The current T+2 cycle is claimed to be less effective, as many incidents of fraudulent activities, trade breaks, and financial losses have been recorded recently. T+2 fell short of executing the trade effectively. There are a lot of trade breaks due to the extended period taken to clear and settle.

In Feb 2023, the Securities and Exchange Commission (SEC) implemented a rule amendment to reduce the standard settlement cycle. This change intends to shift the settlement cycle and complete the whole process within two business days. As the name suggests, T+1 refers to settlement within one business day after the trade date. With SEC’s proposed May 2024 deadline, market participants are racing against time to prepare for the accelerated cycle.

Accelerating the settlement cycle is bound to create challenges for buy-side firms, sell-side firms, and prime brokerages in the digital brokerage sector. This blog elaborates on the effects of this rapid shift on prime brokers, focusing on how they can overcome the technological and regulatory hurdles presented by this change.

Let’s Take A Look At The Role of Prime Brokers Before Learning About Their Journey Toward T+1

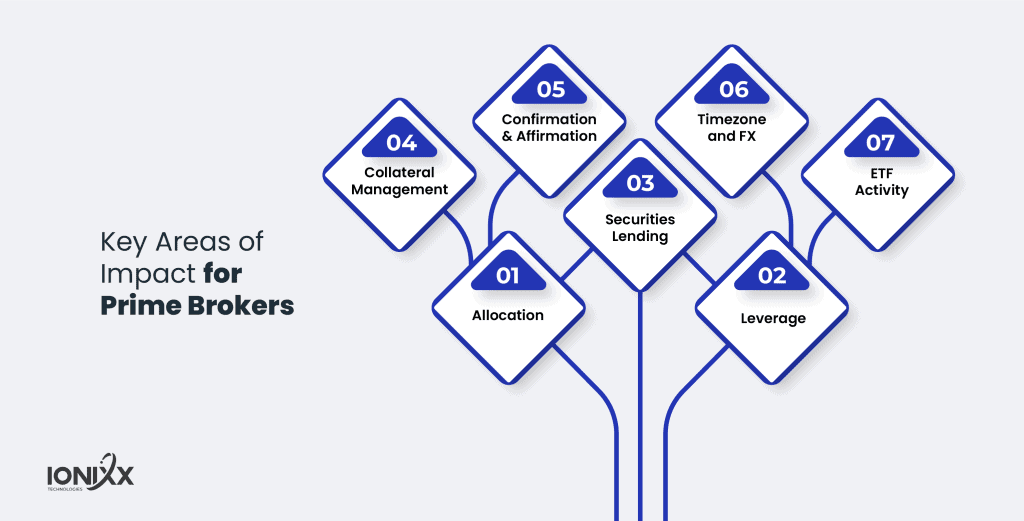

Prime brokers provide a comprehensive range of trade-related services that span custody, settlement, securities lending for short sales, margin financing, asset servicing, and the supply of advanced back-office technology. The confirmation and affirmation process between executing brokers and prime brokers is essential for the smooth and efficient processing of trades within the digital brokerage industry.

The key function of prime brokers in digital brokerage operations is trade settlement. Here, executing Brokers are responsible for settling trades on behalf of the prime broker. This process may involve the prime broker utilizing self-clearing methods or collaborating with clearing firms to manage the settlement of a portion or the entirety of their clients’ trades. This approach ensures versatility and efficiency in managing complex trade settlements.

How Does T+1 Shift Impact The Prime Broker in Digital Brokerage?

Today, buy-side firms deliver trade data to prime brokers and executive brokers separately. The trade and allocation details are sent to prime brokers before the trade is matched with executive brokers. The shift to a T+1 settlement cycle presents a significant timing challenge.

The accelerated cycle has the potential to cause issues between the asset manager and the executing broker. In cases where the asset manager and executing broker identify and rectify an exception, the prime broker remains disconnected from the process. This gap introduces risks related to timing and market fluctuations, often leading to a full day’s delay in resolution.

Such delays cannot happen in a T+1 scenario. To adapt, buy-side firms need to implement solutions that provide prime brokers with real-time trade details as matches occur between the asset manager and the executing broker, or alternatively, relay the trade details to the prime brokers immediately after the trades are matched.

This shift is expected to decrease credit, market, and liquidity risks associated with unsettled securities trades, alongside a reduction in the rates of failed transactions.

How Does T+1 Impact The Prime Broker At Various Stages of The Trade Lifecycle?

Transactions

The affirmation cutoff time for specific transactions is undergoing a significant change, moving from the current deadline of SD-1 at 11:30 AM to TD at 9 PM. This adjustment means that all prime broker Transactions affirmed by 9 PM on Trade Date (TD) and meeting the National Securities Clearing Corporation’s (NSCC) Continuous Net Settlement (CNS) eligibility criteria will be forwarded from the Investment Technology Platform (ITP) to the NSCC for processing through the NSCC’s CNS service.

Disaffirmation Process

Currently, a Prime Broker can disaffirm an account and its transactions until 5 PM on the Settlement Date minus one day (SD-1). However, with the transition to a T+1 Settlement Cycle (T1SC), the disaffirmation deadline will shift to 5 PM on T+1. This change still provides prime brokers with the necessary time to disaffirm transactions.

Here’s a simplified breakdown of how the disaffirmation process will work under T1SC in digital brokerage:

Disaffirmations from 9:00 PM on Trade Date (T) to 1:30 PM on T+1

If the original prime broker transaction hasn’t been settled yet, the disaffirmation will be offset against it.

If the original prime broker transaction has been settled, the disaffirmation will create new NSCC positions to be settled.

In both cases, this could affect the intraday margin requirements for both the prime broker and executing broker (EB) at NSCC, potentially triggering intraday margin calls.

Disaffirmations from 1:31 PM to 5:00 PM on T+1

Similar to the first scenario, if the original prime broker transaction is unsettled, it will net against the disaffirmation.

If the original transaction is settled, new NSCC positions will be created for settlement.

This will impact the next day’s (Settlement Day +1) NSCC margin requirements for both the prime broker and an executive broker.

Optional Service

DTCC is considering the introduction of a new optional service, which would enable participants to send their unaffirmed Institutional and Prime Broker transactions from ITP to DTC for processing. This service would also include affirmed non-prime Broker transactions, and all would be processed through DTC’s Institutional Delivery (ID) Against No-Ex (ANE) process. All these transactions would need to meet the same 10:45 PM authorization and exemption cutoff on the trade date. However, the final decision on this service’s development is pending further guidance from the SEC, particularly regarding their proposed rule necessitating trade affirmations by day’s end. The implications of this rule for both the industry and DTCC are significant and will influence the eventual rollout of this service.

Overall Readiness On The Road to T+1

The sector as a whole will be impacted by the switch to T+1, including dealers, asset managers, and custodians. Both behavioral adjustments and technology advancements will be necessary for the transition. It will be necessary for many businesses to modify their workdays to end after 5:00 PM or to use their worldwide presence as they get used to the shorter workdays.

Some businesses may have to get rid of or severely cut back on their manual procedures. Large organizations find it challenging to manage the throughput and integration requirements of modern clearing platforms, particularly when replacing an in-flight older solution. So, anyone on the verge of change will require strong technological support.

Giving all market players—from up-and-coming managers to major institutions—the resources and services they require to participate in the modern digital brokerage markets is our aim. The need for tools that enable companies to understand the markets in real-time is more evident than ever before due to the dynamics of speed, volatility, and regulatory change. Contact us today.

[sticky_tab url=”https://www.ionixxtech.com/solution/fintech/brokerage” text=”Explore Our Digital Brokerage Solutions”]