With the D-day (May 28, 2024) fast approaching, market participants are on an intense countdown, preparing for the T+1 settlement cycle. It’s more than a ticking clock—it’s a call to action.

Across the globe, financial market institutions (FMIs) are rethinking old models and embracing new opportunities. As industry participants preparing for T+1 settlement grapple with integration complexities, cost considerations in adopting new technologies, and the need to adjust operationally—a pertinent question emerges: How can the industry effectively prepare for T+1 settlement and navigate the shift towards innovative technology solutions while moving away from outdated infrastructures?

To shed light on these issues, we engaged with experts from Ionixx Technologies to offer their insights:

- Muniraj Muniappan, Capital Markets Solutions Architect

- Jon Tennyson, Project Head for OMS Trading & Risk Management Platforms

- Pravin Charles, VP of Technology & Delivery

They discuss the current positioning of industry stakeholders and provide a glimpse into what the future holds. Here’s a quick peek into what’s coming:

- Clear steps for an incremental approach to digitization of the Securities Trading Industry.

- How to bridge crucial gaps in post-trade processes, front-office order management systems, and compliance adherence.

- How are emerging technologies such as AI, DLT, and Automation set to revolutionize securities trading across the entire spectrum from pre-trade to post-trade activities?

- How Ionixx has established itself as a leading FinTech Solutions technology partner to help firms strategically stay competitive in this disruptive landscape.

T+2 to T+1 Settlement – Where are the Gaps?

1. Even as trading volume spikes and settlement acceleration continue to lead the agenda—in your view, what are the most significant challenges that financial institutions and capital market firms face in digitalizing post-trade processes?

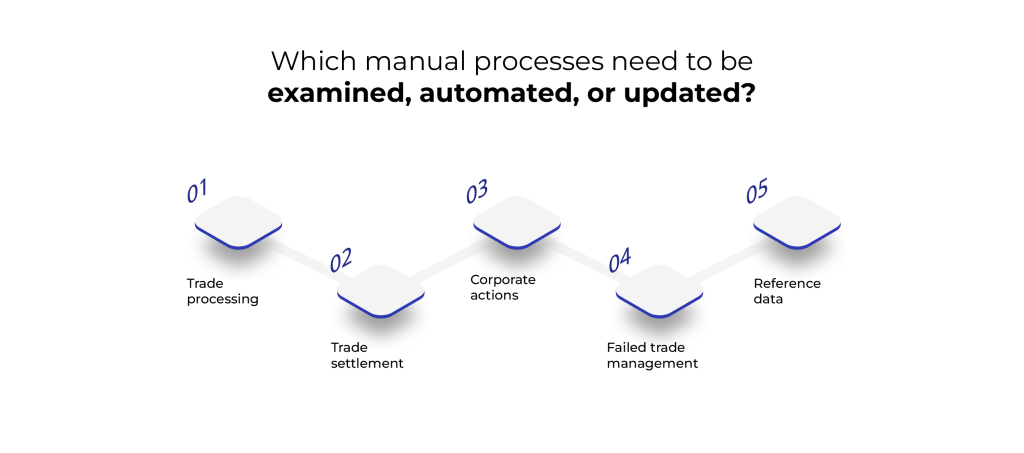

Muniraj: Dismantling the hold of legacy systems, mitigating the costs of digital adoption, and ensuring cross-industry collaboration for smooth integration are the three key challenges, the way I see it. Firms have to keep at their digitization efforts consistently, and this calls for more than band-aid solutions or technological upgrades; it requires a strategic overhaul to eliminate existing inefficiencies.

Pravin: Integration of deeply entrenched legacy systems, which are often at odds with modern, agile digital solutions, has been a persistent problem area. Enhancing cybersecurity amidst a complex regulatory landscape and ensuring the scalability and performance of new technologies is another key area of concern. Equally important is change management—addressing the human and behavioral aspects of digital transformation—as adopting new technologies invariably reshapes organizational workflows and redefines employee roles.

2. How do pre-trade activities and Order Management Systems (OMS) need to evolve to align more effectively with digitized post-trade processes?

Muniraj: Adopt a vertical integration strategy. The old playbook, where deals were sealed upfront and post-trade was an afterthought, is no longer relevant. Now, accuracy and ownership of trading data by the front office from the get-go is more than good practice. Different business units (such as equity, fixed income, rates, or credit) that now work in silos must work in concert with front, middle, and back-office functions. This shift needs to go beyond theory and procedure; it should be a mindset shift aiming for improved transparency.

Jon: Effective upgrades to OMSs and pre-trade activities must align with post-trade process enhancements, ensuring seamless, real-time data flow between them.

A two-way communication between core-trade and post-trade systems is a no-brainer.

Given the complexity of integrating various third-party systems—such as reference data, market data, and FIX connections—it’s crucial to maintain synchronous communication throughout the trade lifecycle.

Pravin: Typically, the evolution entails leveraging advanced data analytics and Machine Learning (ML) algorithms to enhance pre-trade decision-making and optimize order routing strategies in real-time. Interoperability between pre-trade systems and post-trade platforms is crucial to ensure seamless data flow and streamline end-to-end trade lifecycle management.

Burying Your Head in the Sand: Why Compliance Can’t Be an Afterthought in Securities Trading

3. What steps can organizations take to stay on top of post-trade compliance? What kind of technology solutions does Ionixx help with?

Muniraj: Post-trade processing revolves around standardization and cost-effective practices. Remember these:

- If a process isn’t enhancing your competitive advantage, avoid reinventing the wheel. Instead, consider purchasing a solution rather than developing it in-house, especially if it’s already standardized.

- Find the sweet spot between leveraging the right tech stack to unlock opportunities for growth while also keeping a conscious tab on cost overruns.

- Engage actively in industry forums as every organization encounters similar post-trade challenges.

Pravin: Organizations should invest in vigilant monitoring systems that scrutinize every transaction against regulatory benchmarks in real time. Regular, thorough audits are essential for pinpointing compliance discrepancies promptly, while comprehensive staff training programs are critical for keeping teams up-to-date on the evolving regulatory landscape.

At Ionixx, we empower firms with state-of-the-art compliance solutions that leverage automation and ML algorithms. Our systems are equipped to get deep into trade data, efficiently sifting through to identify potential infractions and streamlining the reporting process.

4. What are your insights on integrating traditionally isolated front, middle, and back-office operations?

Muniraj: We’re steering towards a future where the middle office is leading the charge in data consolidation and straight-through processing. Preparing for T+1 settlement necessitates real-time processing to avoid costly errors and fines.

It’s about staying nimble and error-free in a world that won’t wait for batch processing to catch up. The goal needs to be clear: speed up processing, but first, fix the process. It’s not just about being fast; it’s about being right.

Jon: Although traditional and modern trading platforms share core functions, the way data flows between the front, middle, and back offices is a different ball game now. We’re talking about a major upgrade in communication across these areas, which is key to building a solid platform. As the trend shifts towards low-to-zero-touch trading platforms over traditional high-touch ones, seamless integration and smart automation between the middle and back offices become essential.

Setting up The Blueprint for the Industry’s Future – AI, DLT, Data Management & APIs

5. How do you see AI fitting into the different stages of securities trading – pre, core, and post-trade processes?

Muniraj: At its current state, AI is poised to transform the trading lifecycle at every step. Pre-trade it’s like having an intelligent assistant that personalizes how we communicate with clients, ensuring they get the correct information at the right time, thanks to clever algorithms and data analysis.

During actual trading, imagine a savvy advisor who sifts through mountains of market data to spot trends, helping brokers make sharper decisions and manage portfolios with precision.

Post-trade; it’s where AI can help with the heavy lifting in compliance and back-office chores, spotting risks we might miss, and keeping things ticking without a hitch. All this tech hinges on having top-notch data to chew on; the fresher and more accurate, the better the AI works.

So, the first critical step to leverage the full potential of AI is to invest in data integration and normalization capabilities.

Jon: In the post-COVID-19 landscape, there’s been a surge in novice traders entering the market from the comfort of their homes, and that’s where AI has played a part.

Through AI-driven trading desks like Robo-Advisors, trading platforms now leverage sophisticated analytics and timely insights, aligning with individual investment strategies to improve trading outcomes and stimulate more trading activity.

AI’s role extends to enhancing Transaction Cost Analysis (TCA) for both pre and post-trade processes.

Pravin: AI fits quite nicely into the scope of the securities trading industry, offering various applications across pre-, core, and post-trade processes.

For example, in reconciliation, AI algorithms can be applied to automate the matching of trade details across different systems, reducing manual effort and speeding up the reconciliation process, thus minimizing errors and ensuring accurate trade settlement.

6. Can you shed some light on the impact of technologies like Distributed Ledger Technology (DLT) and tokenization on clearing and settlement?

Muniraj: DLT is rewriting the rulebook for the post-trade world, offering a decentralized way to record and process transactions faster, more transparent, and more secure. It’s a giant leap from the traditional system, with potential benefits like immediate settlement and enhanced transparency. With DLT and tokenization implemented at scale, we’re looking at a more efficient, accessible clearing and settlement process.

However, the real challenge lies in bringing everyone together to adopt DLT and ensuring it meets the market’s needs and regulatory standards.

7. How do you foresee the evolution of data management in trading systems, especially considering the role of APIs? What advancements do you predict or wish to see in this area?

Muniraj: APIs are leading the charge in making the exchange of data between systems smooth and fast, which is crucial for making quick trading decisions. But let’s not forget the challenge of dealing with old legacy systems—it’s a marathon, not a sprint.

In terms of the future, we’re seeing a significant move towards using cloud solutions, especially for post-trade processes, which makes systems more flexible and ready for whatever the market throws at us. The magic happens when we marry cloud technology with APIs, creating a seamless link between old and new.

I’m all in on seeing this blend of cloud and APIs become the norm. That’s the sweet spot for making trading infrastructures more dynamic and ready for the future. This creates an ecosystem of sorts, enhancing automation and ensuring data is where it needs to be, exactly when it’s needed.

Jon: It’s clear that adopting APIs not only streamlines operations but also significantly boosts data processing speeds, with firms reporting up to a 30% improvement.

This shift is also underscored by a noticeable decline in the use of SFTP protocols within the securities trading sector, which, while reliable, fall short of supporting the immediacy required for modern trading operations. The future of trading systems hinges on this seamless integration, emphasizing operational agility.

Preparing for T+1 Settlement: The Role of Ionixx As A Strategic Technology Partner

8. Looking ahead, what key trends or technologies do you believe will significantly shape the future of trading systems? How is Ionixx preparing for these future developments?

Pravin – I’d like to believe that there is going to be an increased interest as well as continued adoption and adaptation to AI and ML for algorithmic trading strategies, as well as the proliferation of blockchain and decentralized finance (DeFi) solutions for enhancing transparency and efficiency in trade settlement processes. Additionally, advancements in quantum computing may revolutionize trading systems by enabling faster analysis of vast amounts of data and more sophisticated risk management techniques.

- Ionixx is well-positioned to capitalize on our expertise in blockchain implementations to assist financial institutions in adopting DLT and tokenization for clearing and settlement. With our knowledge and experience in developing blockchain-based solutions, we can design and implement robust platforms that optimize clearing and settlement processes, enhance transparency, and reduce counterparty risks, helping organizations navigate the transition toward more efficient and secure post-trade operations.

- We have empowered organizations by equipping them with cutting-edge tools and solutions that harness the power of advanced analytics and ML algorithms.

- Our commitment to innovation enables our customers to make insightful, data-driven decisions, optimizing their trading strategies across various asset classes.

Closing Thoughts

Clearly, embracing digital transformation for the securities trading industry isn’t just about preparing for T+1 settlement; it’s a continued journey toward increasing efficiency and ensuring market integrity. The critical takeaway is to create a unified language that enhances how market participants and key stakeholders interact and conduct business, ensuring everything is transparent and regulator-friendly.

At Ionixx Technologies, we’re excited by what’s on the horizon and continue to collaborate with our customers to create a smoother, more efficient, and accessible securities trading ecosystem that goes beyond just preparing for accelerated cycles.

With expertise in blockchain, Cloud automation, AI, and data management solutions, we are well-positioned to help firms strategically adapt to and thrive in the changing dynamics of the industry.

We’re equipped to guide you through every step of your T+1 settlement transition, regardless of where you stand on your digital transformation journey. We will ensure your operations are not just compliant but also primed for the future of securities trading.

To speak to our Capital Markets & Securities Trading Solutions team, write to us at info@ionixxtech.com or fill out our form, and we will be sure to get back asap.