In the past, post-trade processes received less attention than front-office operations when it came to automation. However, the landscape has changed, and automating post-trade systems has become essential for firms to stay ahead and thrive in a T+1 market, where efficiency and speed are paramount.

The condensed timeframe of T+1 trading emphasizes the need for immediate market insights and predictive analysis. Traders must have real-time visibility into ongoing deals to make informed decisions. With trades happening more frequently and at greater speeds, firms that analyze the market with significant delays will lag behind their competitors.

The global industrial automation market is projected to grow from USD 205.86 billion in 2022 to USD 395.09 billion by 2029, exhibiting a CAGR of 9.8% during the forecast period.

Increasing automation in post-trade processes offers firms a competitive advantage.

It enables quicker analysis of current settlements, allowing for the prompt identification of errors and failures. This, in turn, leads to more accurate and completed trades.

A May 2022 whitepaper by SIFMA, ICI, and DTCC highlights that firms leveraging automated post-trade processes have achieved a near 100% affirmation rate on the trade date. This reduces costly reconciliation efforts and post-trade exceptions.

By embracing automation, firms can future-proof their technologies and ensure their survival in a rapidly evolving market. Immediate market insights, predictive analysis, and streamlined post-trade processes enable firms to enhance their efficiency, reduce errors, and stay competitive in a T+1 environment.

A recent news about DTCC collaborating with Nomura Research Institute to bring post-trade automation and efficiency to Japan proves the importance of automating trade.

“This timely effort addresses domestic and cross-border transactions and aligns with the global financial industry as it prepares for the 2024 implementation of the T+1 settlement cycle in the U.S”

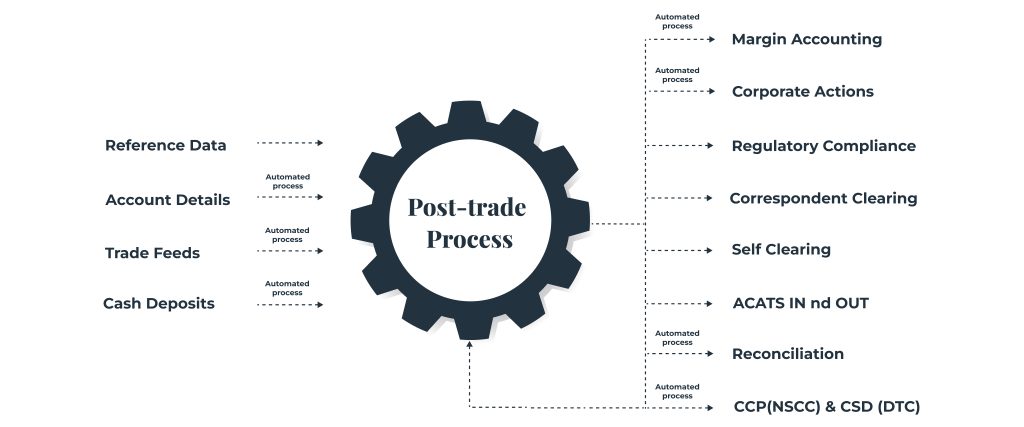

So let’s take a deeper look at the major advantages brought to the buy-side and sell-side firms by automating the post-trade system.

What Are the Key Advantages of Post-trade Automation Systems?

Efficient Settlements

Automation has led to significant efficiency gains in post-trade processes. For example, the Depository Trust & Clearing Corporation (DTCC) reported a 90% reduction in the time required for trade affirmation and confirmation through automation.

To ensure an efficient and streamlined post-trade automation process, it is crucial to integrate automated solutions within the front and middle office’s Order Management System (OMS) and the front office’s Execution Management Systems (EMS). This integration requires seamless two-way communication with key third-party entities, including prime and executing brokers, custodians, fund administrators, and central matching.

By establishing this connectivity, transaction data can be retrieved in real-time from the trading platform and automatically allocated, matched, and reconciled against external counterparty data. This eliminates the need for manual intervention and enhances the accuracy and efficiency of post-trade workflows.

Reduced Risks

A white paper published by DTCC on Automatic Trade Affirmation has talked about the reduced risk and cost for institutional trades in the US market.

The post-trade automation embedded within the OMS offers a wide range of functionalities to support this front and middle-office-centric approach. Advanced commission and fee schedule management, and allocation, automatic trade pairing and matching at block and allocation levels, and easy cancellation and rebooking of tickets in case of mismatches are just a few examples. By leveraging these capabilities, clients can significantly reduce manual tasks traditionally associated with post-trade processes.

Increased Market Participation

Infrastructure modernization, driven by the adoption of technology and automation, offers significant benefits in terms of reducing operational risk, increasing productivity, and minimizing friction for market participants. The migration to a T+1 settlement cycle presents opportunities to leverage automation in the following ways:

Improved Reconciliation Time and Cost Savings

Through post-trade automation, the industry can expedite the adoption of STP and re-engineer processes accordingly. For instance, implementing match-to-instruct capabilities for trade affirmation and confirmation eliminates redundant processes and automates reconciliation, saving time and costs.

Optimized Margin Calculations

Automation enables more efficient margin calculations and can reduce margin requirements for customers, brokers, and clearinghouses. This is especially true with the recommended allocation and affirmation timelines changes, allowing for improved margin management and cost savings.

The benefits include faster and more accurate processing, cost savings, and an improved experience for all involved in the trading and settlement process.

Enhanced Compliance

Securities firms face challenges in corporate action processing due to surging trading volumes and increasing complexity. To cope and stay competitive, firms are considering full automation. The regulatory compliance automation in trading operations is attributed to reduced cost, improved end-to-end visibility, increased efficiency, and better preparedness.

However, with growing volumes and complexities, automation becomes necessary. Integration challenges and aligning manual processes with market standards pose additional difficulties. Firms are adapting to meet client demands for real-time information to mitigate risks. Ensuring effective resolution and minimizing loss for beneficial owners is crucial.

Increased Operational Efficiency

To fully harness the potential operational efficiencies of automation, resiliency, and faster settlement, firms must prioritize interoperability and transparency within their systems.

The impact of the transition to T+1 extends beyond the United States, as European and UK markets are also poised to follow suit. Navigating this shift presents complex challenges, including multiple currencies and clearing paths. Automation becomes essential in ensuring a smooth transition and adapting to evolving market behavior.

Automation serves as the backbone of a seamless transition to the new settlement standard. Moreover, as the industry progresses, there is an anticipation for the wider adoption of advanced technologies like distributed ledger (DLT). DLT has the potential to revolutionize trade settlement, enabling not only faster but also more secure and accurate transactions.

Conclusion

From DTCC taking a bigger step in bringing post-trade automation and efficiency to Japan, it is evident that automated post-trade systems bring numerous advantages to both buy-side and sell-side firms. They will enhance operational efficiencies, reduce risk, and stay ahead of the curve. The adoption of advanced technologies, coupled with automation, will pave the way for a more efficient and secure future of trade settlement.