Collateral management involves the exchange of assets between two parties to mitigate credit risk in unsecured financial transactions. These parties can include banks, broker-dealers, insurance companies, hedge funds, pension funds, asset managers, and large corporations. The core concept is straightforward: cash, securities, or other instruments like bonds and equities are transferred from one counterparty to another as security for credit exposure.

The shift from a T+2 to a T+1 settlement cycle has several significant effects on collateral management. It can decrease the overall collateral requirements for prime brokers and clients, leading to reduced margin costs for market participants. This change also enables quicker access to cash from settled trades and reduces the potential for default or settlement failures, thereby enhancing risk management within collateral management processes. Additionally, it improves efficiency in clearing and settlement procedures.

In short, the transition to a T+1 settlement cycle promotes more efficient collateral management practices, decreases risks, and lowers costs for market participants.

What Are The Benefits Obtained In Collateral Management Processes During The T+2 to T+1 Settlement?

Collateral Availability: Faster settlement cycles demand readily available collateral for timely margin and settlement requirements. Firms should ensure collateral availability to meet the margin and settlement requirements.

Collateral Reallocation: Collateral management systems will adapt to more frequent reallocations as settlements occur faster. This benefits the market participants as they receive their collateral sooner than in the T+2 settlement.

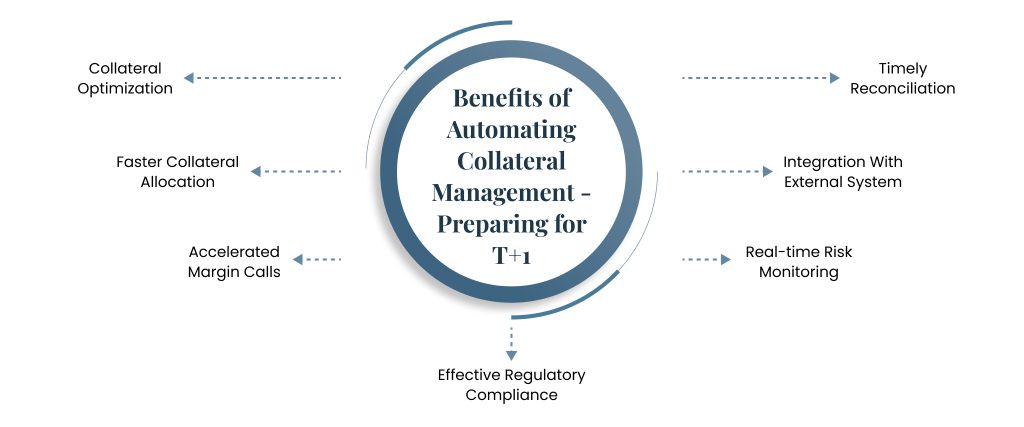

Real-Time Risk Monitoring: Enhanced risk monitoring, including margin utilization, counterparty risk, and collateral sufficiency, is essential in the shorter settlement cycle.

Margin Efficiency: T+1 settlement may reduce margin requirements, enabling better capital optimization through margin model adjustments.

Regulatory Compliance: Firms must ensure their collateral practices meet T+1 settlement regulatory requirements, potentially requiring adjustments to reporting and documentation.

Timely Reconciliation: Reconciliation processes should swiftly identify and resolve discrepancies in the faster settlement cycle, necessitating robust tracking tools.

Accelerated Margin Calls: Efficient mechanisms are crucial for issuing and receiving margin calls promptly to meet the shorter settlement timeline.

Risk Mitigation Evaluation: Firms should assess risk mitigation strategies, including credit, liquidity, and operational risk, within the context of T+1 settlement, potentially involving active monitoring and hedging.

The Role of Automation

Automation plays a pivotal role in collateral management by boosting efficiency, minimizing operational risks, optimizing collateral utilization, and ensuring adherence to regulatory mandates. It stands as a fundamental element in collateral management practices, allowing financial institutions to navigate the ever-changing and high-speed landscape of financial markets while efficiently overseeing collateral assets and liabilities.

Eliminating Manual Work: Automation reduces the need for manual tasks, streamlining the collateral management workflow. This means less time spent on data entry and more time for strategic decision-making.

Data Integration: Automated systems can seamlessly integrate data from various sources, ensuring consistency and accuracy. This is vital for managing collateral effectively.

Real-Time Monitoring: Automated systems offer real-time monitoring of collateral positions, exposures, and margin requirements, enhancing risk management and responsiveness.

Streamlined Workflows: Automation fosters smooth communication among stakeholders, like clients, clearinghouses, and custodians, leading to increased overall efficiency.

Integration with External Systems: Automation enables seamless integration with external systems, such as market data feeds, risk management platforms, and trading systems, aligning collateral management with trading and risk strategies.

How Can Broker Firms And Banks Prepare for Collateral Management Changes During T+1 Settlement?

Assessing Operational Efficiency

It is important for the broker-dealers to keep their back office ready for the settlement change. Improving the efficiency, accuracy, and timeliness of collateral management processes is essential while the market moves to T+1 settlement. It is crucial for the firms to have a fully automated and streamlined collateral management system.

Ensuring Overall Automation

When shortening settlement cycles, the firms should work on a critical strategy that involves reducing manual tasks and the time required for data handling. Automation should become pivotal, ensuring seamless, straight-through processing (STP) across all workflow steps.

The Bottom Line

As the financial industry moves towards T+1 settlement, effective collateral management processes become paramount for the firms. Shortening the settlement cycle brings numerous benefits, including reduced credit, market, and liquidity risk, as well as more streamlined operations. However, firms should be ready to accept the transition and keep their back-office readily optimized. At Ionixx, we help your firm leverage appropriate technology frameworks to support the automation of your collateral management processes, thus optimizing complex manual workflows and enabling seamless data interactivity and process integration. To speak to our expert post-trade solutions team, schedule a meeting.