The demand for a decentralized, openly accessible, transparent, more inclusive, and secure financial ecosystem has started shaking the existing financial architecture. It has failed to create an inclusive framework for those who cannot access the existing financial solutions.

The increasing adoption of Web3 solutions, blockchain, and DeFi apps signifies a paradigm shift towards a decentralized financial system. According to Statista, 46% of fintech applications leverage Web3 technology in some way or other. Even institutional adoption has seen a marked increase in Web3 adoption. A Coinbase report further confirms this trend. Since the start of 2022, almost 60% of Fortune 100 companies have taken initiatives in Web3 and DeFi space.

Web 3 And DeFi: Addressing Challenges in Traditional Finance

The modern financial system has undergone tectonic changes during the last many decades, and the changes have largely been driven by technology. However, there are still some structural challenges the financial system has been grappling with.

1. Lack of Financial Inclusion

The traditional financial system imposes high barriers to entry in many ways, such as creditworthiness, minimum capital requirements, and documentation. As a result, many people remain unbanked or face limited access to loans, credit, and investments, seriously affecting financial inclusion.

2. Excessive Centralization and Control

Traditional financial systems rely on over-centralization via banks and governments for their management. This also makes the system vulnerable to potential manipulation and liable to act in the favour of powerful people.

3. Inefficiency and High Transaction Fee

The complex approval process involving intermediaries and multiple stakeholders results in delays and high fees.

4. Lacks Transparency and Trust

A drawback of traditional financial systems is their opaqueness and limited visibility into the functioning of institutions. Since the 2008 financial crisis, the world has seen many financial institutions collapse and governments bailing them out.

5. Limitations in Global Access

The global financial system is geographically fragmented and restrictive, limiting access to global investment opportunities.

Web3 and DeFi: Components of New Financial Order

The concepts of Web3 and DeFi have been fused together to create new use cases and opportunities for users.

| Component | Function | Challenges It Solves |

| Wallet | Acts as a fulcrum in Web3. Allows users to interact with tokens and smart contracts. It’s an account everywhere, allowing users to control data and assets. Stores digital assets like NFTs, DeFi, dApps, enabling them to sell it without involving other stakeholders. | Promotes financial inclusion by allowing users with a wallet to access financial services. Provides complete control over data and digital assets, eliminating dependencies on centralized systems. Enhances the security of assets by eliminating the need to expose personal data to third parties. |

| Token | Digital representation of assets in web3. Fungible tokens: Enables one to one Use case: Using DEX to access discounts and loyalty, governance, and voting using DAO. Non-Fungible Tokens: One-to-one transactions are not possible. Use Cases: Digital collectibles and content | Promotes efficient use of digital assets Non-fungible tokens have opened new ways of earning and monetization. |

| Smart Contract | Computer programs that define token behavior. | Automates manual processes while removing intermediaries and increasing efficiency. Possibilities of creating tailored financial products to meet specific needs. Immutable record keeping and boosts transparency |

| Blockchain Network | Foundational infrastructure layer of Web3 | No geographical restriction Transparent and secure Resists single entity control Creates a level-playing field for participants. |

| DeFi | Addresses most of the challenges faced by financial systems. Use cases: Startups can raise funding by issuing tokens. Businesses can tokenize their invoices Expensive assets can be fractionalized to make it accessible | Open and more accessible financial ecosystem. Cuts fees by eliminating the middleman Promotes new use cases. |

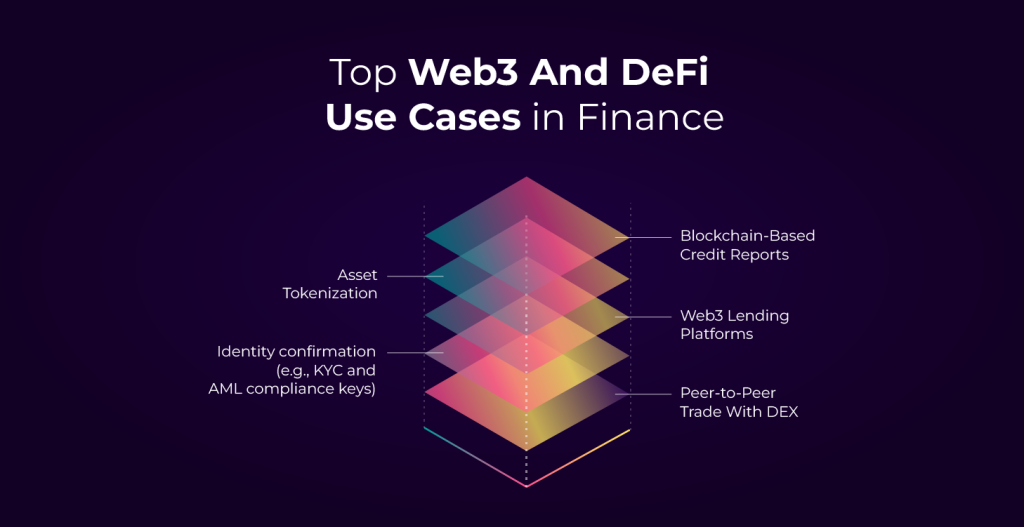

Six Real-World Use Cases of Web3 And DeFi That Signify the Future of Finance is Already Here

The explosion of Web3 solutions and decentralized finance has raised the possibilities of changing how modern financial systems work forever.

Let’s understand how they transform many functions of the current financial system.

Use Case 1: Peer-to-Peer Lending Platform

By leveraging decentralized lending platforms, users can access to p2p microloans without encountering restrictive factors such as creditworthiness, documentation or minimum capital requirements. Borrowers only require their web3 wallet history.

Use Case 2: Tokenization of Expensive Assets

High-value real estate assets can be tokenized using DeFi, making them accessible for investors seeking to invest in expensive assets.

Use Case 3: Participating in Insurance

People can buy health insurance where premiums are automatically paid through smart contract platforms, thereby reducing the dependence on traditional insurance institutions.

Use Case 4: Say Hello to Speed with P2P Transaction

DEX facilitates peer-to-peer transactions without involving any external institution in the process and, as a result, increases transaction speed and reduces costs.

Use Case 5: Solving Lending Process Inefficiencies

Accessing timely credit can be a nightmare for small businesses owing lengthy and time-consuming loan approval process. However, this can be addressed using Web3 development and DeFi solutions.

For example, an SME seeking credit uploads its financial records on a DeFi platform. The platform’s algorithm quickly conducts credit evaluation and makes a decision to disburse the loan.

Use Case 6: Decentralized Identities

In the Web3 ecosystem, users store all verified credentials and sensitive identity-related data within a digital wallet. Whenever they need to subscribe to a new financial service, the relevant information is verified through a blockchain-based decentralized system. Using Zero Knowledge Proof protocols, the system validates data without sharing information with a third party.

Final Thoughts

Though concepts of DeFi and Web3 are still in the nascent stage, they show a significant promise to revolutionize every aspect of the existing financial framework. They are poised to create a scenario where traditional and decentralized financial systems coexist.