Multi-asset trading has gained traction recently, providing customers with a full assortment of assets to expand their investment portfolios. Pre-trade firms have shifted focus to all kinds of alternatives, including bonds, commodities, equities, ETFs, derivatives, and cryptocurrencies, for better yield.

In Firebrand’s research survey involving 25 sell-side firms, respondents were asked to score multiple assets out of 10 points based on their trading frequency. The results show that newer and more esoteric asset classes have become solid investment options along with fixed income and FX. However, interviewees in the survey indicated that they do not yet have a single system to cover all of their post-trade asset classes equally.

Broker-dealers must prioritize upgrading their existing systems into global standalone Middle Office solutions, Managed FIX Services, and exchange derivatives to expand their reach across asset classes. For this reason, it has become imperative for them to invest in an agile post-trade processing infrastructure to fully participate in multi-asset trading for greater transparency and immediate execution.

The Challenge: Breaking Free from Single-Asset Constraints

Traditionally, post-trade firms have separate operations and platforms for dealing with equities, stocks, and digital tokens. For example, many customers want to purchase a combination of equities, mutual funds, liquidities, options, Bonds, and cryptocurrencies for protection against large swings. However, the symbols of these assets have different character lengths, which means they cannot be processed together since most legacy systems can process one symbol type at a time.

Since most broker-dealers have siloed infrastructures, they need an integrated solution that enables their existing systems to cover all of the post-trade asset classes equally. So, the challenge lies in seamlessly accommodating diverse asset classes without the disruption caused by overhauling existing systems.

The Requirement: Multi-Asset Settlement for Operational Efficiency

To deliver operational excellence in complex multi-asset settlement, firms have to reduce manual interventions, streamline processes, and mitigate risks. They seek solutions that can adapt to the unique nuances of each asset class, offering a unified post-trade processing environment.

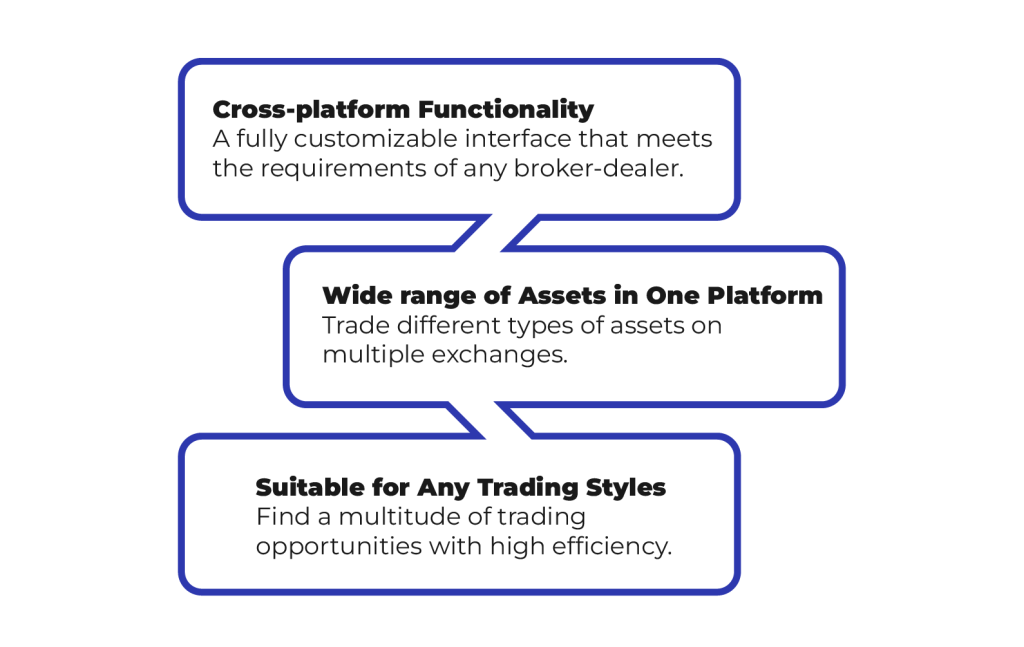

The ideal solution should be modular, allowing customization based on the specific needs of each broker-dealer. It should seamlessly integrate with existing systems, fostering adaptability to evolving market conditions, compliance requirements, and emerging opportunities.

The Goal: Breaking Down the Silos for Seamless Integration

Markets are dynamic, and so should the technology that supports them. The simpler and more consolidated a firm’s technology stack, the easier it will be to meet new requirements. The transition to a multi-asset settlement system isn’t just about overcoming challenges; it’s about unlocking new possibilities. Ionixx empowers broker-dealers to enhance client satisfaction by providing a more comprehensive and seamless trading experience.

An open, flexible architecture not only future-proofs post-trade processes but also provides the agility needed to capitalize on emerging opportunities. By unifying processes across asset classes, broker-dealers can modernize their back-office clearing and settlement ecosystem through component or modular architecture for seamless integration with legacy systems.

Flexibility in Action: Adapting to Market Dynamics

Ionixx’s solutions are built with flexibility in mind, allowing broker-dealers to adapt to changing market conditions and regulatory requirements. Our solutions are agile and modular, allowing broker-dealers to cherry-pick the components that align with their needs. Whether it’s compliance updates, new asset classes, or evolving market standards, Ionixx ensures that broker-dealers stay ahead of the curve.

We recognize the intricate nature of post-trade processing, especially when dealing with multiple asset classes. By delivering tailored solutions to upgrade existing systems, deliver a cohesive post-trade ecosystem that adapts to the unique requirements of each asset class so settlements seamlessly flow without the need for constant manual intervention.

Our technology suite streamlines the front-to-back trading stack, increases efficiencies and operations, reduces operational risk and vendor risk, and optimizes the balance sheet through the utilization across equities, fixed income, exchange-traded derivatives, and other asset classes. This robust operational framework contributes to reduced settlement times, minimized errors, and improved risk management.

| Cost Reduction | Decommission existing silo-based systems and consolidate operational and support resources by eliminating duplicative and manual processes. |

| Compliance-related Objectives | Compliance risk is much lower when there is a consolidated view of data and greater transparency of processes across the whole firm. |

| Business Expansion and Support | A unified technology platform with a modern, more flexible architecture allows firms to meet the requirements of new markets and asset classes with minimal changes to their existing post-trade systems. |

| Business-wide Position Management | A consolidated view of holdings and positions for seamless collateral management, financing, and margining across asset classes. |

| Focus on Transformation Rather than Plumbing | Redirect staff and investment resources toward developing new capabilities and digitally transforming other business areas. |

| Scalability | Flexibility to scale up in the required areas when needed by reducing duplicative processes and eliminating system redundancy. |

Conclusion: How Ionixx Solutions Make A Difference

The challenges of today’s financial markets demand a partner who understands the intricacies of post-trade processing and can navigate the technical complexities with finesse. Our commitment to staying at the technological forefront is evident throughout our comprehensive suite of cutting-edge technologies, including but not limited to APIs, blockchain, microservices, and cloud-native architectures.

We foster a collaborative approach and work in tandem with our clients. By understanding their specific needs, challenges, and aspirations, we offer a roadmap to seamlessly transition from single-asset to multi-asset settlement. This collaborative spirit ensures that our solutions are not just technology upgrades but strategic enablers of long-term success.

Get in touch to know how our integrated multi-asset solutions can offer a single, streamlined workflow and centralized set of records across all asset types.