Until now, much of the T+1 settlement discussion has been surrounding the impact on post-trade settlement efficiency and its benefits for retail investors and market participants. However, the move will also impact other aspects of the trade operations, requiring a coordinated effort to implement several legal, regulatory, technological, and infrastructural changes in the capital markets. At the top of the list are corporate actions, which will be put to the test in the T+1 settlement cycle due to their intricate and manually-intensive processes.

What are corporate actions, and how are they managed today?

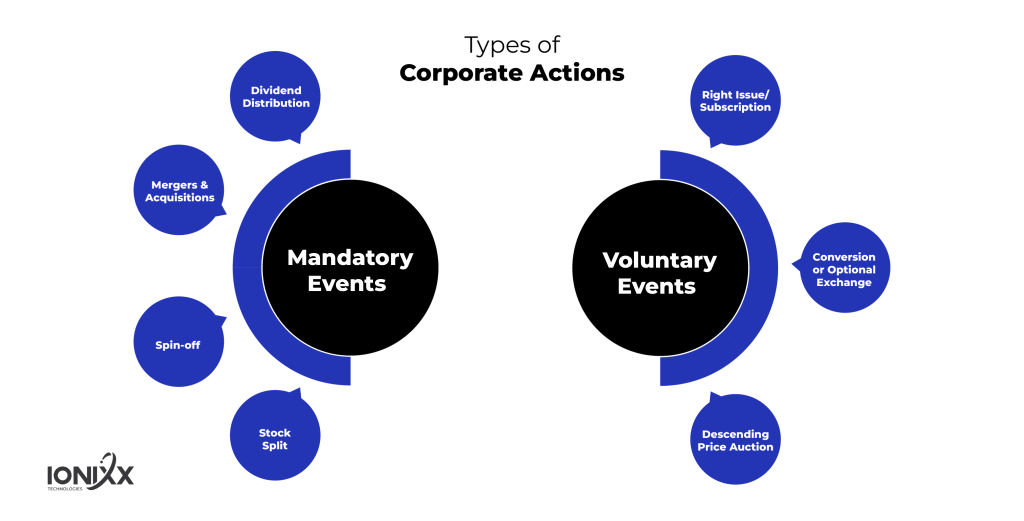

A corporate action is an event initiated by a publicly traded company incorporated by a group of stakeholders who share ownership rights in it. So, any initiatives or actions these corporate companies take impact their stakeholders and share prices. These corporate actions can be either voluntary when investors choose to participate or mandatory when participation is obligatory. While some corporate actions have a negligible effect on stock prices, the other major ones can also impact a company’s financial health, F&O contracts, and settlements.

Corporate actions like dividends have an event date on which the event was announced, a date of the record, and an ex-date. In the current settlement cycle, the ex-date is generally set as the settlement period minus one from the record date, as buying the stock from the ex-dividend date onwards will not entitle the investors to the applicable dividend. Similarly, voluntary events like subscriptions have a guaranteed delivery feature, which allows trade, reconciliation, and delivery of the position on expiration since settlement occurs on T+2.

How T+1 settlement impacts corporate actions

Moving to the T+1 settlement cycle will significantly impact the settlement of corporate actions, such as distributions, tender offers, exchange offers, and rights subscriptions. T+2 gives firms time to reconcile trade files, submit instructions to DTC, and ultimately send liabilities to counterparties. Many firms utilize a potential liability to lock in confirmation of the obligation 24 hours before this deadline. In T+1, these potential liabilities and all of this reconciliation will have to occur on the trade date, which could be challenging, especially on systems that utilize a batch process.

Moving to a T+1 settlement cycle will require firms and counterparties to make changes to their corporate action processing schedules. For example, Continuous Net Settlement (CNS) won’t accept additional trades for any security undergoing a voluntary event with settlement on Cover/Protect Expiration Date. There’ll be one less day to balance CNS transactions, so participants must identify their CNS Positions and input their protect instructions in CNR on the input date before 10:45 p.m.

For the same-day settlement of trades received on the Cover/Protect Expiration Date, NSCC will create trade-for-trade balance orders. So, participants can use the real-time summary and balance order messaging to quickly identify counterparties, allowing for the prompt transfer of liabilities between parties on the Cover/Protect Expiration Date. Since the cover/protection period will increase by one day, corporate actions teams must upgrade their middle and back-office systems and adjust their standard operating procedures.

What are the pain points in corporate action processing

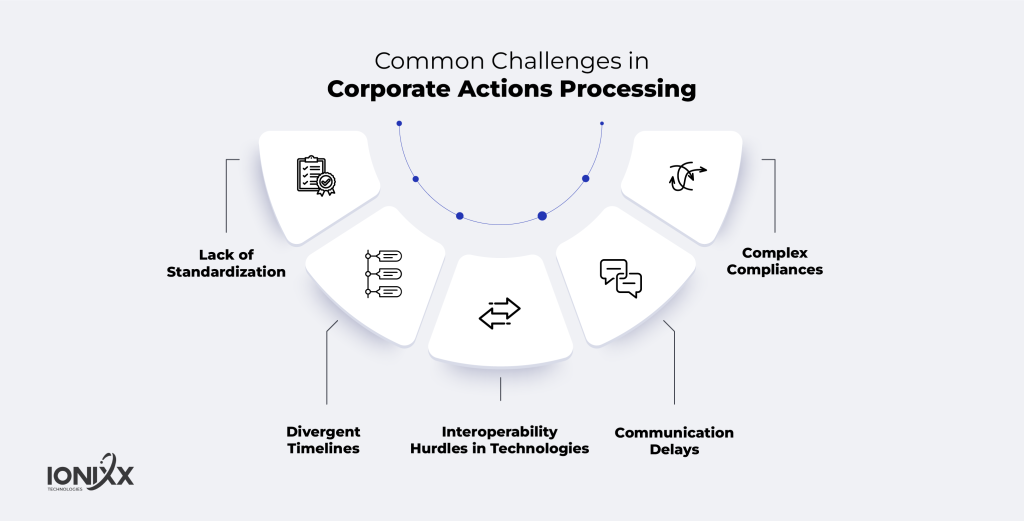

Once the T+1 regime comes into play, any corporate actions affecting instrument static data and trade matching must be processed within 24 hours of trade execution to avoid failed settlements. Firms dependent on custodian data and manual spreadsheets will likely find T+1 compliance extremely challenging. They won’t be able to handle complex events and provide real-time visibility into middle and back-office operations, leading to increased errors, missed elections, administrative burdens, and costs.

- Compressed timeframes: Since there’ll be one less day, trades posted or booked on the trade date will be settled the following day, compressing highly intricate schedules into a significantly shorter time frame. It’ll require firms and their counterparties to consider the necessary adjustments on a system level and operationally in how they conduct their business. They need to take a comprehensive approach to processing corporate events, perform trade reconciliation to determine the liabilities, and then tie in the client instructions to DTCC, all in a timely manner.

- Industry Collaboration: Systematic communication between the investment manager, custodian, and broker can ensure real-time collaboration and the elimination of manual intervention. By automating the announcements, instructions, and allocation, firms can ensure consistency across the corporate action event lifecycle. It’ll also standardize event dates and different instructions for the same event, which will play a critical role in the move to the T+1 settlement cycle.

Conclusion: The way forward

The goal of T+1 is to increase the efficiency and integrity of the capital markets, which requires a thorough contemplation of corporate action processing. It’ll ensure efficient communication and collaboration between custodians, clearing houses, and broker-dealers to resolve discrepancies effectively and reconcile trades promptly for seamless settlement.

Firms should plan early and look across systems and business processes that could be impacted by the move to T+1. They should start identifying workflows that currently require manual intervention and upgrading their core operations to meet new deadlines and cascaded impacts in a planned manner across the trade life cycle. By leveraging straight-through claim processing, transparency, and automation, they can navigate these changes in an efficient and cost-effective manner.

Get in touch with us for effective corporate action automation supported by a robust post-trade settlement infrastructure in the wake of T+1.