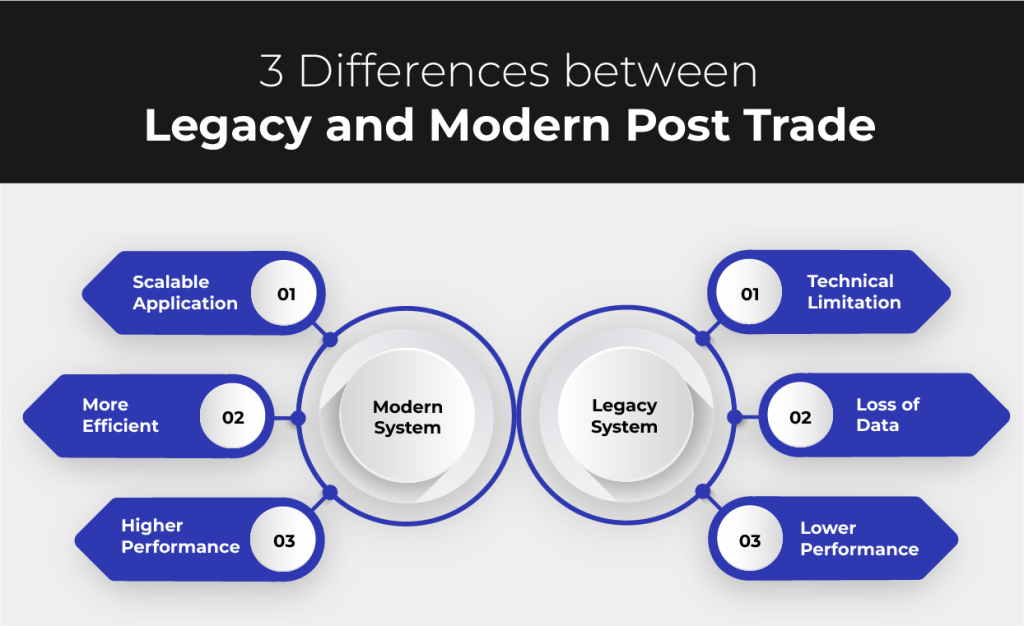

The distinction between legacy and modern post-trade services is more than just a matter of technology. It represents a fundamental shift in how financial institutions manage their risks and stay competitive in today’s markets. Let’s dive into three key differences that highlight the evolution of post-trade processing solutions.

Technology Infrastructure in Post-trade: From Rigidity to Agility

Legacy post-trade processing systems rely on older technology that is not flexible and is costly to maintain. These systems make it challenging to adapt to changing market conditions and regulatory requirements.

In contrast, modern post-trade processing solutions leverage the latest technologies, including cloud computing and distributed architectures. Cloud-based systems offer scalability and flexibility, allowing financial institutions to scale their operations seamlessly as their business grows. The more agile solutions enable quicker response to market demands, reducing the time and effort required to implement updates or changes in the post-trade workflow.

The shift from a rigid, legacy infrastructure to an adaptive foundation helps in staying competitive and resilient.

Data Management in Post-trade: From Disparate Silos To Unified Insights

Legacy systems often suffer from data silos, where information is scattered across different platforms and databases. This fragmented approach to data management not only hampers efficiency but also increases the likelihood of errors and inconsistencies. In the context of post-trade processing, where accurate and timely data like market data is paramount, these challenges become significant.

Modern post-trade processing systems prioritize unified data management. These systems integrate various sources into a centralized and cohesive platform. The APIs within the micro-service architecture are easy to connect. This approach facilitates real-time visibility into trade data, eliminates the risk of manual errors, and provides a holistic view of the entire post-trade process.

Modern systems incorporate advanced analytics and reporting tools. This enables financial institutions to extract valuable insights from their data. This shift from disparate silos to unified data management enhances operational efficiency and makes data-driven decision-making faster for better risk management and strategic planning.

Regulatory Compliance in Post-trade: From Reactive to Proactive

Financial institutions would retrofit their systems to meet new regulatory requirements, leading to delays, increased costs, and a constant struggle to keep up with platform changes.

Modern post-trade processing systems take a proactive approach to regulatory compliance. These are designed with a deep understanding of regulatory frameworks and can adapt swiftly to changes. Automated compliance checks and real-time monitoring features ensure that trades adhere to regulatory standards, minimizing the risk of non-compliance and associated penalties.

Modern systems often come equipped with built-in regulatory reporting capabilities, streamlining the process of generating and submitting required reports.

The transition from legacy to modern post-trade solutions represents more than just a technological upgrade. It signifies a shift in mindset, embracing agility, unified data management, and proactive regulatory compliance. As financial institutions navigate today’s markets, investing in modern post-trade processing solutions becomes a strategic choice for sustained success.

Wrapping Up

The evolution from legacy to modern post-trade processing systems is a long-term investment.

In persistent market volatility, evolving regulatory demands, and increasingly diverse digital assets, embracing modern technologies is essential.

However, the adoption of technology and back-office automation requires strategic technology partners such as Ionixx. These partners should possess the capability to facilitate extensive digital transformation endeavors aimed at optimizing post-trade settlements. We have assisted multiple broker-dealers in their journey towards digital transformation, ensuring efficiency and innovation. Contact us today.