According to a DTCC estimate, the global cost of failed trades reached a staggering $9 billion in 2021.

DTCC Annual Report 2021

This could be substantially mitigated through streamlined, advanced tech-led post-trade systems. Modernization in the post-trade settlement process has become a mandate owing to two significant reasons

- Rising trading volumes

- Increasing aggregate trade data

These two reasons translate to a growing need to reimagine back-office processes, and firms are preparing to invest in post-trade modernization initiatives that would help make the move from archaic legacy systems to a robust, modern technology infrastructure a seamless transition.

While APIs do not enjoy an exclusive focus for most executives in the securities servicing industry, several other advanced technologies such as distributed ledger technology (DLT), cloud-based data solution, Robotic Process Automation (RPA), and others are garnering their attention in the pursuit of margin improvement and revenue growth.

In this article, we have chosen to explore APIs specifically as the maturity of the technology, combined with the myriad use cases being explored today, suggest their adoption has great potential across the industry. By centralizing and standardizing APIs, firms can future-proof their products for the evolving capital markets landscape and be prepared to welcome the adoption of automation technologies.

Current Challenges with Post-trade Technology Modernization

The path to technological modernization is often fraught with challenges, especially when it involves migrating entrenched legacy systems, a common occurrence in dynamic capital markets. The effectiveness of endeavors such as enterprise workflow automation hinges on the seamless integration of a company’s IT systems. Historically, finance firms have grappled with integration and data standardization hurdles.

Inadequate Real-time Data Access

Currently, the securities services landscape operates with a distinct lack of real-time capabilities, relying on messaging within the confines of the ISO 20022 standard, managed by SWIFT. While delving into the ISO 20022 for Dummies book might not be a universal recommendation, its essence can be understood as a cornerstone for electronic data exchange between financial institutions—being integral to frameworks like FIX protocol, ISDA, and SWIFT. For asset managers in pursuit of critical data, real-time access remains elusive. Traditionally, such data trickles in as files, necessitating integration into their internal systems to oversee positions, manage risks, and generate reports. The journey lacks the fluidity of straight-through processing.

How Are APIs Advantageous for Capital Markets?

The seismic shift within the securities servicing domain from an operational business model to a dynamic technology and data-driven system is setting up the stage for more innovation and in turn efficiency. In this context, Application Program Interfaces, or APIs, are emerging as important pillars that support optimal data integration and interoperability.

Here are a few ways that APIs are leading change.

Accelerating Data Exchange

As market participants across the capital markets ecosystem demand flexibility and real-time access to their data held by custodians, exchanges, centralized securities depositories, and others, APIs serve as a gateway to increased efficiency by streamlining STP rates. APIs can change the game of data exchange by enabling quicker data access and better data management.

Improving Systems Integration

APIs typically tap into the several manual touchpoints that hinder data and instruction handling. This makes them well poised to drive deeper integration of an organization’s internal systems, improving efficiency and unlocking opportunities for value-added service offerings.

Ensuring Readiness for Tech Adoption

While the narrative that legacy systems become obsolete with time is becoming more pronounced with respect to the securities servicing landscape, the path is clear for emerging technologies such as distributed ledgers to make an impact. Should newer technologies such as robotic process automation (RPA), be broadly adopted, APIs could play a meaningful part in the target-state solution as well as provide a bridge from existing systems to the systems of the future.

How APIs Work in Post-trade Systems

Data Volume and Complexity

As the frequency of interaction and volume of data exchanged between participants in the post-trade industry is growing by the day, the need for highly integrated data models is key to post-trade settlement efficiency.

APIs are well suited to meet the complex data exchange requirements between the buy-side and custodian banks, and can enable more seamless integration between servicer and client systems regardless of the underlying technology infrastructure.

A Spurt of Alternative Assets

Growth in alternative assets has resulted in the proliferation of complex asset types. This calls for high-level innovation both with respect to data handling and system scalability. With new instruments on the horizon, the need for the creation of extensive data fields to facilitate seamless data exchange is a must. Even more so, the growing need to cut down the reliance on manual processes is critical.

API solutions can be the answer to offer adequate levels of flexibility while maintaining optimal STP rates.

Fee Compression And Resultant Inefficiency

As there continues to be fee pressure in the post-trade world, driven by the rise of passive investment vehicles and the continued reduction of fees paid by investors, pockets of inefficiency still exist in post-trade. For example, some asset managers and custodians remain reliant on electronic faxes and phone calls for many of their inter-firm communications.

APIs lower the barrier to adoption as the investment required for implementation is low compared with existing post-trade solutions.

Expanding Scope of Service Offerings from Custodians

Custodian banks are exploring ways to expand their position in the market, and are increasingly looking to provide services such as data management, analytics and insight, portfolio risk analytics, and others. State Street’s acquisition of Charles River Development is perhaps the most visible recent manifestation of this trend. These new business models will entail engagement with different units in the existing client base (e.g. front-office), and will require more ways of interfacing than currently in use.

APIs can support firms as they expand the scope of services that they offer.

Future-Proofing for the Evolving Capital Markets Landscape

As technology continues to evolve, the capital markets landscape is experiencing significant changes.

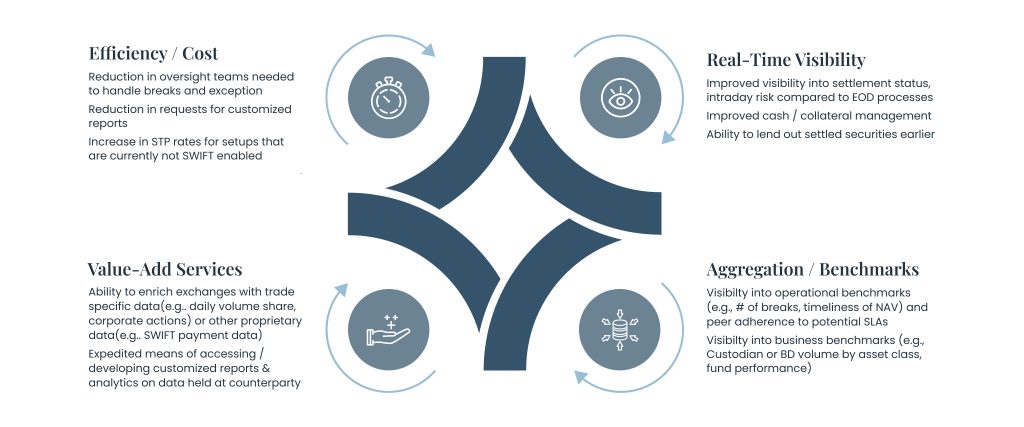

APIs in post-trade can be used to solve the following pain points.

Real-time Status of Settlement Instructions

Current status reporting mechanisms are found wanting. Currently, high volumes of status messages with low data quality can overwhelm systems without effectively prioritizing exceptions that require immediate attention. As a step ahead, exception monitoring should be fast, automated, and simple.

As a solution, API calls can be used to provide instant access to settlement status, thereby increasing flexibility and reducing notification latency. In cases of exceptions, data fed back can be customized based on the type of exception encountered, thus improving transparency of the information sent back to consumers.

Ad-hoc Consumption of Securities Positions across Custodians And Depositories

Currently, intraday communication of holdings is often manual, especially when a position in a specific asset is needed on an ad-hoc basis. Having access to securities positions across multiple accounts is essential to sell-side firms when receiving an allegement (missing trade match).

APIs allow account holders to request security positions across multiple accounts held at different account servicers. It also helps the reliance on batch processing for custodians and depositories, and improves the efficiency of middle, back, and front office operations for buy-side and sell-side firms.

Normalizing Complex Asset Classes Information

Asset classes such as syndicated loans or derivative contracts have complex and dynamic requirements regarding the exchange of deal information. Since multiple types of data and multiple data providers are involved in the current settlement process, there is often a problem of fragmented data. Procedures lack standardization and are difficult to automate. Revolving credit facilities call for real-time access to data for borrowers, lenders, and agents.

A collaborative and open-source modeling tool and methodology can help the creation of flexible and standardized API contracts.

Use of Automation

The increased use of automation technologies and the adoption of new regulatory frameworks require firms to future-proof their products and operations. By standardizing and centralizing their web APIs, firms can adapt more quickly to market changes and leverage emerging technologies such as blockchain and Distributed Ledger Technology (DLT) without the need for extensive reengineering or data migration.

Monolithic to Microservices Cloud

Firms should look to lift and shift monolithic applications from on-premises to the cloud. From there, the key is to re-architecture applications and services to a microservices model so that they can more easily be transitioned, should the need arise in the future. The next step is to start carving services out that make sense while preserving legacy monolith cores where there are no functional or performance challenges.

APIs for The Future of Post-trade Efficiency

By streamlining the integration process for numerous brokerage solutions, APIs empower businesses to make timely, informed decisions and seize automation opportunities without exerting exhaustive development resources.

As next steps, brokerage firms could look at consolidating several APIs into a cohesive web services framework. This can help redefine the development experience for enterprise customers and pave the way to a more modern and dynamic post-trade settlement system.

How We Can Help

As we navigate this paradigm shift, the adoption of secure APIs is one of the key success factors to further harden security and create essential trust in the ecosystem. Ionixx is dedicated to being a technology-first brokerage services helping broker-dealers to benefit from quick and seamless integrations. In order to complete an efficient integration, we offer comprehensive services to build/enhance your platform successfully.

If you have not already signed up, we urge you to start building with our APIs in the Sandbox environment. Get in touch with us for a free demo. If you have any questions during this process, write to us at info@ionixxtech.com.