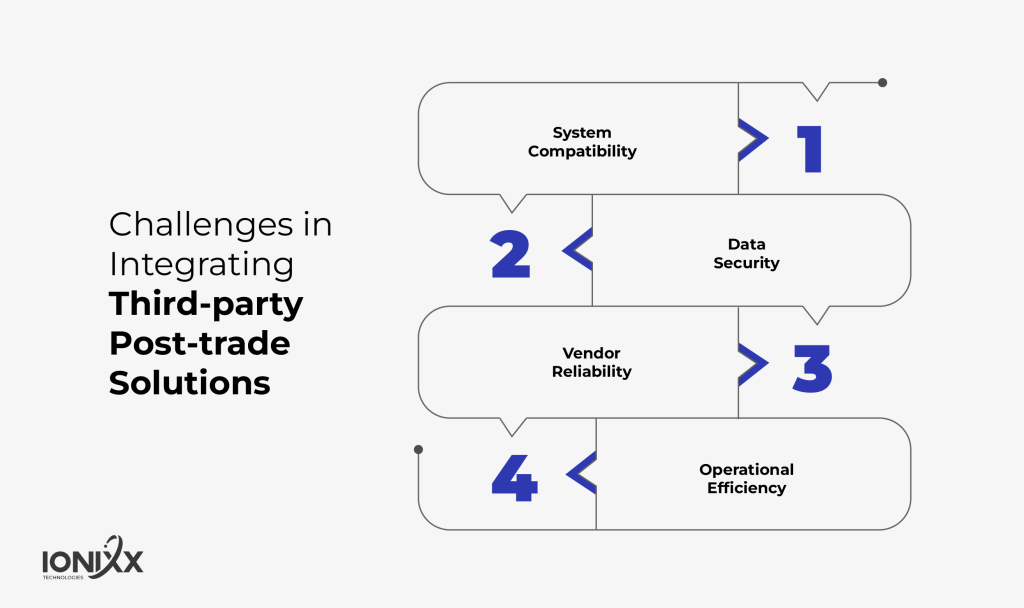

Integrating third-party post-trade solutions into existing brokerage platforms can be a complex and challenging process. This blog will explore the key challenges brokerages face when they look to transition from outdated systems to enable modern integrations. The challenges range from aspects such as system compatibility, data security, regulatory compliance, and more.

Challenges Faced During The Integration of Post-trade Solution

1. Lack of Compatibility

One of the primary challenges in integrating third-party post-trade solutions is ensuring compatibility with existing systems. Financial institutions often operate on legacy systems, which might not be easily compatible with newer third-party solutions. This can result in significant technical hurdles, requiring substantial customization or even a complete overhaul of existing systems.

2. Huge Volume of Data

Data is the cornerstone of post-trade solutions. Integrating a new system often means merging large volumes of data from different sources. Ensuring data accuracy, consistency, and integrity during this process is crucial. Furthermore, the challenge is not just in integrating data but also in managing it efficiently to ensure smooth operations, post-integration.

3. Poor Regulatory Compliance

The financial sector is heavily regulated, and any new system integration must comply with many regulations. Third-party post-trade solutions must be vetted to ensure they meet all regulatory requirements. Non-compliance can lead to legal issues and hefty fines, making this a critical aspect of the integration process.

4. Adherence to Global Standards And Local Requirements

With financial markets being global, third-party solutions often need to cater to international standards. However, local market practices and regulations can vary significantly. Balancing these global standards with local requirements is a complex task, requiring a deep understanding of different regulatory environments.

5. System Scalability And Performance

Post-trade processing can be volume-intensive, especially during peak trading times. The integrated system must be scalable to handle high volumes without performance degradation. This requires robust infrastructure and efficient software that can grow with the organization’s needs.

6. Inadequate System Security

Integrating a new post-trade solution introduces new points of vulnerability. Ensuring data security and protecting against cyber threats is paramount. This involves not just securing the software but also training staff and establishing strong cybersecurity protocols.

7. Need for User Training and Change Management

Adopting a new system requires training the users effectively. Resistance to change is a common issue in many organizations. Proper change management strategies need to be in place to ensure a smooth transition and acceptance of the new system by all stakeholders.

8. Cost Implications

Integration of a third-party solution is a significant financial investment. Beyond the initial cost of the software, there are costs related to customization, data migration, training, and ongoing maintenance. Balancing these costs with the expected ROI is a key consideration.

9. Business Strategy Alignment

Any new integration should align with the organization’s overall business strategy. The chosen post-trade solution should not only solve current issues but also support future growth and adapt to changing market conditions.

10. Vendor Dependence

Relying on a third-party vendor for a crucial part of your operations can be risky. Issues such as vendor stability, support quality, and commitment to future updates are important considerations. Establishing a strong relationship and clear communication channels with the vendor is essential.

Conclusion

Integrating a third-party post-trade solution presents a range of challenges, from technical and operational to strategic and financial. Successfully navigating these challenges requires thorough planning, a deep understanding of both the technology and the financial sector, and a strong focus on compliance and security. While the process can be daunting, the benefits of enhanced efficiency, scalability, and compliance alignment make it a worthwhile endeavor for financial institutions looking to stay competitive in the ever-evolving financial markets.

For fintech companies, traders, and investors, the imperative is clear: Integration is not merely an option; it is the path to progress. For those poised to embrace or invest in the upcoming surge of trading technology, the strategy should be not only ambitious but also intelligent.

As an expanding provider of software and IT solutions, Ionixx specializes in crafting bespoke software and IT solutions. Utilizing cutting-edge technologies like blockchain, cloud computing, and artificial intelligence, we excel in creating robust brokerage solutions that lead to success. Connect with us today.

[sticky_tab url=”https://www.ionixxtech.com/solution/fintech/post-trade” text=”Explore Our Post Trade Solutions”]