Distributed ledger technology (DLT) has slowly made space for itself in the digital brokerage industry. Renowned for its role in cryptocurrency trading, particularly with Bitcoin, DLT stands out for its decentralized validation by users rather than a central authority.

Beyond virtual currencies, the financial sector is exploring DLT’s potential applications in securities markets to streamline processes. Yet, the extent of DLT’s impact on the actual trading of securities, clearing, and settlement remains uncertain based on existing technology and observed proof of concepts.

Trading, Clearing, and Settlement Process with DLT

The focus remains on addressing inefficiencies in the post-trading segment before potentially merging various aspects of the trade life cycle into a unified DLT solution.

Upon integration of DLT into the post-trade framework, when two clients initiate a trade during the trading phase, they authenticate the transaction by applying their private keys to unlock securities. Subsequently, ownership is transferred through their public keys, seamlessly executing the transaction on the decentralized ledger.

This signed transaction is then broadcast to the entire system for validation. The validation process involves other clients akin to miners in a Bitcoin system.

Focusing on the crucial validation step before updating the ledger, a consensus-based verification process is employed. This implies that several participants in the system must agree on the validity of the underlying database, the same as the blockchain transaction.

We consider various consensus techniques, including providing the hash value of the latest ledger version. Validators would then verify whether the correct hash function was provided in this process.

The settlement process could occur simultaneously with the validation process, reflecting new asset ownership in the system. Fewer intermediaries could eliminate many repetitive business processes, resolving issues associated with long custodian chains for exchange-traded and OTC securities. DLT would enhance owner transparency, allowing investors direct access to holdings, and issuers could more easily identify ultimate shareholders. The trade life cycle could be simplified, reducing costs associated with manually reconciling conflicting trade data stored in duplicated ledgers.

The Future Role of CCPs And CSDs While Integrating DLT in Digital Brokerage

As market participants explore DLT’s application in the trading, clearing, and settlement phase of digital brokerage, the roles of CCPs (Central Counterparty Clearing) and CSDs (Central Securities Depository) become uncertain. The direct trading between issuers and investors via a shared ledger could make CSDs unnecessary. Integrating trading and clearing phases may reduce the need for CCPs and CSDs, potentially minimizing counterparty risk with DLT’s instantaneous settlement capability.

While traditional CCP roles may diminish, new services are emerging, including coordinating DLT protocol evolution, managing private keys for network security, and overseeing token introduction or cancellation on ledgers. This evolution may redefine the importance of CCPs and CSDs.

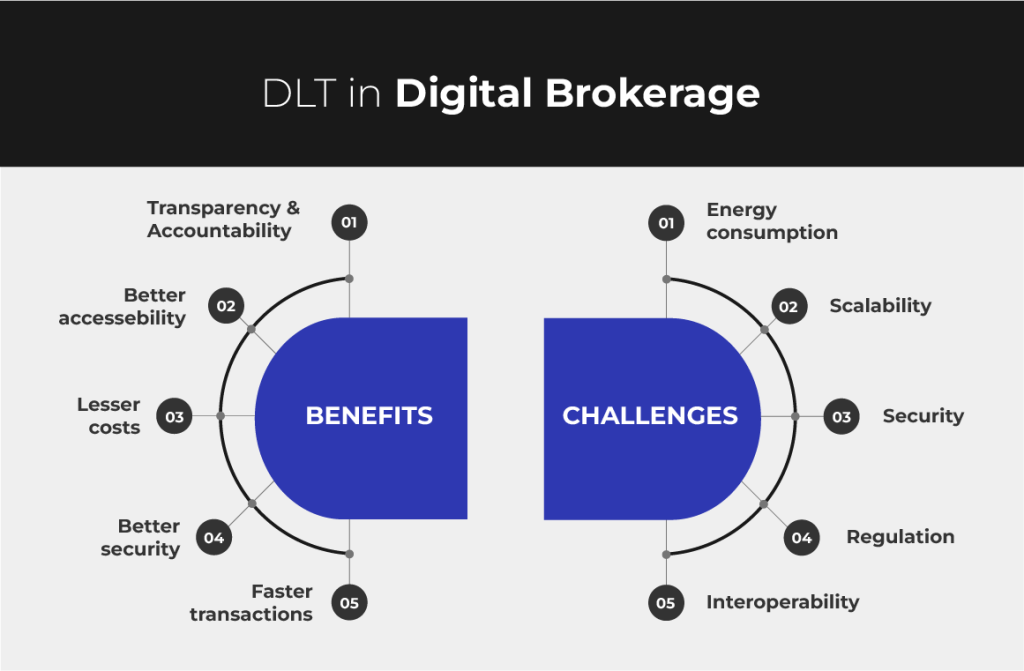

Challenges of DLT Application in Digital Brokerage

DLT systems present notable advantages in digital brokerage. However, challenges persist. To enhance transparency, information on ledger transactions is typically visible to all participants, potentially raising privacy and competition concerns.

Another challenge arises from the potential incompatibility between niche DLT systems developed by different market participants, leading to fragmentation and operational risks. Many financial institutions and digital brokerage industries aim to establish common DLT protocols and standards, mitigating compatibility concerns. Despite ongoing technological advancements, legal challenges, particularly in addressing regulatory issues, could pose hurdles to the widespread implementation of DLT in digital brokerage.

Regulatory Challenges

DLT systems operate on fundamentally different principles than legacy systems, necessitating a distinct regulatory approach. If existing clearing and settlement providers in the digital brokerage industry adopt DLT as a mere technological upgrade, this will anticipate some regulatory challenges. The SEC regulatory framework, considered ‘technology neutral,’ does not mandate specific technologies for market infrastructures.

However, if DLT replaces current market setups and infrastructures, especially in permissioned DLT systems, it could encounter legal challenges. Existing post-trade regulations may hinder DLT’s introduction, and if implemented, the technology might bring about prudential and conduct risks insufficiently addressed by current regulations.

The discussed regulatory barriers highlight that existing legislation, including SFD, EMIR, and CSDR, did not anticipate DLT. Legislators were unaware of this technology and its potential significance in financial markets. Even after resolving regulatory barriers and operationalizing DLT systems, managing prudential and/or conduct risks introduced by the technology may necessitate additional requirements. The DLT systems may be technologically secure, but they could distribute legal risks differently among participants compared to the concentrated risks with a limited number of central institutions.

Conclusion

In conclusion, integrating DLT into the digital brokerage industry offers promises and challenges. At the same time, DLT systems present opportunities for enhanced transparency, reduced counterparty risk, and streamlined processes; regulatory and legal hurdles pose significant challenges. Despite the complexities, the potential benefits of DLT in reshaping the trading, clearing, and settlement processes underscore the industry’s evolving landscape, with ongoing efforts required to navigate regulatory frameworks and ensure secure, efficient, and compliant digital brokerage practices.

Leveraging Distributed Ledger Technology (DLT) in the post-trade process is a game-changer, significantly reducing risks, mitigating fraud, and eliminating errors. Our cutting-edge, fully automated post-trade solution is designed to revolutionize trade automation across various asset classes, including equities, options, fixed income, mutual funds, and digital/crypto assets. Contact us today.