolution. | AI algorithms have the potential to accurately identify and categorize issues, minimizing the likelihood of false alerts, and ensuring that alerts are relevant and actionable. |

| Manual Settlement & Reconciliation Processes | Consider implementing AI tools to develop a real-time consolidated view of inventories across asset classes, geographies, and business lines. Implement comprehensive APIs that allow for efficient netting of positions and timely actions, key for a T+1 environment. Currently, DTCC’s CTM system for matching and settlement notifications has a few shortcomings. Due to high transactional costs, high-volume firms route only a relatively small share of flows through CTM. This works in a T+2 environment, but with impending T+1, firms will have to fix incorrect matches/disaffirm trades in a much shorter timeframe. | Operational costs associated with manual reconciliation can be reduced through 100% Straight-through-Processing (STP). This helps with improved decision-making and enables enhanced compliance. |

| Poor Scalability for The Future | Consider Distributed Ledger Technology (DLT) for real-time tracking and efficient allocation of collateral. Invest in automated, and flexible technology architecture, setting the stage for a seamless transition to T+0 settlement in the future. Assess client capabilities, identify potential challenges, and offer advisory services to strengthen relationships and ensure smooth trade processing and settlement. | DLT provides a transparent, single source of truth for all parties involved. Adaptable technologies such as DLT help build inherent trust and reduce disputes through a shared, tamper-proof ledger. |

Opportunities for Buy-side and Sell-side Firms

T+1 presents a unique window for firms to lay the groundwork for a flexible and automated infrastructure,. This not only proves useful for T+1 but also for future transition, the potential leap to T+0.

Adopting Futuristic Technology Infrastructure

API-based integrations have the potential to see a 30% reduction in settlement time.

DTCC 202I

Automation and AI

Implementing automation and AI-driven solutions can streamline trade processing, reconciliations, and data management. AI-driven algorithms can automate trade reconciliations, dramatically reducing manual errors. For instance, automating trade confirmations can save up to 90% of processing time, significantly boosting efficiency. A DTCC’s 2021 press release on the voluntary corporate actions lifecycle posits how automation can help reduce times by 30% or more. AI’s predictive analytics can foresee potential settlement issues, enabling proactive resolutions.

Blockchain Integration

Exploring blockchain technology can drive secure and transparent transactions, aiding in faster settlements and enhanced trust. DLT can ensure greater automation of contracts, for example in the area of corporate action announcements. DLT-based systems could be adopted with the aim of standardizing and streamlining processes, leading to cost savings. They can reduce unnecessary duplication of activities, e.g. reconciliation, and enhance risk management.

How Can Ionixx Help Buy-side and Sell-side Firms?

Through Comprehensive Technology Solutions with Future-proof Tech Stacks

Ionixx provides modern brokerage technology solutions to address the challenges faced by brokerages.

Leveraging advanced technologies such as automation, real-time monitoring, AI, blockchain & DLT, and predictive analytics can substantially enhance efficiency and reduce settlement times for brokerages. However, challenges such as integration complexity, data security, and regulatory compliance must be carefully tackled to make the best use of the opportunities that technological advancements present.

Our brokerage tech stack is carefully chosen to streamline back-office operations, leading to a significant boost in operational efficiency.

The Way Forward

As the countdown continues toward the SEC‘s May 28, 2024 deadline, the importance of preparation cannot be overstated. A critical element for T+1 is real-time data exchange and transmission.

With proactive preparation and strategic technological investments, firms can position themselves at the forefront of this crucial move, unlocking new opportunities and ensuring a successful migration to T+1.

At Ionixx, we equip both buy and sell-side firms to automate data exchange and improve real-time transparency through dynamic cloud tech and powerful APIs. We also ably support brokerages with premium user experience and seamless UI interfaces.

Talk to our digital brokerage and capital markets technology team today.