The U.S. Securities and Exchange Commission (SEC) has set the deadline to shorten the settlement cycle to T+1, effective May 28, 2024, for all U.S. securities transactions that settle through Depository Trust Company (DTC). Canada has also adopted a similar rule covering its markets, as its securities will begin trading using a T+1 settlement date on May 27, one day before U.S. securities. However, this monumental change is not merely about settling trades faster but fundamentally reshaping the trade lifecycle process.

Why is Transitioning to T+1 More Than a Regulatory Shift?

Viewing the T+1 transition solely through a settlement lens risks overlooking its broader impact. It’ll also push post-trade firms to meticulously examine their operational frameworks, risk mitigation strategies, and technological infrastructures. Regulatory bodies push for faster settlement cycles to enhance market efficiency by speeding up clearing and settlement processes.

However, the strategic imperative behind this transition goes beyond mere compliance. The accelerated settlement timeline enables financial institutions to quickly free up capital, reducing systematic risks and enhancing overall liquidity. By streamlining the settlement process, market participants can deploy their capital more efficiently and lay the foundation for future innovations like T+0 in smart contracts and decentralized finance (DeFi).

| Advantages | Challenges |

| Lower counterparty risk | One-time cost for operations and technology upgrades |

| Capital optimization and reduced liquidity buffers | Limited time frame for reconciliations and exception processing |

| Decreased market deposits for broker-dealers | Increased resources needed to meet settlement deadlines |

| Faster access to fund post-trade execution | Increased costs in trade fails for inefficient firms |

How Can Operational Frameworks Drive Efficiency in T+1?

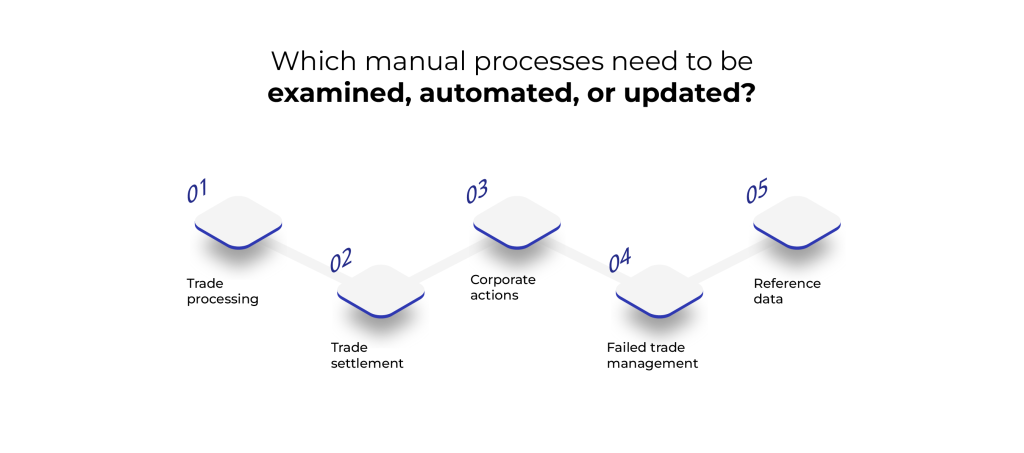

T+1 will have far-reaching impacts on trade suite, technology infrastructure, and operational processes. The imperative is to prioritize automation to rectify legacy inefficiencies within trade confirmation, matching, clearance, and settlement. It further optimizes the interconnectedness of trade execution and the post-trade system in real time. Therefore, trade details are immediately loaded into the post-trade system upon execution. Likewise, the trade confirmation and reconciliation process gets validated instantly once the clearing house confirms trade information.

Furthermore, it also averts incorrect or missing SSIs (Settlement Standing Instructions), one of the common reasons for trade failures. Firms can identify and address trade failures by updating trade confirmation details automatically and in real time for clean reference data and accurate SSIs.

How to Mitigate The Risk in This Accelerated Landscape?

The shortened settlement window increases the risk of liquidity challenges, demanding a meticulous evaluation of capital adequacy and liquidity reserves to navigate unforeseen fluctuations effectively. A 1Q survey with The ValueExchange showed that only 41% of industry participants have yet to start looking at T+1, but on the buy side, the number climbs to 61%. By removing a full day from the settlement cycle, counterparty preparedness may be an in-scope firm’s biggest risk.

Proactive risk management strategies require robust controls and validation mechanisms across the settlement cycle, employing advanced technologies to scrutinize transactions for accuracy and compliance. It’s high time that firms start reevaluating legacy systems and a commitment to adopting cutting-edge solutions that seamlessly integrate with existing infrastructures. This technology-driven approach not only aids in risk prevention but also ensures regulatory compliance in a dynamic environment.

Which Technologies Will Become The Pillars of T+1 Success?

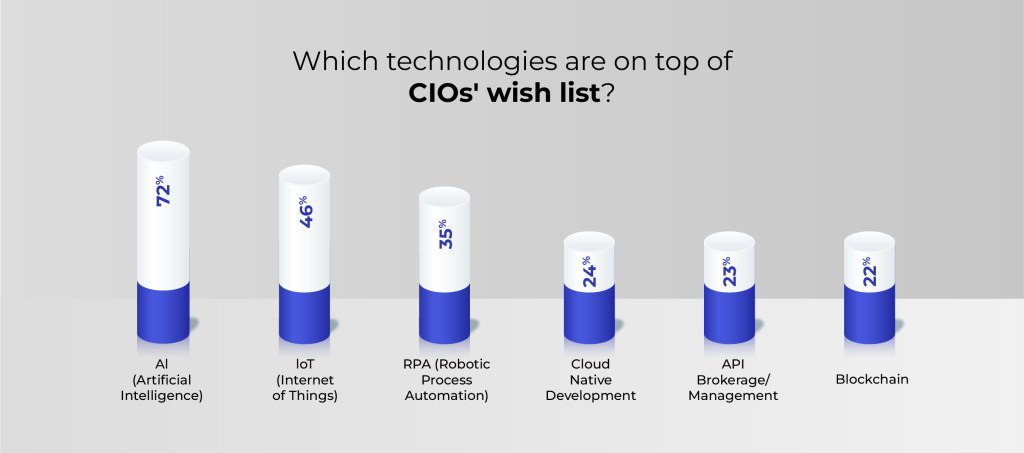

With the shortened settlement cycle, allocation and confirmation must happen on the trade date, which pressures investment managers, broker-dealers, and custodians to establish a robust technological foundation. With its on-demand resources and decentralized architecture, the cloud provides the flexibility needed to navigate the complexities of T+1 settlement. Its scalability ensures that broker-dealers can seamlessly expand or contract their infrastructure based on transaction volumes, thus optimizing operational efficiency.

Integrating Distributed Ledger Technology (DLT) is also a promising avenue due to its immutable and decentralized nature, which ensures an incorruptible and transparent record of transactions, mitigating the risk of fraud or errors. With the clear benefits of applying AI and machine learning for automation, firms must adopt these solutions to mitigate risks and improve operational efficiency.

Conclusion: What’s The Course Forward?

The transition to T+1 settlement demands an integrated approach encompassing operational efficiency, risk mitigation, technological innovation, and regulatory compliance. In conclusion, the challenges and opportunities of this transformation allow broker-dealers and decision-makers in post-trade firms a thorough understanding of the following:

- Holistic planning and oversight: Develop comprehensive test plans, communicate transparently, and address manual processes that impede efficiency.

- Prioritizing automation and STP: Embrace technology to streamline settlement processes and minimize human intervention.

- Investing in high-quality reference data and SSIs: Ensure clean data and accurate instructions for flawless trade settlement.

- Leveraging the expertise of independent assessment providers: Gain valuable insights and recommendations to navigate the complexities of the transition.

- Collaboration and a shared vision: Work together, embrace the challenges, and capitalize on the opportunities for a future-proof post-trade ecosystem.

Comprehensive testing plans, meticulous coordination with stakeholders, and a relentless focus on eliminating manual processes will be the cornerstones of T+1 success. By embracing these principles and prioritizing meticulous testing – not mere box-ticking exercises – firms can confidently navigate the complexities of this seismic shift.

Contact us to identify the functional areas of your firm impacted by this transition and create a target operating model for a roadmap to T+1 readiness.