Imagine that your gym equipment rewards you with tokens for your regularity and performance, and you use these accumulated tokens to pay your outstanding credit card bills. DeFi can make these scenarios a reality shortly.

It promises to change the traditional financial system, which feels like a highly centralized and restrictive maze. Powered with peer-to-peer, open source, and self-executing smart contracts, DeFi has shown the power to reset the financial order by putting lending and borrowing on autopilot, removing the middleman forever, and processing payments within minutes that used to take days.

KPMG, in a 2021 report on digital assets, opines that DeFi can be a ‘game changer’ for financial markets, considering its ability to facilitate seamless transactions and enhanced security.

In this blog, we’ll explore five use cases of DeFi to hint at how DeFi is rewriting the traditional financial order unimaginable a few years ago.

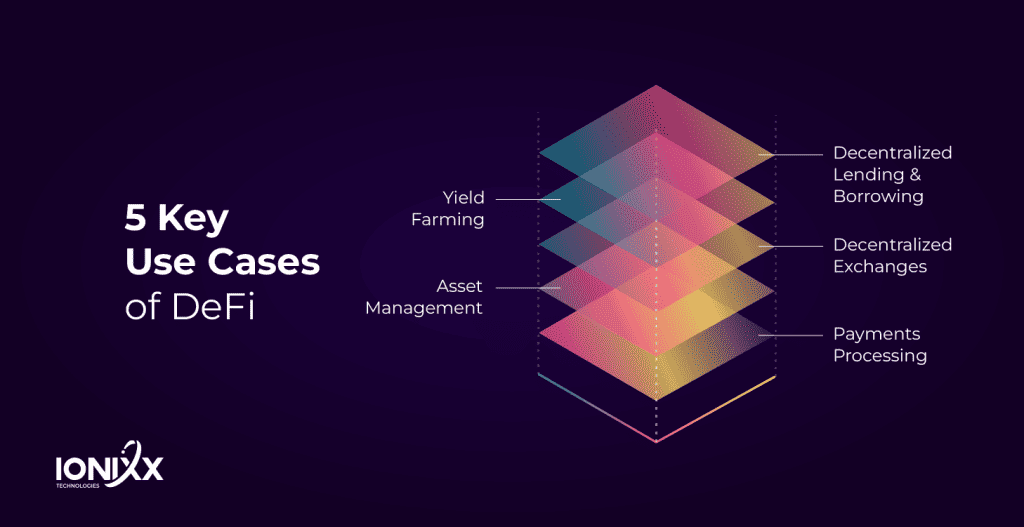

Decentralized Finance: 5 Key Use Cases

Some of the critical use cases of DeFi include the following:

1. Decentralized Lending And Borrowing

Decentralized lending and borrowing platforms (DeFi lenders) are like futuristic, automated banks run by code and powered by the blockchain. In a decentralized financial ecosystem, lending and borrowing functions occur through smart contracts based on decentralized protocols. Borrowers use the funds to trade or invest.

A lot regarding scalability, interoperability, and security is desired before DeFi lending and borrowing goes mainstream. However, projects like Aave and Compound enable users to lend and borrow various digital assets. More exciting projects will emerge with advancement in oracles and governance DAO.

2. Yield Farming

Yield farming, known as liquidity mining, allows token holders to lend their digital assets in their wallets and earn some interest as a reward. It is lucrative because the interest rate is higher than traditional saving options.

Yield farmers use a liquidity pool to earn extra yield and then reinvest this yield into other liquidity pools to earn extra rewards. Platforms like Marker DAO are popular platforms offering yield farming.

They offer a Marker Vault where digital assets are locked, and this is used as collateral. Yearn. Finance, a relatively new decentralized platform, algorithmically finds profitable trades to optimize token lending opportunities for token holders.

3. Decentralized Exchanges (DEX)

Put simply, decentralized exchanges are marketplaces where tokens change hands among buyers and sellers without involving a middleman. It cuts the role of intermediaries and gives you control. If you’re looking to trade a hot DeFi project not listed anywhere, DEX is where you can find a buyer or seller instantly.

Thus, DEX serves multiple functions, powering the building of an open, global financial system, removing gatekeepers, and unlocking new possibilities.

PancakeSwap, for example, is built on top of the Binance Smart Chain and offers a platform to trade NFTs and an Initial DEX offering platform.

Conversely, Balancer is a famous DEX platform and automated portfolio manager based on the Ethereum blockchain protocol. It empowers users to participate in liquidity pools to find the best prices for token swapping.

4. Asset Management

Asset management in DeFi works differently, where users are the custodians of your crypto fund and all the associated data.

For example, Range Protocol is a well-known asset management platform in the DeFi space that facilitates automated asset management and provides purpose-built vaults, NFT finance, liquidity staking, and derivative investment.

While Set Protocol enables users to create and manage customized investment portfolios leveraging intelligent contracts, Index Coop has developed smart contracts to rebalance your crypto portfolio automatically, depending on the market situation.

5. Payments Processing

Payment processing in the current financial system is highly centralized. The process takes time, and the cost of the transaction is high. This is due to the control of a few massively big institutions that control everything. DeFi promises to change all by facilitating peer-to-peer transparent transactions without needing any financial intermediary.

PayStand, for example, leverages DeFi to streamline B2B payments using notarization, automated bookkeeping, and expense-related functionalities. It puts account receivables on autopilot. Stax is another payment platform enabling businesses to receive payments for goods and services.

Both PayStand and Stax are real-time, cost-efficient, and transparent all-in-one payment solution platforms.

Decentralized Finance: Reshaping the contours of the financial industry

DeFi powered with smart contracts, oracles, blockchain, and other technologies are relatively nascent, and a long way must be traversed before their use cases are established. However, the promise is so strong that DeFi has witnessed strong interest from global institutions, governments, businesses, and entrepreneurs.

As a result, many projects are being evaluated, and new exciting use cases are emerging. The pace of change is so fast that it is perfectly possible that a sizable portion of the existing financial ecosystem will be automated and will run on codes and algorithms without any human intervention.

An article published in the Nasdaq.com imagines a self-driving bank. Theme article fu, or coins the concept of “embedded finance”—where e DeFi will be integrated with non-financial services or products.

Conclusion

Given the increasing interest and a surge in use cases, DeFi will play a pivotal role in the global financial system. It will provide many realistic, faster, and better alternatives to financial tasks, outperforming similar systems in traditional Finance in all aspects.

As blockchain technology becomes more mature, reliable, and scalable, DeFi products and services will become more compliant, secure, and reliable, gaining wider acceptance from users.

Are you ready to launch your DeFi project and looking for a reliable partner? Ionixx can help you launch your DeFi app within your budget and timeline.

Reach out to us for a free consultation.

[sticky_tab url=”https://bit.ly/3HCClAR” text=”Explore Our web3 Solutions”]