In the first quarter of 2023, the SEC (U.S. Securities and Exchange Commission) announced the deadline of May ’24 to shorten the standard trade settlement cycle from two business days (T+2) to one business day (T+1). This move solidifies the significance of streamlining the post-trade clearance and settlement processes to reduce liquidity, credit, and market risks. However, it depends on whether market participants like broker-dealers can automate trade settlements, asset custody, and back-office functions to ensure faster settlements and safer trading environments.

How does T+1 settlement enhance market safety?

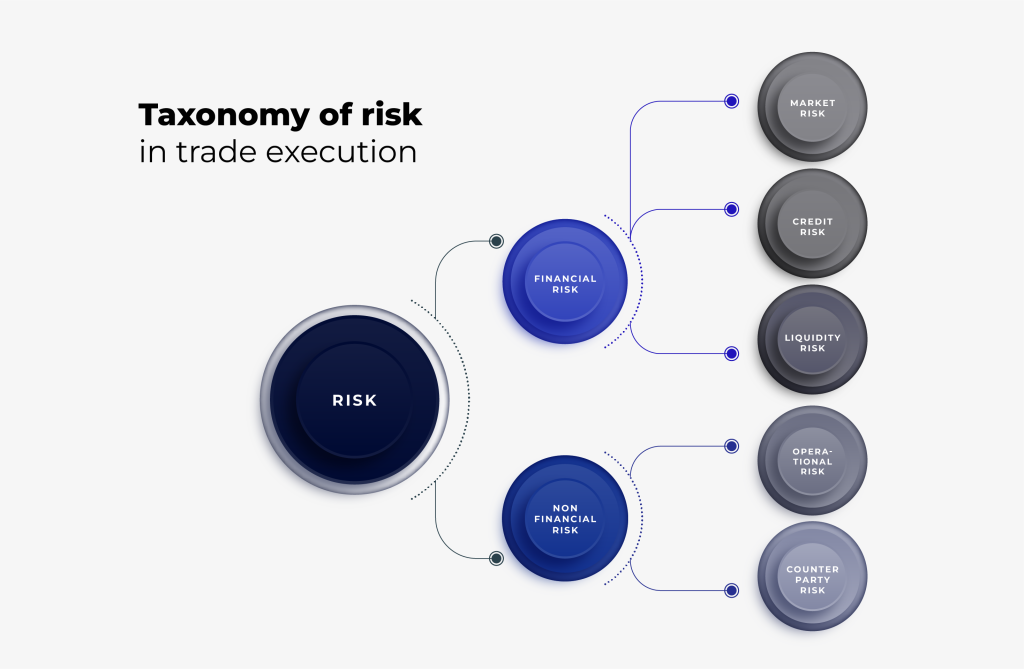

Broker-dealers act as intermediaries between buyers and sellers. They must effectively identify, assess, and mitigate risks associated with securities transactions to safeguard their client’s assets and maintain regulatory compliance. However, the COVID-19 pandemic, the meme stock fiasco, and subsequent trading restrictions highlighted potential liquidity and counterparty risk vulnerabilities.

So, the SEC plans to shorten the settlement cycle to protect investors and maintain fair, orderly, and efficient trades by streamlining and enhancing the post-trade processes. By removing one day of the settlement cycle, there’ll be less time for a counterparty to default on a trade. It’ll also decrease both market and liquidity risks since market fluctuations have less time to impact unsettled trades.

There is also greater funding efficiency, allowing buyers and sellers to quickly access their funds and purchases while reducing the potential for market disruptions, failed trades, and frauds. At the same time, funds and securities get exchanged more quickly, so market participants, especially broker-dealers, are exposed to lower liquidity risks.

What does moving to T+1 mean for broker-dealers?

While the shorter settlement cycle offers several benefits, the move has raised new challenges in the financial industry. The transition will force broker-dealers to completely rethink their risk assessment and trade processing models. With only 48 hours to settle trades, they must maintain strict adherence to regulations and proper books and records throughout the transaction process. The time compression will become more complicated for counterparties across different time zones since they have a shorter window to resolve any breaks or exceptions.

The shift to T+1 requires industry-wide transformations in trade processing, asset servicing, and documentation. So, the risk won’t disappear completely and move to another area, and right now, that area will be back-office operations. Therefore, broker-dealers must start examining and upgrading their core and post-trade processing systems and technologies to ensure the accuracy and completeness of transactions and avoid settlement failures.

Why is real-time trade processing essential for efficient risk mitigation?

Time becomes crucial in global trading since many counterparties are positioned in different time zones. They’ll have a limited time window to match trades with counterparties, source the necessary cash and securities, and execute transactions. However, many post-trade firms still maintain siloed, legacy back-office infrastructures prone to operational risks, such as manual errors, inefficiencies, delays, data failures, and a lack of real-time visibility necessary for settlement exposure and exception management.

Therefore, post-trade firms must move to automated systems capable of real-time processing trades rather than batch processing. So, instead of relying on manual intervention, broker-dealers can effectively handle real-time trade allocation, reconciliation, and confirmation to reduce operational risks. It’ll also ensure smooth cooperation across borders as each counterparty has accurate and real-time trade information and clean standard settlement instructions (SSIs).

| Credit risk | By validating and reconciling trade details in real-time, market participants can minimize the credit default risk between trade execution and settlement to ensure a more secure and efficient trading environment. |

| Market risk | Post-trade automation significantly reduces market risk by expediting the trade confirmation and settlement process, thereby minimizing the exposure to market fluctuations. |

| Liquidity risk | Post-trade automation expedites the movement of assets and funds so broker-dealers can efficiently manage their positions and reduce the risk of liquidity shortages or constraints, ultimately promoting a more resilient financial environment. |

| Counterparty risk | Automating the settlement process allows quicker and more accurate completion of trades. This reduces the time for a counterparty to default on trade and the chances of errors associated with manual data entry and processing. |

Conclusion: What’s ahead for broker-dealers?

The shift to a T+1 settlement cycle does come with its risks, but the benefits far outweigh them. However, there is no room for error in a T+1 settlement environment. Therefore, brokers should start investing in innovative technologies that can create an agile foundation to handle this latest regulatory change and adapt to market demands, regulations, and risks.

With Ionixx as their technology partner, they can accelerate and enhance their core operations to reduce manual work and ensure efficient post-trade execution. It enables them to weave together a variety of endpoints from end to end to achieve a high degree of automation in trade processes, such as matching and confirmation, FX operations, and corporate actions.

By leveraging a white-label solution with automated dashboards and reports that accurately reflect current risk stances and issues, broker-dealers can make more informed risk decisions, set priorities, and respond more effectively to escalations. So, instead of being constrained by inadequate data, outdated technology, and slow processes, they can focus on faster trade execution without the burden of post-trade risks.

Get in touch with us to know how our post-trade automation solutions can help you mitigate risks to ensure a more reliable environment for your investors.