With the SEC set to implement the T+1 rule change from May 2024, financial firms in the capital markets are looking at accelerated settlement cycles as both an opportunity and a challenge. From investors (retail and institutional) and broker-dealers to clearing houses and regulators, the impact of a shorter settlement cycle ripples through the entire ecosystem, reshaping the way securities are executed, cleared, and settled.

In this blog, we analyze what underpins the regulatory decision for a faster settlement cycle, how the decision is seen as an interim step to the possibility of real-time or T+0 settlement, and how the decision has important implications for market participants, particularly broker-dealers and retail investors.

Tracing The Reasons for The T+1 Mandate

The pandemic and growing trade volumes – an accelerated need for automation of back-office functions: With Covid-19’s lockdowns and social distancing measures, many brokerage firms had to quickly transition to remote work setups. This posed challenges in terms of maintaining operational efficiency, data security, and communication with clients. While most firms pivoted to fully remote working, not all could, as they required physical manpower on-premise, to enable business continuity processes, e.g., faxes, to be sent. An April 2021 DTCC whitepaper reveals how sudden spikes in trade volumes and a burning need to shift to a remote model impacted broker-dealers severely as they needed to reach out to and coordinate with hundreds of counterparties to reconcile breaks and settle trades. Increased trading with meme stocks such as Gamestop & AMC in the past two years has raised margin fees significantly, pushing DTCC to suspend trading in these volatile stocks. T+1 could be the trigger that would push firms to rethink their back-office processes to ensure that systems are automated, robust, and ready to cope with scalability and unexpected volumes.

Highly volatile markets and increasing margin fees: Accelerating settlement to T+1 would lower the capital requirements for broker firms, even though increasing volumes are still a growing challenge.

Rise of newer digital asset classes: A BNY Mellon press release from Feb 2021 announcing its foray into the development of digital custody and administration platform for digital assets is a pivotal point for the capital markets landscape. Even as Digital Ledger Technology (DLT) & digital assets are increasingly seeing mainstream acceptance, it is interesting to note central banks working their way to implement Central Bank Digital Currencies (CBDCs). Such newer asset classes create the need for faster settlement times and push for real-time or T+0 as the optimal goal.

Is T+1 A Precursor to T+0?

In reality, T+0 might still be a few years away. However, moving to T+1 is one of the foundational steps that firms could take already today to lay the basis for real-time settlement in the foreseeable future. Having said that, real-time settlement can sound like a simple technical solution but necessitates several changes across the market structure and needs careful planning.

Working closely with data and leveraging robust data management systems is one of the keys to transitioning from T+2 to a successful T+1 and subsequent real-time settlements.

Impact on Market Players in The Trading Ecosystem

Let’s explore how an accelerated settlement system would impact key marketing players across the securities trading ecosystem.

Retail Investors – Impact, Benefits, And Considerations

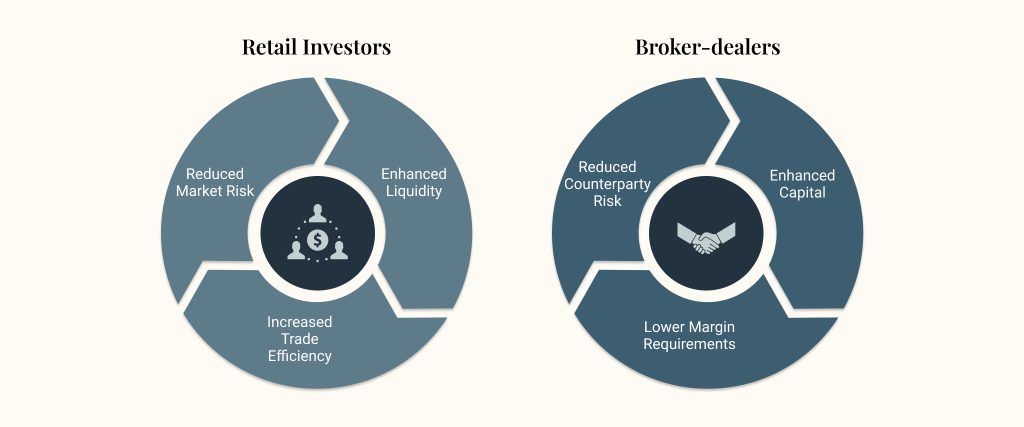

Faster Access to Funds and Enhanced Liquidity: A T+1 settlement would mean that retail investors would have quicker access to their money, as the proceeds from their sold securities would be processed one business day earlier. This opens up the scope for quicker reinvestment or withdrawal opportunities empowering more active market participation.

Reduced Market Risk: Shortening the settlement cycle to T+1 would reduce the time investors are exposed to market risk. With trades settling faster, investors would have less exposure to price fluctuations, which could be particularly beneficial during periods of market volatility.

Increased Trade Efficiency: Retail investors could experience a more efficient trading process overall. Faster settlements would lead to quicker trade confirmation and reduced time for funds to be available for further investment.

Margin Requirements: Retail investors who trade on margin would need to be aware of the shorter settlement cycle, as it could impact margin requirements and the timing of funding their margin accounts to meet regulatory requirements.

Considerations and Challenges for Retail Investors

A Need to Rethink Trading Strategies: Retail investors may need to adjust their trading strategies to accommodate the shorter settlement cycle. For example, day traders may need to be more cautious about trades executed near the end of the trading day, as the settlement of these trades would occur faster.

Enhanced Awareness: With the introduction of a new settlement cycle, retail investors may need to be educated and made aware of the changes in trading and settlement procedures. Broker-dealers and financial institutions have a role to play in how they communicate with their clients and provide clarity by empowering them with relevant educational materials.

Potential for Increased Costs: Although not directly, retail investors could face challenges related to higher transaction fees and other costs given how T+1 settlement thrusts increased operational costs for broker-dealers and other market participants.

Challenges and Considerations for Institutional Investors

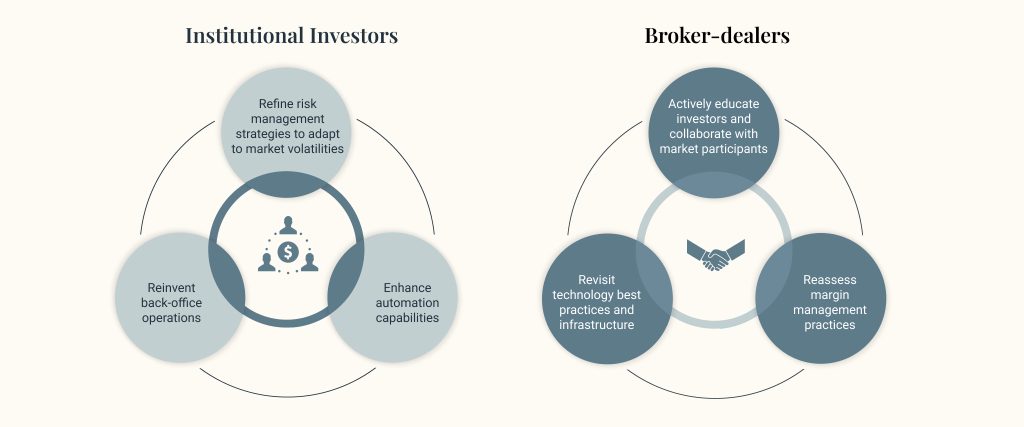

Operational Adaptation: Institutional investors need to adjust their back-office operations, trading systems, and technologies to accommodate the faster settlement timeline.

Increased Trading Frequency and Costs: The transition may lead to higher trading frequency, translating to potential increased costs and a necessity to balance this against the benefits.

Increased Automation and Compliance Readiness: Institutions must enhance automation capabilities to cope with the accelerated settlement cycle while maintaining compliance with regulatory standards.

Market Volatility Implications: Quicker settlements may intensify market volatility as investors react more promptly to price changes, requiring institutions to refine their risk management strategies.

Broker-Dealers – Impact, Benefits, And Considerations

Reduced Counterparty Risk: As for introducing brokers, the T+1 settlement cycle could reduce risk exposure to a certain degree given that client trades would settle more swiftly, aligning with the brokers’ promise of reliable and diligent client service.

A retail-focused introducing broker like Robinhood is impacted by T+1 as it needs to ensure its user-friendly app confirms trades promptly and communicates the accelerated settlement timeline to its user base. It will need to invest in automation especially within back-office and post-trade contexts in order to drive efficiency from the bottom.

Enhanced Capital and Lower Margin Requirements: Broker-dealers benefit from improved capital efficiency as they can use funds and securities more promptly for further investments, leading to potential revenue growth. With faster settlements, broker-dealers experience lower margin requirements due to reduced risk exposure. This optimizes the utilization of available capital. As opposed to introducing brokers, execution brokers are typically impacted in areas such as operational efficiency and risk management.

Considerations and Challenges for Broker-dealers Moving to T+1

Technology Rehauls: Shortening the settlement cycle to T+1 would require broker-dealers to streamline and enhance their operational processes to accommodate the faster settlement timeframe. This might involve upgrading settlement systems, increasing automation, using API integrations, and improving communication and coordination with counterparties.

Margin Management: Broker-dealers that offer margin trading accounts to clients would need to reassess their margin management practices. The shorter settlement cycle could lead to more frequent margin calls and funding requirements for clients engaging in margin trading.

Collateral and Financing: Broker-dealers may need to adjust their collateral management and financing arrangements to ensure sufficient liquidity for settlement obligations in a T+1 environment. T+1 settlement pushes execution brokers to ensure written communication policies that can promptly communicate trade details to clearing brokers to ensure timely clearing and settlement. Clearing brokers will need to invest in technology upgrades for advanced systems to validate and process trades quickly, reducing exposure to market fluctuations and potential errors.

Client Education: Broker-dealers would need to educate their clients, particularly retail investors, about the changes in settlement procedures and the potential impact on funding and trading practices.

Industry Coordination: The transition to T+1 settlement would require close collaboration among market participants, including broker-dealers, exchanges, clearinghouses, and custodians, to ensure a smooth and coordinated implementation.

Compliance and Regulatory Reporting: Broker-dealers would need to adjust their compliance procedures and regulatory reporting systems to comply with the new settlement timeframe mandated by the SEC.

Three Key Benefits of Transitioning to T+1

Shortening the settlement cycle aims to create more efficient markets that serve investors better. The prospective benefits are substantial.

Counterparty Risk Reduction And Market Exposure

Since margin requirements and collateral requirements for broker-dealers will be reduced, a T+1 cycle will reduce counterparty risk by reducing exposure between the counterparties to a trade, between the counterparties to the clearinghouse, and for the clearinghouse itself.

According to DTCC’s estimates, removing one day’s exposure to risk could translate into a 41% reduction in the volatility component of CCP margin requirements.

DTCC

An accelerated settlement cycle should also allow investors quicker access to their funds following trade execution and settlement. This could prove particularly beneficial in instances when markets behave erratically, as underscored by market volatility in March 2020 and January 2021, and its resultant impact of variation margin in cleared trades.

Increased Liquidity for Investors

Operational efficiencies in the capital markets landscape: In an increasingly real-time world, T+1 settlement will also help keep traditional financial markets relevant and attractive to investors. The execution through settlement phases will need to be automated and modernized to enhance straight-through processing and minimize exceptions. While that will take investment, it will strip out manual workflows and bring operating efficiencies and substantial, cost savings.

Market Stability

The T+1 settlement cycle contributes to market stability by reducing the time gap between trade execution and settlement. This minimizes the chance of operational disruptions affecting market participants.

Industry Readiness – How Can Brokerage Firms Prepare for T+1?

In an April 2023 interview, David Kirby, DTCC Executive Director, Americas Relationship Management & Global Account Management insists on pushing the urgency button as a pin-up message for firms in the capital markets.

For buy-side firms, start on your T+1 impact assessments now if you have not done so already. If you have not completed your impact assessment by now, you are already late. Get started today.

David Kirby, DTCC Executive Director, Americas Relationship Management & Global Account Management

For brokers and custodians: start to evaluate how counterparty behavior is impacting processes and investigate areas of inefficiencies.

That said, accelerating settlement requires careful consideration, industry coordination, and a balanced approach so settlement can be achieved as close to the trade as possible, without creating capital inefficiencies and introducing new, unintended market risks, such as eliminating the enormous benefits and cost savings of multilateral netting. Firms should view the transition to T+1 as an opportunity to enhance their existing technology and automation capabilities.

AI for post-trade

Of particular interest in the age of generative AI is how AI can play a role in optimizing manual workflows that are typical of post-trade settlements. This will translate into reduced manual support across the trade lifecycle and maximize operational efficiency.

Significant change and program management efforts

The bottomline remains that as firms continue to progress through their T+1 transition, we believe they should prioritize enhancing existing technology solutions to further increase straight-through processing rates and maximize efficiency. By prioritizing straight-through-processing (STP) solutions, firms can focus on correcting legacy systems’ shortcomings and reinventing archaic processes.

How Ionixx Can Help

From a technology standpoint, automation can be a key driver in achieving T+1. It is critical for firms to get a clear understanding of what tasks key stakeholders are performing during the current T+2 processes and to enable them to share information digitally in real time.

Here’s a set of next steps we have put together for market participants to prepare for T+1 under the proposed timeline:

- Conduct an impact assessment: Review the current operating model to pinpoint specific parts of the technology infrastructure and operational processes that will be impacted by moving to T+1.

- Mobilize a T+1 program and establish governance: Identify accountabilities among key stakeholders to drive progress and decision-making.

- Develop the strategy and roadmap: Define key objectives and deliverables around accelerated settlement and assign target dates.

If you are looking to optimize your entire trade lifecycle with trading and post-trade solutions that deliver efficiency and competitive advantage, get in touch. We will help you automate your trade lifecycle clearing and settlement systems to support T+1, without significantly affecting your business process continuity.