The trading world is complex and ever-evolving. Gone are the days when firms could rely on a single, comprehensive solution for their trading needs. While the allure of a one-size-fits-all system is clear – streamlined processes, uniform user experience – the reality is often far from the ideal.

The Traditional Landscape

Historically, giants in the trading software world, like Fidessa, Reuters and Bloomberg Terminal, promised a holistic approach to trading. Their pitch was simple: Why juggle multiple systems when one can do it all? On paper, it’s compelling. In practice? Not so much.

From my own experience, these top-tier vendors, while dominating the market, aren’t necessarily the champions in every aspect of the trade lifecycle. Be it the lack of customization options, a missing suite for top-performing algorithmic trading, absent ala carte pricing, or the unavailability of Transaction Cost Analysis (TCA) – the cracks begin to show.

The Limitations of Existing Solutions

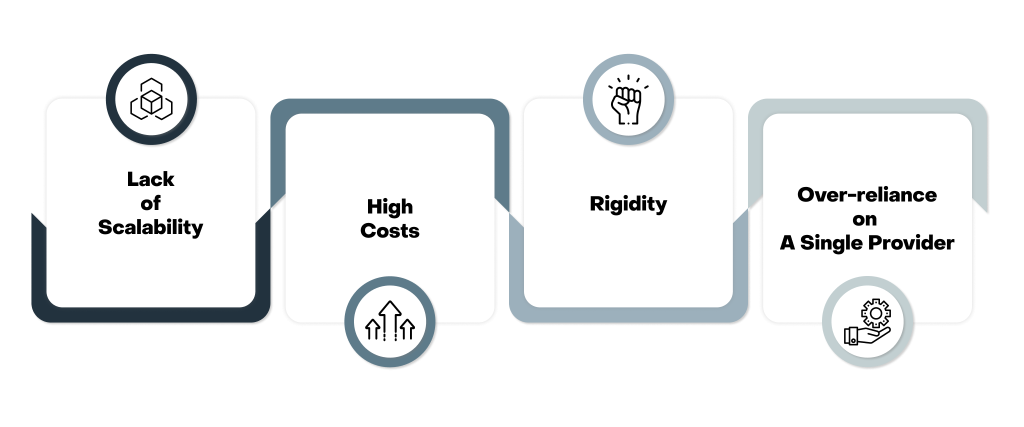

Even the most robust solutions have their challenges:

- Scalability: Adjusting these systems for businesses of different scales isn’t straightforward.

- Heavy Costs: They come with a hefty price tag.

- Rigidity: Tailoring the system to a business’s unique requirements. Often a pipe dream.

- Over-reliance: Depending heavily on a single provider has its risks.

The New Paradigm: Component Integration

Enter the age of component integration. Progressive firms are acknowledging that the dream of a perfect all-in-one system is just that – a dream. Instead, they’re integrating components from different top-tier providers to curate a solution that’s just right.

This approach has manifold advantages:

- Flexibility: Integrate only what’s needed, ensuring an efficient system without redundancies.

- Cost-Effectiveness: Paying for only the used components often proves cheaper.

- Optimal Performance: By selecting the best in class for each function, firms ensure peak system performance.

- Rapid Innovation: Easier to upgrade or replace a single component than an entire system.

The Future is Integrated

For C-level executives in fintech, traders, portfolio managers, and investors, this isn’t just a fad. It’s the future. By cherry-picking the best of the best, companies not only optimize their operations but also position themselves as innovators in a competitive landscape.

Furthermore, this approach fosters competition among software providers. No longer can they rest on their laurels, assured of a client’s continued patronage. If a component isn’t delivering, it can be swiftly replaced.

Looking Ahead: Beyond Monolithics

The future of trading software isn’t in a monolithic system, regardless of its promises. It’s in a tailored, integrated approach that combines the strengths of multiple top-tier providers, leaving out their weaknesses. For fintech firms, traders, and investors, the message is clear: Integration isn’t just an option; it’s the way forward.

For those looking to invest in or leverage the next wave of trading technology, it’s time to think not just big, but also smart. Think integration, Think Ionixx!

As a growing software & IT solutions provider that specializes in providing custom software and IT solutions, we leverage advanced technologies such as blockchain, cloud, and AI to deliver successful brokerage solutions.