Artificial Intelligence (AI) is reshaping the digital brokerage sector, driving transformative changes across the industry. From cutting down human errors to enhancing risk management and ensuring compliance, AI is set to empower firms to stay competitive and efficient in the evolving capital markets landscape.

The use of AI-based applications is proliferating in the securities industry and transforming various broker-dealer functions. A few large firms have established centers of excellence to review, share, and build expertise and create synergies related to the use of AI across their organizations. In addition, firms are exploring and incorporating AI tools built by financial technology startups and vendors, says FINRA in its white paper about AI in the Securities Market.

This fact is also supported by DTCC when it believed in the AI revolution in capital markets.

In this blog, we will talk about the applications of AI in digital brokerage across a wide range of functions.

The Role of AI in Digital Brokerage

AI has transformed the landscape of digital brokerage, elevating trading strategies, bolstering risk management, tailoring services to individual clients, ensuring regulatory adherence, and automating critical post-trade processes such as reconciliation and collateral management.

It has swiftly become an essential asset for brokerage firms, enabling them to maintain competitiveness in dynamic and ever-changing financial markets.

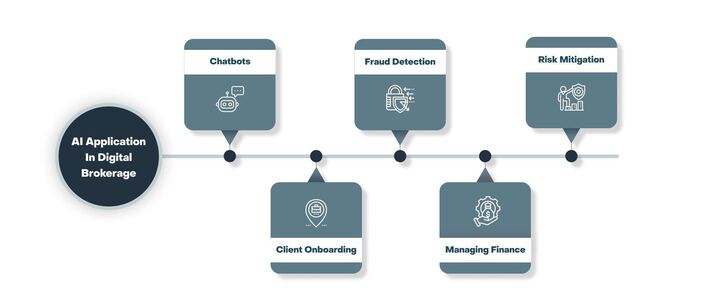

Diverse Applications of AI in Digital Brokerage

The term AI serves as an overarching label encompassing a wide array of diverse technologies and applications, including the following examples:

Robotic Process Automation

Robotic Process Automation (RPA) encompasses the utilization of preconfigured software tools that interact with various applications to automate labor-intensive tasks. This automation results in heightened precision, swifter execution, and cost-efficiency gains. Typically, RPA tools are deployed for tasks that involve substantial volumes of repetitive work associated with structured data. Examples of such tasks include account reconciliation, processing accounts payable, and handling check deposits. While some stakeholders do not classify RPA as a category of AI due to its rules-based approach, others regard it as a foundational form of AI, especially when combined with other technologies like Machine Learning (ML).

Natural Language Processing

Natural Language Processing (NLP) represents a facet of AI technology that empowers machines to comprehend and interpret both text and voice inputs. It excels at extracting valuable insights from this data and has the potential to transform this information into preferred output formats, including text or voice. In the securities sector, NLP finds diverse applications, spanning from basic tasks like extracting keywords from legal documents and language translation to more intricate functions like sentiment analysis and delivering pertinent information through chatbots and virtual assistants.

Deep Learning

Deep learning models are constructed based on artificial neural networks, employing algorithms that handle extensive volumes of unstructured or unlabeled data. This process involves multiple layers of learning, drawing inspiration from the functioning of neural networks in the human brain.

Deep learning finds its application when dealing with vast datasets sourced from various origins, often featuring diverse formats like text, voice, and video. To illustrate, within the securities sector, certain companies are actively creating surveillance and conducting monitoring solutions rooted in deep learning models. These applications of deep learning can be categorized as supervised, unsupervised, or reinforcement-based approaches.

How AI Impacts Various Areas of Digital Brokerage

Many capital firms have already incorporated process automation to handle repetitive tasks like client onboarding and compliance checks. But AI can also extend its application in the following areas of post-trade such as collateral management, reconciliation, and corporate actions.

Collateral Management

Collateral optimization and liquidity management is one area where AI has the potential to support decision-making. There are a large number of parameters influencing optimization decisions, for example, collateral costs, operational and settlement costs, counterparty efficiency, etc. Feeding historic data around the performance of optimization runs and then using AI to suggest more optimal collateral allocations in the future could provide significant cost benefits.

Reconciliation

AI has significantly transformed reconciliation in post-trade by automating and enhancing the accuracy of this critical process. Through machine learning algorithms and natural language processing, AI systems can rapidly compare vast amounts of transaction data, detect discrepancies, and reconcile accounts with unprecedented speed and precision. This not only reduces the risk of errors and settlement failures but also cuts down on operational costs and frees up human resources for more strategic tasks.

Corporate Actions

AI plays a pivotal role in corporate actions by streamlining and automating the complex processes associated with dividend payments, mergers, acquisitions, and other corporate events. It enhances the accuracy and speed of data extraction from various sources, interprets event details, and automates decision-making processes based on predefined rules, significantly reducing the risk of errors and ensuring compliance.

Compliance Management

Market players are increasingly leveraging AI for compliance and risk management. This is consistent with FINRA’s 2018 research on the use of regulatory technology (RegTech), where it is observed that “market participants are increasingly looking to use RegTech tools to help them develop more effective, efficient, and risk-based compliance programs.

A 2018 survey by Chartis Research and IBM, involving 100+ risk and tech professionals, revealed that 70% were using AI in these functions.

Broker-dealers grapple with evolving regulations and diverse risks like cybersecurity and financial threats. Simultaneously, they have access to abundant data and cost-effective computing, enabling the development of automated compliance and risk tools.

Below, we explore examples of firms integrating AI into their compliance and risk management processes.

Enhance Surveillance with AI

AI technology revolutionizes data capture and surveillance by handling vast, structured, and unstructured data from various sources (text, speech, image, video). This enables comprehensive monitoring across enterprises and individuals efficiently. These tools reduce false positives, freeing up compliance teams for more thorough reviews. AI shifts from traditional rule-based systems to predictive, risk-based surveillance, identifying data patterns for informed decisions. For instance, AI-based tools monitor customer communications beyond lexicon-based reviews, deciphering tone, slang, or code words indicative of risk or non-compliance.

AI Streamlines Regulatory Compliance

Broker-dealers adopt AI tools to transform regulatory intelligence management. Instead of traditional manual processes, they now digitize, review, and interpret evolving rules, regulations, and enforcement actions. AI integration enhances compliance programs, offering efficiency gains and cost reductions. Research indicates that AI in financial institutions boosts risk and compliance functions.

Detecting Settlement Failure

Detecting settlement failures is a pressing concern within the post-trade sector. These failures occur when either the seller doesn’t deliver securities or the buyer fails to provide the necessary funds by the agreed-upon settlement date.

Settlement failures carry significant financial implications for broker-dealers and their clientele. Aside from the substantial fines imposed under the Central Securities Depository Regulation (CSDR), they also disrupt trading strategies, necessitate manual interventions, and hinder the provision of a seamless custody service.

Wrapping up

In the digital brokerage landscape, AI isn’t merely a buzzword; it’s a transformative force. It reshapes the financial landscapes to foster inclusivity and enhance automation. It empowers brokerage firms to make data-driven decisions, manage risks, and deliver superior customer experiences. In the future, AI will be pivotal in staying competitive and agile in the trading space. To stay ahead in the market, it is important to choose a trusted technology partner that can unlock AI-driven value at scale. With our experience in delivering complex post-trade applications with modern and emerging technologies, we can help you explore how AI fits into your trading and brokerage operations. Get in touch.