Continuing from our previous exploration of how AI is shaping UX for trading apps, in part 2 of our two-part series on AI for UX design, we unpack the value of sophisticated tools that allow designers tools for innovation and greater efficiency — Predictive Analytics, Natural Language Processing (NLP), and Sentiment Analysis.

Determining When Predictive Analytics for UX Can Be Useful

As we continue to deliberate on which AI tools for trading UX can be a great fit, let’s acknowledge that AI makes it easy for users to be informed and competitive. Predictive analytics in AI helps traders make informed decisions by using machine learning algorithms to read the market and predict future trends and movements. AI can predict short-term and long-term price movements, which can inform decisions like when to invest and when.

As designers, we identify specific use cases where predictive analysis can add value, such as forecasting market trends, recommending trading strategies, or alerting users to potential opportunities or risks.

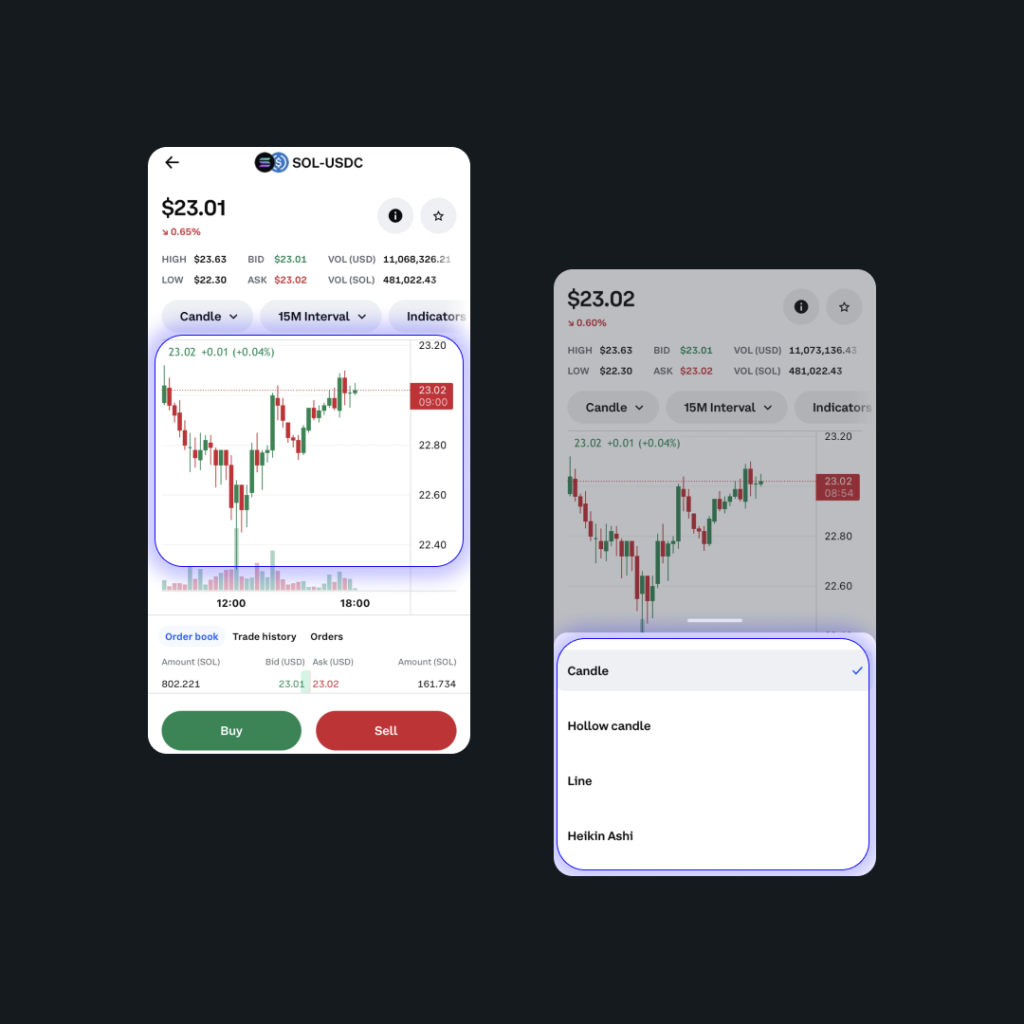

- Visualize predictive insights and data visualizations to communicate complex information in a clear and intuitive manner. Use charts, graphs, and other visual elements to represent predicted trends, patterns, and recommendations.

- Consider incorporating interactive elements that allow users to explore predictive data in more detail, such as zooming in on specific periods or adjusting parameters for predictive models.

Leveraging Natural Language Processing (NLP) for Trading Interfaces

NLP brings a human touch to trading apps. Chatbots and virtual assistants, driven by AI, engage users in conversations, answering queries, providing market insights, and assisting with trade execution. This conversational interface enhances user engagement and accessibility, making the trading experience more user-friendly.

Here are several features that a UX designer could design to implement NLP features in a trading application:

Natural Language Input Field

- Design an input field where users can type or speak their queries using natural language. This field should be prominently displayed and easily accessible to users.

Real-time Feedback

- Provide real-time feedback as users type or speak their queries. This could include auto-suggestions, text highlighting, or immediate recognition of spoken words to confirm that the application is accurately capturing the input.

Intent Recognition

- Design algorithms to accurately recognize the intent behind user queries. This involves analyzing the semantics of the input to understand what action the user wants to perform, such as checking stock prices, placing trades, or getting account information.

Contextual Understanding

- When interpreting queries, incorporate contextual understanding into the NLP algorithms to consider the user’s previous interactions, current market conditions, and other relevant factors. This ensures more accurate and personalized responses.

AI for Sentiment Analysis in Trading

Managing sentiment analysis in a trading application involves incorporating features and widgets that enable users to assess market sentiment and make informed trading decisions based on sentiment data.

Here are some standard features and widgets used for managing sentiment analysis in a trading application:

Sentiment Analysis Dashboard

A customizable dashboard that provides users with an overview of sentiment analysis data, including sentiment scores, sentiment trends, and sentiment indicators for various financial instruments.

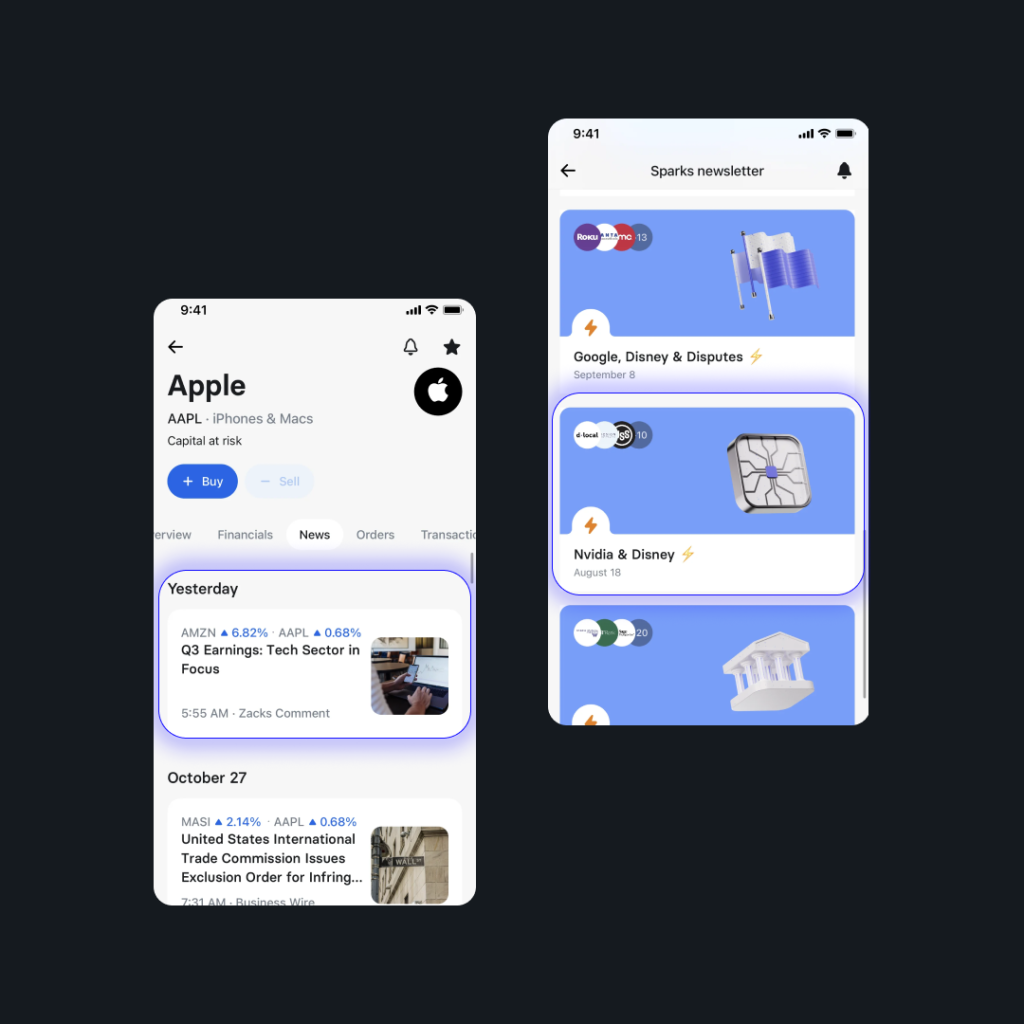

News Aggregator

A widget that aggregates news articles, social media posts, and other sources of information relevant to the financial markets. Users can filter and analyze sentiment data from these sources to gauge market sentiment.

Social Media Sentiment Tracker

A feature that tracks sentiment data from social media platforms such as Twitter, Facebook, and LinkedIn. Users can monitor sentiment trends, sentiment volume, and sentiment scores for specific financial assets or market sectors.

Sentiment Heatmap

A visual representation of sentiment data across different financial instruments or market sectors. The heatmap provides users with a quick overview of sentiment trends and helps identify potential trading opportunities or risks.

Sentiment Analysis Alerts

Widgets that notify users of significant changes in market sentiment, such as sudden shifts in sentiment scores or sentiment indicators reaching predefined thresholds. Users can receive real-time alerts to stay informed about sentiment changes affecting their trading decisions.

Sentiment Indicators

Visual indicators or widgets that display sentiment scores or sentiment trends for specific financial assets or market sectors. Users can analyze sentiment data alongside other technical or fundamental indicators to make well-informed trading decisions.

Historical Sentiment Analysis

Features that provide users with access to historical sentiment analysis data, allowing them to analyze sentiment trends over time and identify patterns or correlations with market movements.

Customizable Sentiment Filters

Tools that allow users to customize sentiment analysis filters based on specific criteria such as keywords, sentiment thresholds, or sentiment sources. Users can tailor sentiment analysis data to their trading preferences and strategies.

Sentiment Analysis Reports

Features that generate sentiment analysis reports summarizing sentiment trends, sentiment scores, and sentiment insights for specific financial assets or market sectors. Users can use these reports for in-depth analysis and decision-making.

Integration with Sentiment Analysis APIs

Integration with third-party sentiment analysis APIs or services that provide sentiment data and analytics. Users can access real-time sentiment data and leverage advanced sentiment analysis algorithms to enhance their trading strategies.

Behavior Analysis for Security

AI’s ability to analyze user behavior plays a crucial role in ensuring the security of trading platforms. By detecting anomalies and patterns indicative of fraudulent activities, AI helps protect user accounts and maintains the integrity of the trading ecosystem.

A UX designer who is leveraging AI tools for trading UX needs to focus on behavior analysis for security in a trading application. They can design several features to enhance security and user experience to bake in the best of AI tools for a seamless user experience. Here are some potential features and methods for implementing them:

Multi-factor Authentication (MFA)

Design a seamless MFA process that requires users to verify their identity using multiple factors such as passwords, biometrics (fingerprint, facial recognition), or one-time passcodes (OTPs). Implement intuitive user interfaces for MFA methods, ensuring ease of use without sacrificing security.

Activity Monitoring

Design a dashboard or activity log that provides users with real-time insights into their account activity, including login attempts, trades executed, and changes to account settings. Utilize visualizations such as graphs and charts to highlight unusual or suspicious activities that may indicate unauthorized access.

Alerts and Notifications

Design customizable alert systems that notify users of important account activities or security events, such as failed login attempts, large transactions, or changes to account settings. Allow users to configure their preferred communication channels for receiving alerts, such as email, SMS, or push notifications within the trading application.

Behavioral Biometrics

Integrate behavioral biometrics technologies that analyze user behavior patterns, such as typing speed, mouse movements, and touchscreen gestures, to continuously authenticate users during trading sessions. Design interfaces for collecting and analyzing behavioral biometric data in real-time, ensuring minimal disruption to the user’s trading experience while maintaining high levels of security.

Risk Assessment and Scoring

Design risk assessment AI tools for trading UX that evaluate user behavior and assign risk scores based on factors such as transaction history, trading patterns, and device usage. Present risk scores to users in a clear and understandable format, along with recommendations for mitigating identified risks, such as changing passwords or enabling additional security measures.

Training and Education

Design interactive tutorials or guides within the application to educate users about common security threats, such as phishing attacks or malware, and provide tips for securely navigating the trading platform. Implement gamification elements to make security training engaging and encourage users to adopt secure behaviors while using the application.

User Feedback and Reporting

Design feedback mechanisms that allow users to report suspicious activities or security concerns directly within the application. Implement processes for analyzing and responding to user-reported issues promptly, demonstrating a commitment to addressing security threats and maintaining user trust.

Closing Thoughts

Through the strategic application of predictive analytics, natural language processing, and sentiment analysis, we can cradt a trading experience that not only meets the demand for precision and speed but also resonates on a human level.

Our exploration of AI’s transformative power in trading UX design is just the tip of the iceberg. There is a whole world of innovation waiting to be unleashed as we continue to integrate these advanced technologies into our design practices. As the financial landscape evolves, so must our tools and techniques. To understand how AI can be part of your design process, speak to our expert designers at Studio iX.