A lot of investors buy stocks on margin, so they don’t have to spend their whole credit on it. However, there are still problems and risks that come with buying stocks on margin. Before buying any stocks or securities using the margin, investors need to carefully read the margin agreement that their broker gives them before buying stocks in a margin account.

Once an investor decides to buy stocks, they can either pay the full price all at once or borrow money from the investor’s brokerage firm. If an investor chooses to borrow money, an investor will open a margin account with the company. The company will give investors money based on the securities the investor bought. If the stocks in the investor account go down in value, the collateral for the investor loan will be worth less. The firm may do certain things, like giving investors a margin call or selling securities in an investor account, to keep the required amount of equity in the account. This whole process might be called “margin management” after the trade, which is what is detailedly discussed in this blog.

What Are Margin Accounts?

Every clearing broker-dealer may provide to customers of introducing broker-dealer is to permit them to maintain a margin account and purchase securities on credit. A margin account involves an extension of credit in connection with the purchase of a security. Margin is the amount that investors pay when an investor uses clearing broker-dealer credit to purchase a security.

At the time an investor opens a margin account, an investor must furnish their broker-dealer with all the information usually obtained for all other accounts needed to open an account and also sign the Customer Margin and Short Account Agreement, which includes a consent to loan securities form that enables clearing broker-dealer to pledge or lend securities carried for their account.

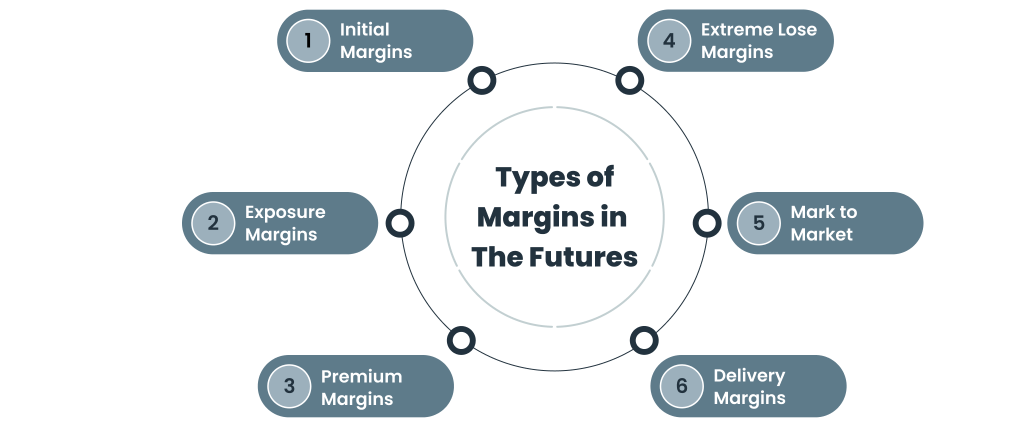

Margin requirements come in two forms. First, there is an initial margin requirement at the time of purchase; thereafter, there is a minimum margin equity that must be maintained in their account.

The minimum amount due for initial purchases is established by the Federal Reserve Board in accordance with the regulation. If the margin requirement is 50%, investors are only required to deposit half of the purchase amount due. The balance due on the purchase will be loaned to the investor by a Clearing broker-dealer.

Investors are required to pay interest on the debit balance as on any other loan. Not all securities are eligible for margin. Investors should confirm with their broker-dealer prior to any transaction that securities investors intend to purchase may be used as collateral for a margin loan.

In addition to the initial margin requirements of the Federal Reserve Board, the SEC requires a customer opening a margin account to have a minimum initial equity of $2,000 in such a margin account.

The SEC also sets minimum margin maintenance requirements. If the equity in their account falls below the minimum margin requirement due to a decline in the market value of the securities in their account, it will be necessary for the investor to deposit additional marginable securities or make a cash payment to increase their equity. For other types of securities, such as bonds, there may be a somewhat higher or lower maintenance requirement, depending on the security.

If their equity falls below broker-dealer maintenance requirements, the investor may receive a notice of a margin call requiring the investor to deposit additional cash or collateral. If an investor fails to meet a margin call, the clearing broker-dealer may liquidate securities positions in their account in order to satisfy the requirements of the call.

Interest Charges in Margin Accounts

The amount of interest the broker-dealer charges each year on the average net debt sum is set by them.

How Is Interest Calculated?

Interest on margin accounts is calculated by taking the daily average of the net debit amounts. The daily debit amounts are added up to get the monthly total. This total is then averaged to get the debit balance that is used to figure out interest. This amount is lessened by any credit sum in a cash account. Normally, interest is due on the 15th of every month and on December 31 of each year. To find the interest, multiply the average daily debit amount by the interest rate (1/360 of the annual rate) and the number of days in the interest period.

Debit balances in all the accounts of the investor will incur interest charges in accordance with the established custom, as disclosed in the Customer Information Brochure, pursuant to the provisions of Rule 10b016 of the Securities Exchange Act.

What Are The Risks Associated with Margin Maintenance?

Understanding the risks associated with margin management is crucial. These risks include

- The potential to lose more than the initial margin deposit in the account. If the value of margin-purchased securities declines, additional funds may be required to prevent the forced sale of these or other securities in the account.

- The firm has the authority to sell securities in the margin account if the equity falls below the legal maintenance margin requirements or the firm’s higher house requirements. Investors are solely responsible for any shortfall in the account after such a sale.

- Securities in the account can be sold by the firm without prior notification. While some investors may believe that a firm must contact them for a margin call to be valid, this is not the case. Although most firms attempt to notify clients of margin calls, they are not obliged to do so. Even if a firm contacts a customer and sets a specific date for meeting a margin call, the firm can take immediate action to protect its financial interests, including selling securities without prior notice.

- Investors have no authority to select which security in their margin account will be liquidated to meet a margin call, as the firm has the discretion to choose the security to sell in order to safeguard their interests.

- If the firm decides to increase its house maintenance margin requirement, it can take effect immediately without any requirement to provide advance written notice, potentially resulting in a maintenance margin call.

- There is no entitlement to a time extension on a margin call, and investors do not have a claim to such an extension.

- The I.R.S. considers dividend payments on loaned securities positions as an alternative payment, subject to regular income taxation, rather than a qualified dividend.

- Regulatory restrictions may limit investors’ ability to vote on securities that have been lent or pledged to others, potentially resulting in a discrepancy between the voting rights indicated in proxy materials and the actual shares in investor accounts or even a complete lack of proxy materials.

How Automation Impacts Margin Management in Digital Brokerage?

Automation should be mandated in every firm irrespective of their scales. This will eliminate the need to engage in low-value tasks such as manually sending margin calls. The presence of manual tasks can significantly amplify operational risks.

However, the focus on improved automation should not be restricted to the margin call process alone. Rather, it should encompass the entire collateral lifecycle, ranging from data capture to dispute resolution and settlement processes. By doing so, businesses can experience heightened growth potential, enhanced scalability, reduced costs, and enable smooth, straight-through processing.

Especially in an environment characterized by rising interest rates, firms seeking to leverage bond collateral for cost reduction should consider the automation of all associated tasks, including asset optimization, pricing, and substitution.

Adopting cutting-edge margin technology allows companies to achieve automation and follow best practices in processing. Companies relying on outdated systems, whether internally developed or vendor-provided solutions, should evaluate their requirements.

Cloud-based solutions offer broker firms access to updated features, effectively eliminating the need for upgrades and infrastructure hosting expenses. Moreover, many of these solutions provide ready connectivity to industry utilities and counterparties, including Acadia electronic messaging, triResolve portfolio reconciliation, and SWIFT settlement.

How Does Ionixx Help with Margin Management?

In conclusion, margin management in securities offers opportunities for leveraging investments but comes with its share of risks and responsibilities. Investors should be well-informed about these risks and diligently manage their margin accounts. Ionixx provides brokerage technology automation solutions to streamline margin calls, ensuring seamless and efficient post-trade workflows. By leveraging intelligent algorithms and secure API systems, broker-dealers can reduce operational risks and optimize their clients’ margin trading activities. Get in touch with our post-trade settlement solutions team.