In the hyper-connected world of financial technology, brimming with advancements like AI, ML, NLP, and the increasingly prominent LLMs (Large Language Models) or Generative AI, there’s a transformative wave reshaping the industry. Today, we spotlight the shift towards an integrated, de-coupled Order Management System (OMS), a move that’s not just about adopting new technology but about harnessing specialized capabilities to revolutionize pre-trade solutions.

In the first part of this series, I delved into how modular solutions with pre-built components are the way forward for the securities trading industry, especially in the wake of T+1 settlement.

In this blog, I explore how agile and integrated microservices are driving the future of operational efficiency

The Need for De-Coupled OMS: Real-World Paradigms Unveiled

In an era where adaptability is king, global giants such as Ion Trading and Trading Technologies are recalibrating their strategies. Known for their robust proprietary solutions, these titans are now strategically acquiring fintech startups in the FX, FI, and cryptocurrency realms. This trend highlights a significant pivot: the shift from monolithic structures to agile, specialized, de-coupled designs that prioritize seamless integration with niche experts in specific trading segments.

Mastering the Market Data Maze

The quintessential OMS of the future leverages premier market data vendors, offering not just comprehensive data but also cost-effectiveness through a pay-what-you-use model. Frontrunners like DataBento excel in delivering real-time market data, while OneTick’s prowess lies in extensive historical data analytics. This nuanced approach to data subscription, focusing on usage, ensures firms get value for their investments, paying exclusively for the data they utilize.

Algo Trading: The New Frontier

In the contemporary trading arena, an advanced Algorithmic trading engine is not a luxury, but a necessity. BestEx Research leads the charge with its dynamic, customizable algorithm designs and superior order routing, ensuring trades are more than just executed—they’re optimized, intelligent, and data-driven.

Empowering Traders with In-Depth Research

When it comes to technical analysis, Trendspider is the go-to authority, whereas platforms like Quandl and OneTick are revolutionizing fundamental research. Beyond mere data presentation, these platforms provide traders with predictive insights, guiding informed decision-making.

Balancing Compliance and Expediency

Compliance needn’t be a bottleneck in trade execution. Solutions like OneTick go beyond ticking regulatory boxes. They leverage AI and ML to scrutinize trading behaviors meticulously, pinpointing and escalating anomalies to ensure seamless, compliant trading operations.

Key Takeaways

- The fintech landscape is not static; it’s dynamically evolving, mandating a similar evolution in the tools we deploy.

- An integrated, de-coupled OMS is the future, bridging the gap between conventional trading systems and cutting-edge, agile solutions.

- Selecting and amalgamating niche vendors across the trading lifecycle doesn’t just enhance operational efficiency; it fortifies compliance protocols and catalyzes successful trading outcomes.

How Ionixx Can Help

At Ionixx, our connoisseurs have delved deep into the intricate offerings of the industry’s top vendors, grasping the unique merits and limitations of each. Our proficiency lies in tailoring integrations based on client specifications and crafting bespoke solutions, setting the stage for unparalleled trading results. The future of trading rejects the one-size-fits-all doctrine, embracing instead the elegance of personalized, integrated excellence.

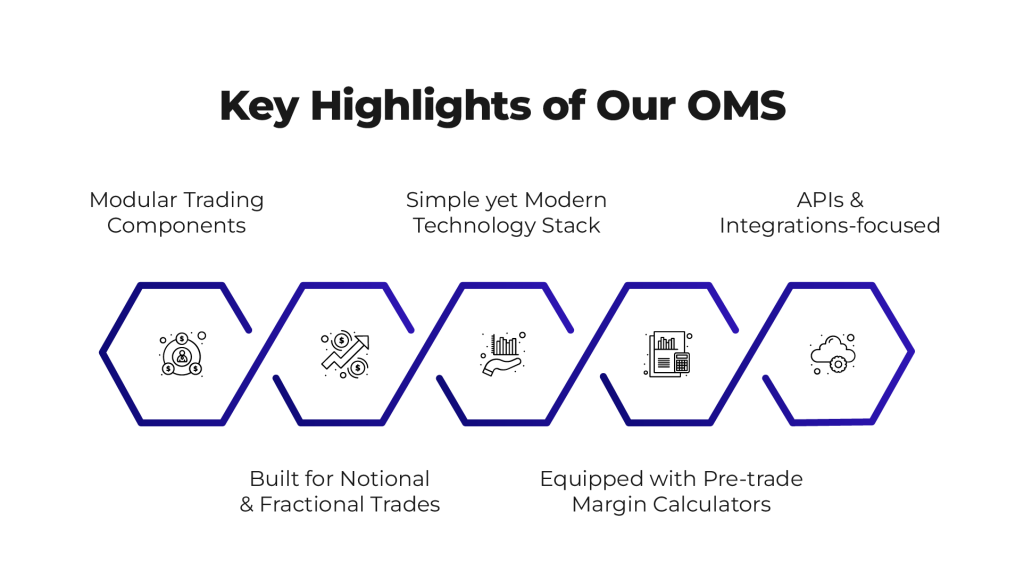

Our approach to building robust OMS solutions is to offer our customers with a bespoke, scalable toolbox from which they can pick and choose the tools that best fit their requirements. Be it for the front office, market-making, or the middle office, collateral management — seamless API connectivity, cloud tech, and interoperability are at the core of our capital markets technology solutions.