Fully paid securities lending is a common lending practice where institutional/retail investors can generate passive income by lending out stocks they have fully bought and paid for. In recent years, it has become a valuable strategy for firms to extract as much value as possible from their portfolios and improve the operational bottom line by enticing clients to earn extra income and remain loyal. While the concept will be new to a few, the business model behind traditional securities lending practices is relatively simple.

An overview of fully paid securities lending program

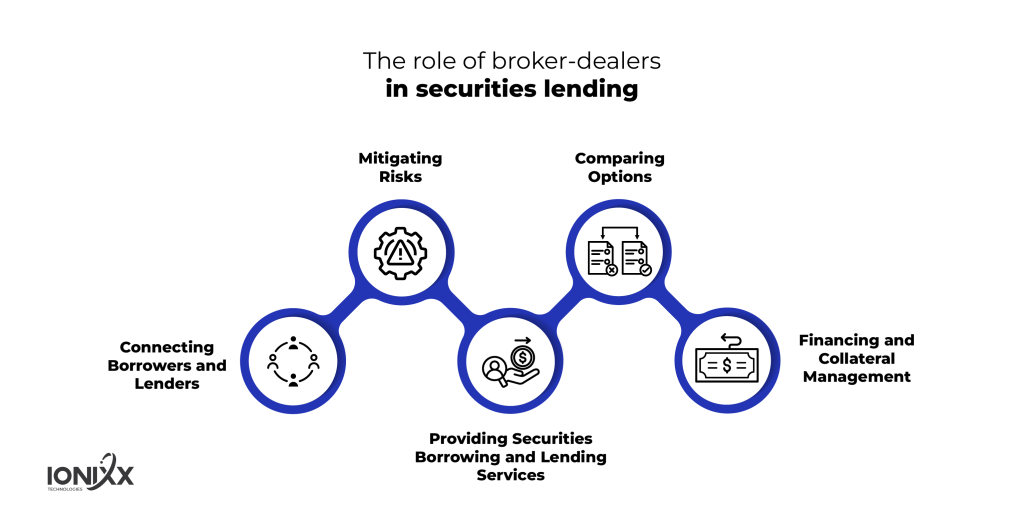

The clearing firm lends a customer’s fully paid or excess margin securities to a third party in exchange for a daily borrowing fee or interest on the cash collateral. The income generated is then shared among the clearing firm, the lender, and the introducing broker-dealer. They manage the loan agreement, secure collateral, monitor the market to mitigate counterparty risk and ensure compliance with regulatory requirements. However, It’s a manually intensive process built on a rigid and less sustainable infrastructure, which leads to delays, inefficiencies, inflated costs, and higher risk.

A report from one of the market regulators has warned that the securities lending market is becoming more complex and heavily regulated. Therefore, processes and systems that have worked until now are proving increasingly cost- and time-intensive. It’s time for market participants, especially broker-dealers, to consider how post-trade processes can be automated, streamlined, and interconnected – in a scalable and future-proof manner.

How can technology help broker-dealers drive business?

The operational challenges of securities lending programs require broker-dealers to upgrade or overhaul their existing processes. They need an adaptable, cost-effective solution that consolidates disparate systems to minimize manual interventions, optimize processes, and manage risks effectively. We utilize our deep market knowledge to provide broker-dealers with an end-to-end solution that automates their middle and back-office operations to navigate the complexities of the market with precision.

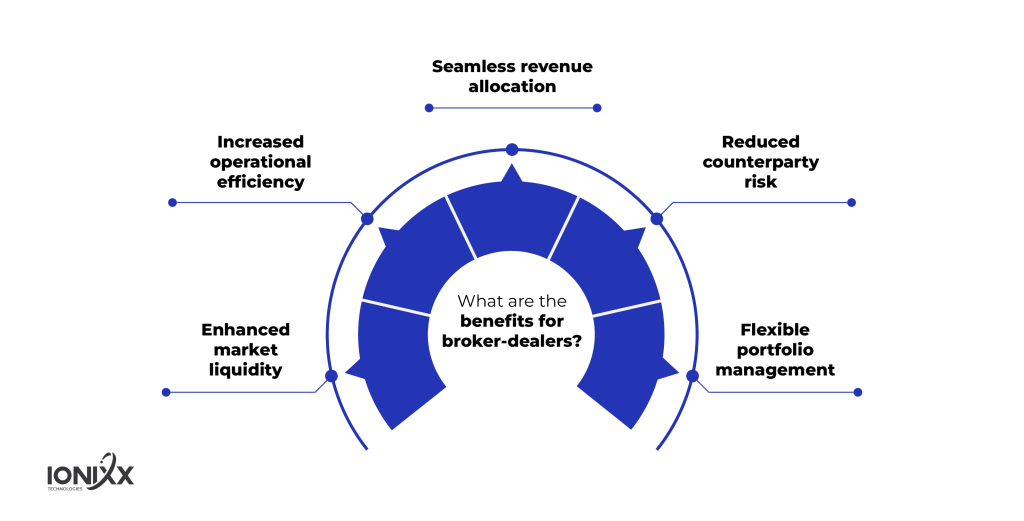

We empower broker-dealers to seamlessly support and execute low-touch workflows, automate key processes, and integrate data from multiple sources. So, they get a bird’s-eye view of their market position and lending activities to prevent administrative errors, minimize counterparty risk, and ensure:

- A transparent and efficient mechanism for tracking lent securities.

- Real-time calculation and reconciliation of accrued interest.

- Seamless revenue allocation among all parties involved.

So, all counterparties — borrowers, lenders, advisors, and broker-dealers — can easily collaborate throughout the life of the loan, from origination and servicing to risk monitoring and repayment.

By utilizing our expertise in securities lending, broker-dealers can upgrade their lending systems with latest technologies regularly enhanced to support seamless integration and customization. An institutional capital brokerage firm was able to automate many of its lending operations, including collateral management, trade matching, revenue allocation, and audit trail reports. With real-time data analytics and reconciliation, they were able to make more informed lending decisions and identify new opportunities for value creation.

Manage securities lending program with confidence

An interconnected back-office solution ensures efficient monitoring and management of all lending activities. It provides a comprehensive overview of key metrics and performance indicators, including current lending positions, outstanding loans, and interests, to mitigate discrepancies and maintain a transparent audit trail to reconcile positions and transactions easily. So, broker-dealers can stay ahead of the curve by viewing real-time market conditions, collateral levels, and counterparty exposures, contributing to developing robust and effective risk management strategies.

- Analyze trends and identify opportunities and revenue for each party to enhance transparency and coordination.

- Real-time insights into lending performance, revenue generation, market conditions, collateral levels, and counterparty exposures for effective risk management strategies.

- Automate the reconciliation process to track changes over time, investigate discrepancies, and maintain a clear audit trail for easy reconciliation of positions and transactions.

- Integrate relevant systems and data sources to configure interest rates, terms, and other parameters automatically within the dashboard, allowing flexibility in adapting to different lending agreements.

- Real-time updates on interest accruals, interest earned, interest rates, and the overall revenue generated at various levels of granularity, facilitating both high-level overviews and detailed analyses.

- View relevant data based on the stakeholder’s role, requirements, and responsibilities to ensure each party gets the information they need for their part in the securities lending process.

Conclusion: Why Ionixx

Ionixx has positioned itself as the strategic partner for broker-dealers, introducing operational efficiency into their securities lending programs. Our agile and adaptable approach is not just technology-driven but tailored to enhance our client’s post-trade cycle, risk management, and lending strategies. Additionally, we ensure seamless integration into existing processes to minimize disruptions and allow our clients to quickly realize the benefits of our solutions without unnecessary delays.

Get in touch to know more about how our solution empowers broker-dealers to democratize their securities lending programs.